Novartis Increases 2030 Growth Projections Despite Analysts' Concerns About Patent Threats

- Novartis raised 2030 sales growth targets to 5-6% annually, driven by high peak sales expectations for oncology drugs Kisqali and Scemblix. - CEO Vas Narasimhan highlighted eight de-risked drugs with $3-10B peak potential, but analysts warned of patent expirations and uncertain pipeline progress beyond 2030. - Shares rose 0.5% post-announcement, while Exact Sciences surged 17% on its $105/share acquisition by Abbott and Samsung Biologics saw a 71% valuation re-rating after spin-off. - J.P. Morgan caution

Swiss pharmaceutical leader

Experts remain split on whether Novartis can maintain this growth trajectory. While

Pre-market trading in the pharmaceutical industry was mixed.

Samsung Biologics, a contract development and manufacturing organization (CDMO) based in South Korea, is set for further expansion after spinning off its biosimilar business.

Novartis’s new outlook also highlighted the significance of its upcoming milestones. The company anticipates more than 15 pivotal readouts over the next two years,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

YFI Value Increases by 1.18% During Market Fluctuations

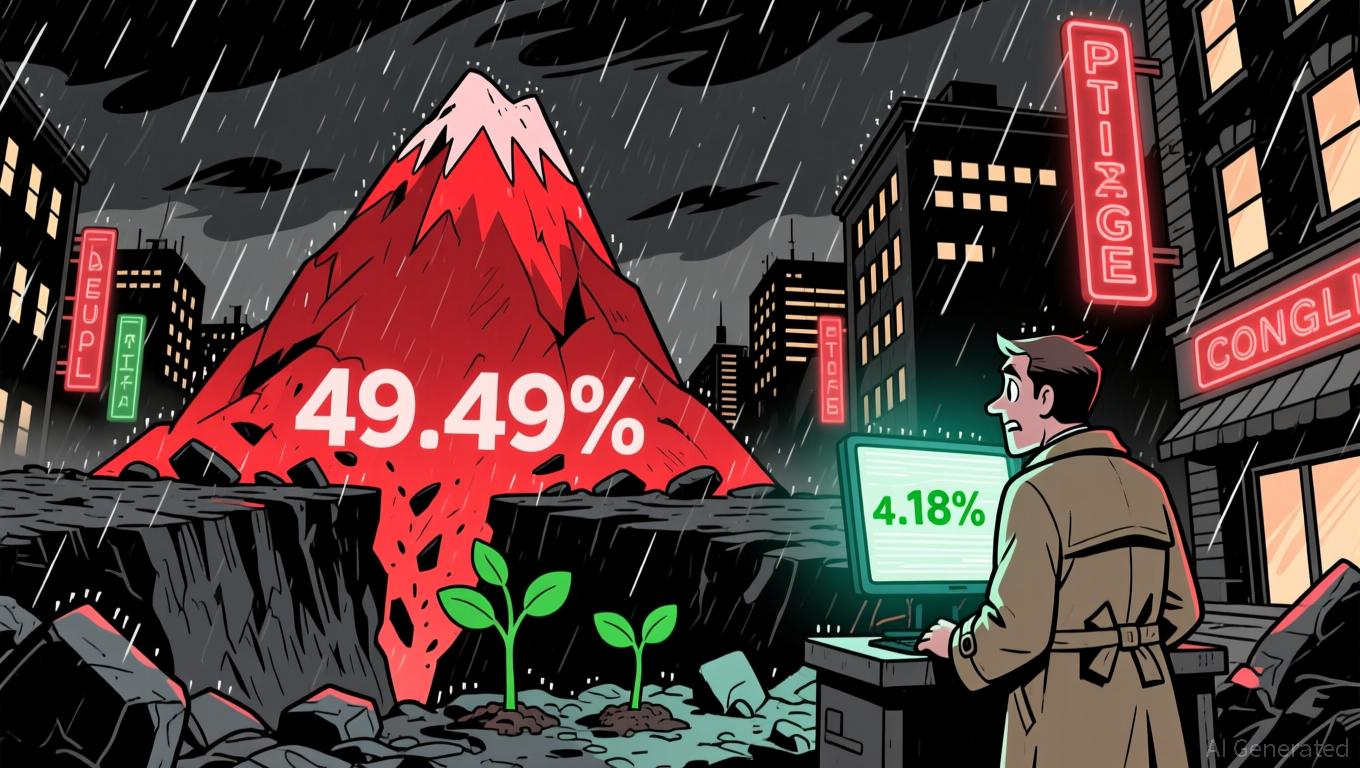

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi