News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1US Stocks Surge as Crypto Reserve Companies Find Growth Hack2Eightco Secures $250M for $WLD Treasury Launch3Bitcoin Inches up to $112K as Stocks Hit Record Highs

The Crypto Card Market Behind CARDS' 260% Daily Surge: When Pokémon Meets Blockchain

Collector Crypt holds over 95% of the market share in the entire crypto card sector.

深潮·2025/09/04 03:28

Tokenized Pokémon card trades surge 5.5x to $124 million in August

CryptoSlate·2025/09/04 02:45

Andrew Webley Reacts to UK Bitcoin Treasury and Narf Cyber Report

coinfomania·2025/09/04 02:30

Treasury Bitcoin Firm Raises $147M and Buys 1,000 BTC

coinfomania·2025/09/04 02:30

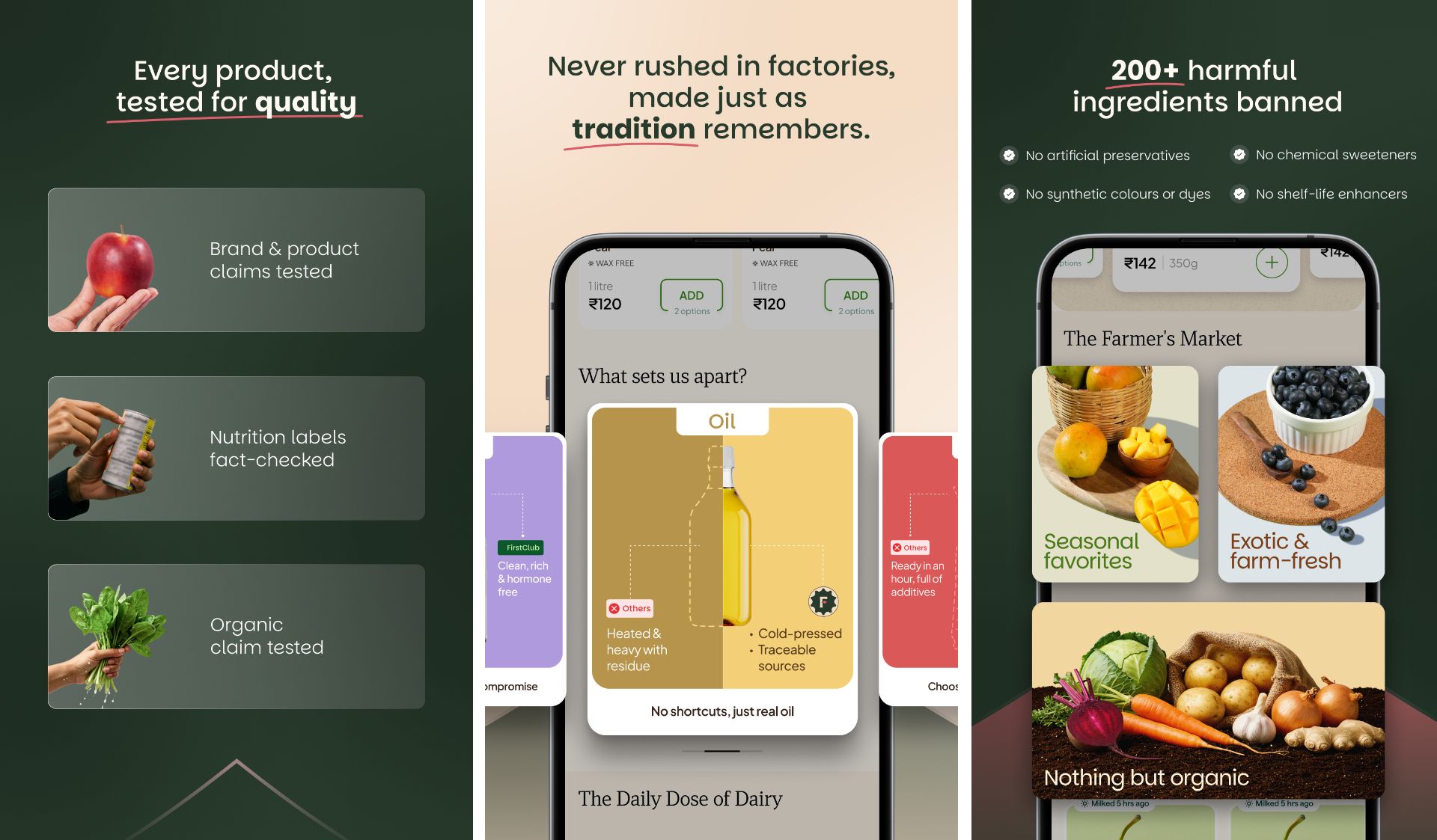

FirstClub bucks India’s speed obsession, quickly triples valuation to $120M with premium approach

techcrunch·2025/09/04 02:17

Mistral, the French AI giant, is reportedly on the cusp of securing a $14B valuation

techcrunch·2025/09/04 02:17

Metaplanet Secures Capital Approval for Bitcoin Acquisition

Coinlive·2025/09/04 02:10

Ethereum NFT Activity Drops to Record Lows in 2025

Coinlive·2025/09/04 02:10

ADP Employment Change Expected to Show 68K New Jobs in August

This week, the US employment is set to take centre stage. Automatic Data Processing Inc. (ADP), the largest payroll processor in the US, is set to release the ADP Employment Change report for August, measuring the change in the number of people privately employed in the US, at 12:15 GMT on Thursday. Investors will be

BeInCrypto·2025/09/04 01:40

Bitcoin Futures Traders Double Down as Market Sits in “Mid-Bull” Zone

Bitcoin’s price stalls, but futures traders increase leverage, betting on a mid-bull phase that could push BTC toward $150,000.

BeInCrypto·2025/09/04 01:38

Flash

- 02:41The South Korean government has removed virtual asset trading and intermediary businesses from the list of restricted industries for venture enterprises.Jinse Finance reported that virtual asset trading and intermediary businesses will be removed from the list of restricted industries for risk enterprises. The Ministry of SMEs and Startups of South Korea (referred to as the "Ministry of SMEs and Startups") announced on the 9th that, at a State Council meeting