News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 26)|BlackRock Registers Bitcoin Premium ETF; Nine European Banks Jointly Launch Euro Stablecoin; Crypto Market Sees Broad Decline as Bitcoin and Ethereum 2Warning Signs for Altcoins as Market Sentiment Flips Bearish3Research Report|In-Depth Analysis and Market Cap of Mira Network (MIRA)

Bitcoin CME Gap Fills Amid Trump Media Options Strategy

Theccpress·2025/07/29 09:15

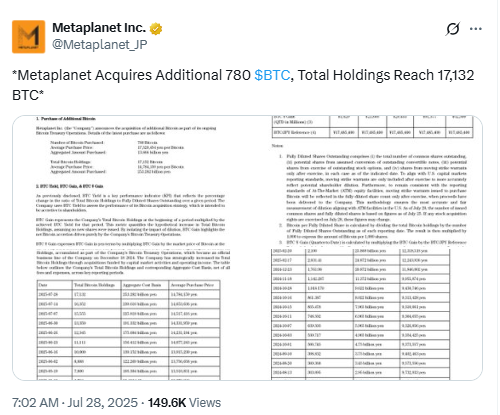

Metaplanet Acquires 780 BTC, Leads Asia in Holdings

Theccpress·2025/07/29 09:15

Senator Lummis Advocates Bitcoin as Personal Sovereignty Tool

Theccpress·2025/07/29 09:15

Rate Cut Tomorrow or Rainfall? Key Week Setting the Stage for August Volatility | Trader's Observation

「Good afternoon」 or 「Hello everyone」?

BlockBeats·2025/07/29 09:00

Standard Chartered Sees Ethereum Hitting $4K by 2025

Cryptotale·2025/07/29 09:00

Tech Stock 30-Year Return Review: Where Will the Next Unicorn Emerge?

The uncertainty brought by new markets often results in the market size being easily underestimated, and successful companies are usually those that can expand the market or target a niche market.

BlockBeats·2025/07/29 08:47

HKMA Unveils Stablecoin Framework to Launch in August 2025

Cryptotale·2025/07/29 08:30

Metaplanet Adds 780 Bitcoin, Holds 17,132 BTC Worth Over $2B

Kriptoworld·2025/07/29 08:15

Dalio’s 15% Portfolio Allocation: Gold and Bitcoin’s Role in a Financial Crisis

Cryptotale·2025/07/29 08:00

Solana rallies as risk appetite returns

Momentum’s back — BTC leads, risk assets follow

Blockworks·2025/07/29 07:55

Flash

- 18:07Data: If ETH breaks through $4,197, the cumulative short liquidation intensity on major CEXs will reach $1.371 billions.According to ChainCatcher, citing data from Coinglass, if ETH surpasses $4,197, the cumulative short liquidation intensity on major CEXs will reach $1.371 billions. Conversely, if ETH falls below $3,815, the cumulative long liquidation intensity on major CEXs will reach $1.132 billions.

- 18:04Hyperliquid has launched the HYPE/USDH spot trading pair.BlockBeats News, September 27, according to the official website, Hyperliquid has just launched the HYPE/USDH spot trading pair, after previously launching USDH/USDC.

- 18:04Next Week's Macro Outlook: Nonfarm Payrolls to Challenge Dovish Bets, Federal Reserve Officials to Speak CollectivelyBlockBeats News, September 27, Federal Reserve officials will collectively speak next week. In addition, if the U.S. government shuts down on October 1, the employment report will not be released on time, and it may even directly affect the CPI and the Federal Reserve's October meeting. The following are the key points that the market will focus on in the coming week (all in GMT+8): Monday 20:00, 2026 FOMC voting member and Cleveland Fed President Mester will participate in a policy panel discussion; Tuesday 01:30, permanent FOMC voting member and New York Fed President Williams, 2025 FOMC voting member and St. Louis Fed President Musalem will deliver speeches; Tuesday 06:00, 2027 FOMC voting member and Atlanta Fed President Bostic will have a conversation with Delta Air Lines CEO on topics such as the Atlanta economy; Tuesday 18:00, Federal Reserve Vice Chair Jefferson will deliver a speech; Wednesday 01:00, 2025 FOMC voting member and Chicago Fed President Goolsbee will deliver a speech; Wednesday 07:10, 2026 FOMC voting member and Dallas Fed President Logan will deliver a speech; Wednesday 08:30, Federal Reserve Vice Chair Jefferson will deliver a speech; Thursday 22:30, 2026 FOMC voting member and Dallas Fed President Logan will deliver a speech; Friday 18:05, permanent FOMC voting member and New York Fed President Williams will speak at the farewell seminar of Dutch Central Bank Governor Knot; Friday 20:30, U.S. September non-farm payrolls, unemployment rate, and average hourly earnings year-on-year and month-on-month.