News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Morning Briefing (Nov 3) | Dash: This month's strong price performance attributed to strengthened fundamentals; Total open interest in ZK contracts surpasses $100 million, hitting a new all-time high; Bitcoin production cost rises to $112,084, approaching record levels2Bitcoin Short-Term Holders Face -1.4 P/L Ratio as Losses Deepen3Fed to Resume Treasury Purchases in Early 2026 as U.S. Economy Gains Relief

TAO Holds $347 as $300 and $200 Stay Prime Levels of Accumulation

Cryptonewsland·2025/08/21 00:00

3 Meme Coins DeepSeek Predicts Could Deliver Massive Moonshots Shiba Inu, Bonk, and Troll

Cryptonewsland·2025/08/21 00:00

Best Altcoins to Buy Now as Ethereum Breaks $4,500 and Market Cycles Turn Bullish

Cryptonewsland·2025/08/21 00:00

Top 5 DeFi Projects Dominating Social Channels and Driving Maximum Community Engagement

Cryptonewsland·2025/08/21 00:00

Solana Price Forms Higher Lows Within Channel as Market Focus Shifts to $210 Resistance Zone

Cryptonewsland·2025/08/21 00:00

Ethereum Nears $4K as $4B Supply Overhang Looms: Analysts Fear Deeper Losses

CryptoNewsNet·2025/08/20 23:50

Bitcoin Miner Bitdeer Aims to Expand US Rig Manufacturing Amid Trump Tariff Headwinds

CryptoNewsNet·2025/08/20 23:50

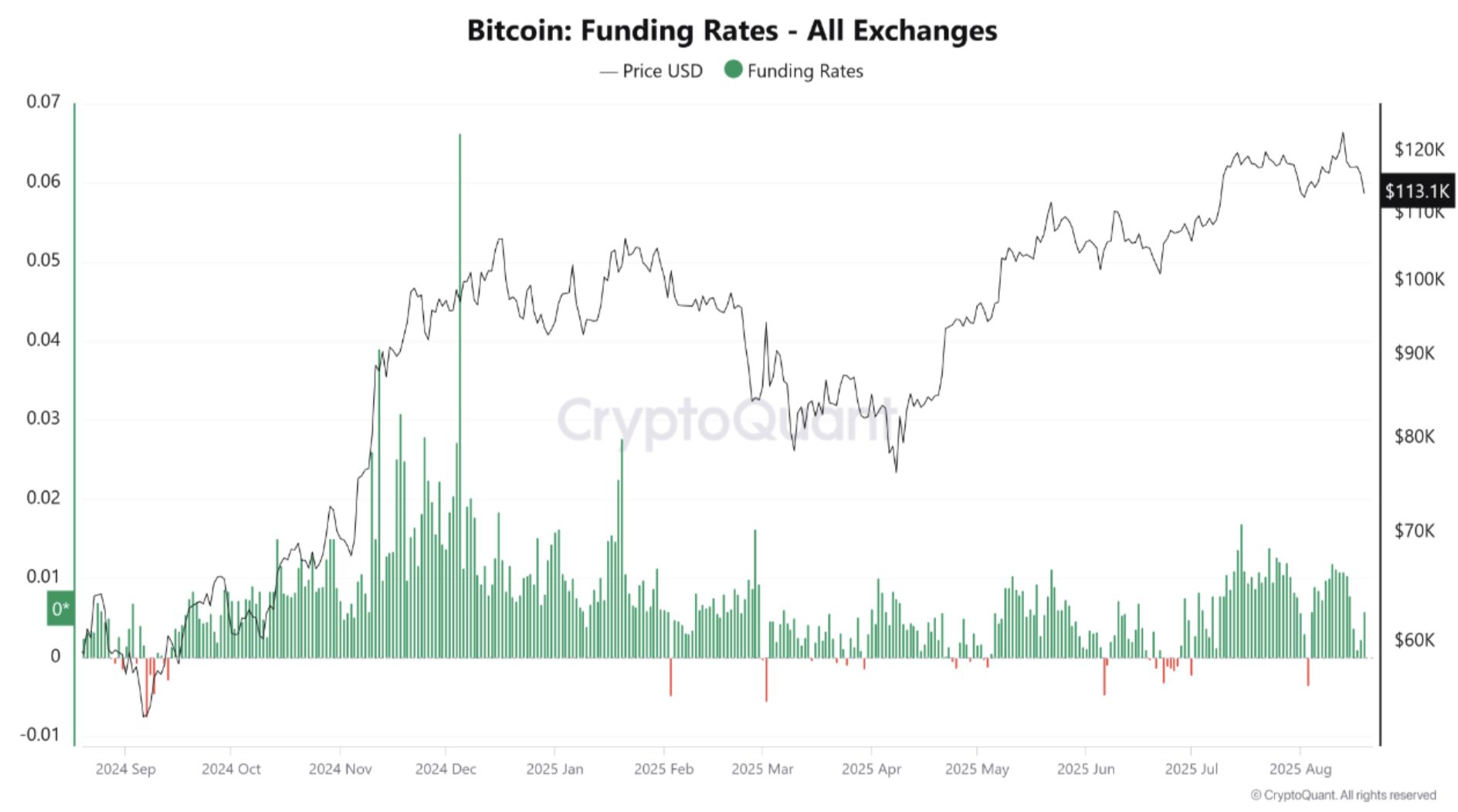

More Pain For Bitcoin? Open Interest Surpasses $40 Billion As Longs Crowd In

CryptoNewsNet·2025/08/20 23:50

Stablecoins: Federal Reserve FOMC Minutes Reveal Critical Discussions

BitcoinWorld·2025/08/20 23:45

Flash

- 23:28BlackRock and 30 other companies participate in GDF tokenized money market fund collateral simulationJinse Finance reported that the Global Digital Finance (GDF) organization has released a report stating that a working group composed of 70 companies has completed a legal study on tokenized collateral of European money market funds. Among them, 30 companies participated in simulation tests, including BlackRock, State Street, UBS, Deutsche Bank, HSBC, and others. The report points out that currently, 68% of collateral is still delivered in cash, and the tokenization of money market funds can improve collateral liquidity and alleviate the pressure of asset liquidation seen in crises such as the 2022 UK government bond crisis. The research focuses on the legal frameworks of the UK, Ireland, and Luxembourg, assessing the impact of tokenization on fund availability, operations, and regulatory risks.

- 23:28Swan becomes the first bitcoin-only company approved to offer a full suite of services to users in New YorkAccording to Jinse Finance, as disclosed by Bitcoin News, Swan has become the first bitcoin-focused company approved to offer a full suite of services to users in New York, including purchasing bitcoin and unlimited withdrawals to self-custody wallets.

- 23:14"1011 Insider Whale" Increases 3x Leveraged BTC Long Position to 350 BTCAccording to Jinse Finance, on-chain analyst Ai Aunt (@ai_9684xtpa) monitored that 6 hours ago, the "1011 Insider Whale" deposited 20 million USDC as margin on Hyperliquid, then opened 3x leveraged long positions in BTC and ETH. Currently, the unrealized profit is $256,000, and the positions are as follows: BTC long position: holding 350 BTC, valued at $37.29 million, with an average entry price of $106,002.1; ETH long position: holding 5,000 ETH, valued at $17.98 million, with an average entry price of $3,575.23.