held at the Yongsan Presidential Office, a partial amendment to the "Enforcement Decree of the Special Act on Fostering Risk Enterprises" containing the above content was reviewed and approved. This amendment will officially take effect from the 16th. The Ministry of SMEs and Startups explained that this revision of the enforcement decree takes into account changes in the global status of the virtual asset industry and the strengthening of domestic user protection systems in South Korea, aiming to lay the foundation for the formal cultivation of core deep-tech industries in the digital asset ecosystem, such as blockchain and crypto technology. The Ministry also pointed out that, globally, the United States approved the listing of spot bitcoin ETFs in January last year, and in July of the same year implemented comprehensive stablecoin regulatory laws, indicating that the trend of recognizing virtual assets as a formal industry is taking shape.

- 02:40Yuta Logistics Technology receives $150 million strategic investment from Huaying Holdings, plans to explore RWA and stablecoin applicationsChainCatcher news, Nasdaq-listed Yuita Logistics Technology announced that Solomon Capital Fund SPC-Solomon Capital SP9, a US dollar fund under Huaying Holdings, has made a strategic investment of $150 million. The two parties will jointly explore the tokenization of logistics assets (RWA) and innovations in stablecoin applications. Yuita Logistics Technology previously announced plans to acquire 15,000 BTC, with a total transaction amount of up to $1.5 billion. In addition, the company also stated that it is actively researching relevant regulatory details and plans to apply for a stablecoin issuance license after the Hong Kong stablecoin regulations come into effect.

- 02:40Data: A certain whale deposited 1.55 million WLD to FalconX, with a total profit of $4.3 millionAccording to ChainCatcher, monitored by Lookonchain, whale 0x4dC3 deposited 1.55 million WLD (worth $2.69 million) to FalconX. This whale previously purchased 6.18 million WLD from FalconX at an average price of $1.25 (then worth $7.75 million), and currently still holds 4.64 million WLD (worth $9.36 million), with a total profit of $4.3 million and a return rate of 55%.