Zcash News Today: Zcash's Return to Exchanges Reignites Discussion on 'Third-Party' Privacy in Crypto

- OKX's Zcash relisting triggered a 12% price surge to $600, outpacing Bitcoin amid U.S. regulatory easing. - Analysts debate Zcash's role: Balchunas warns it splits institutional Bitcoin support, while Van Eck calls it essential privacy complement. - Zcash's quantum-resistant upgrades and $9.24B market cap highlight growing institutional interest despite maximalist skepticism. - Winklevoss twins' Cypherpunk Tech and SEC's regulatory shift signal privacy protocols' rising acceptance in crypto mainstream.

Zcash (ZEC)

This price surge was fueled by

The relisting

On the other hand, investment leaders such as Jan van Eck of VanEck argue in favor of

Zcash’s development team has taken steps to mitigate long-term threats, such as those posed by quantum computing. Engineer Sean Bowe highlighted that the network’s quantum recovery protocol—which allows upgrades without stopping transactions—positions it to handle future cryptographic risks. This stands in contrast to Bitcoin’s slower decision-making process, which critics argue could delay its response to new challenges.

Despite the positive outlook, doubts remain. Market analyst Rajat Soni warned that the recent excitement around Zcash could be driven by “exit liquidity” tactics, referencing fake headlines about Fidelity analysts forecasting a $100,000 price. Meanwhile, Bitcoin purists dismiss Zcash as a fringe asset, with one proponent saying “Bitcoin maxis only look at Zcash to roll their eyes at it.”

OKX’s decision to relist

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

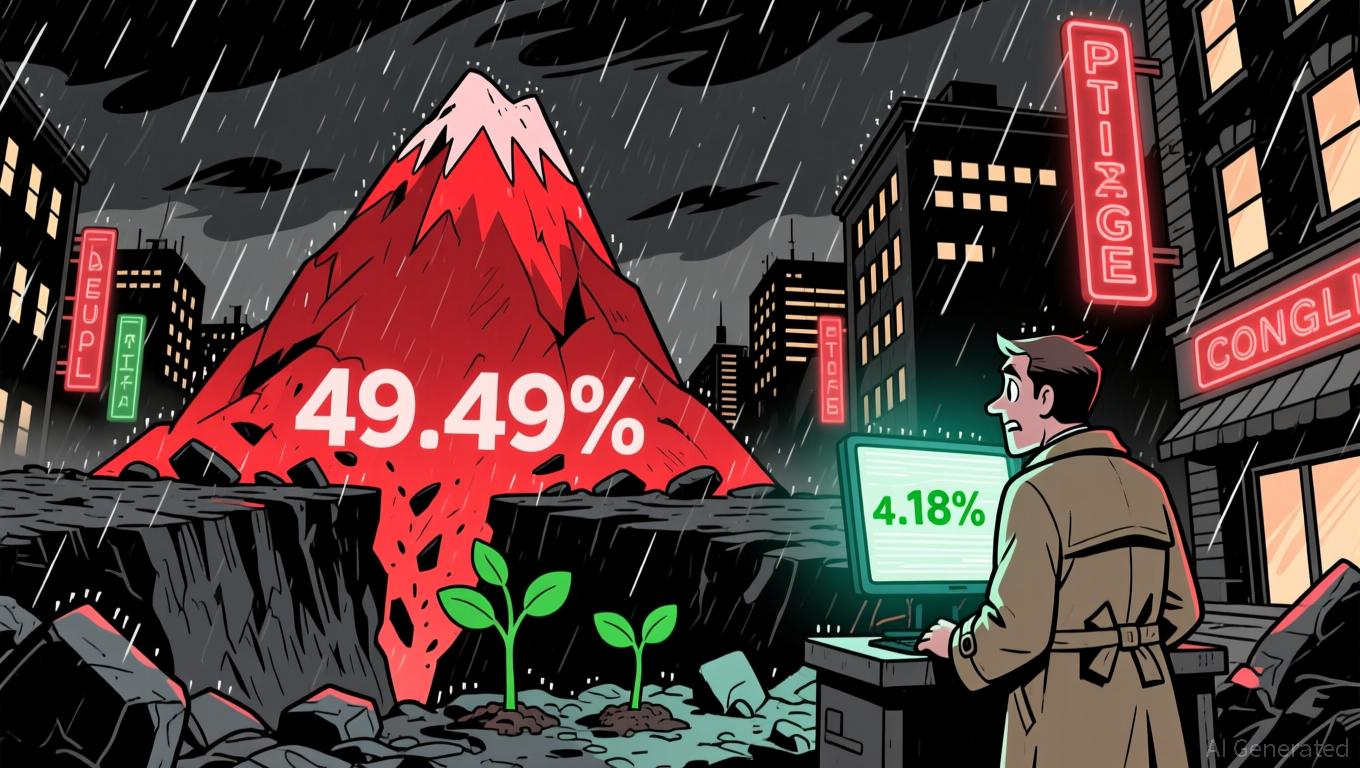

YFI Value Increases by 1.18% During Market Fluctuations

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi