News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 18) | Fidelity Solana Spot ETF Launches Tonight in U.S. Markets; Public Companies Net-Buy Over $847 Million in BTC Last Week; All Three Major U.S. Indexes Close Lower2Young Bitcoin holders panic sell 148K BTC as analysts call for sub-$90K BTC bottom3Ethereum Falls Under $3,100 Amid Spot ETF Outflows, Viewed as Riskier Than Bitcoin

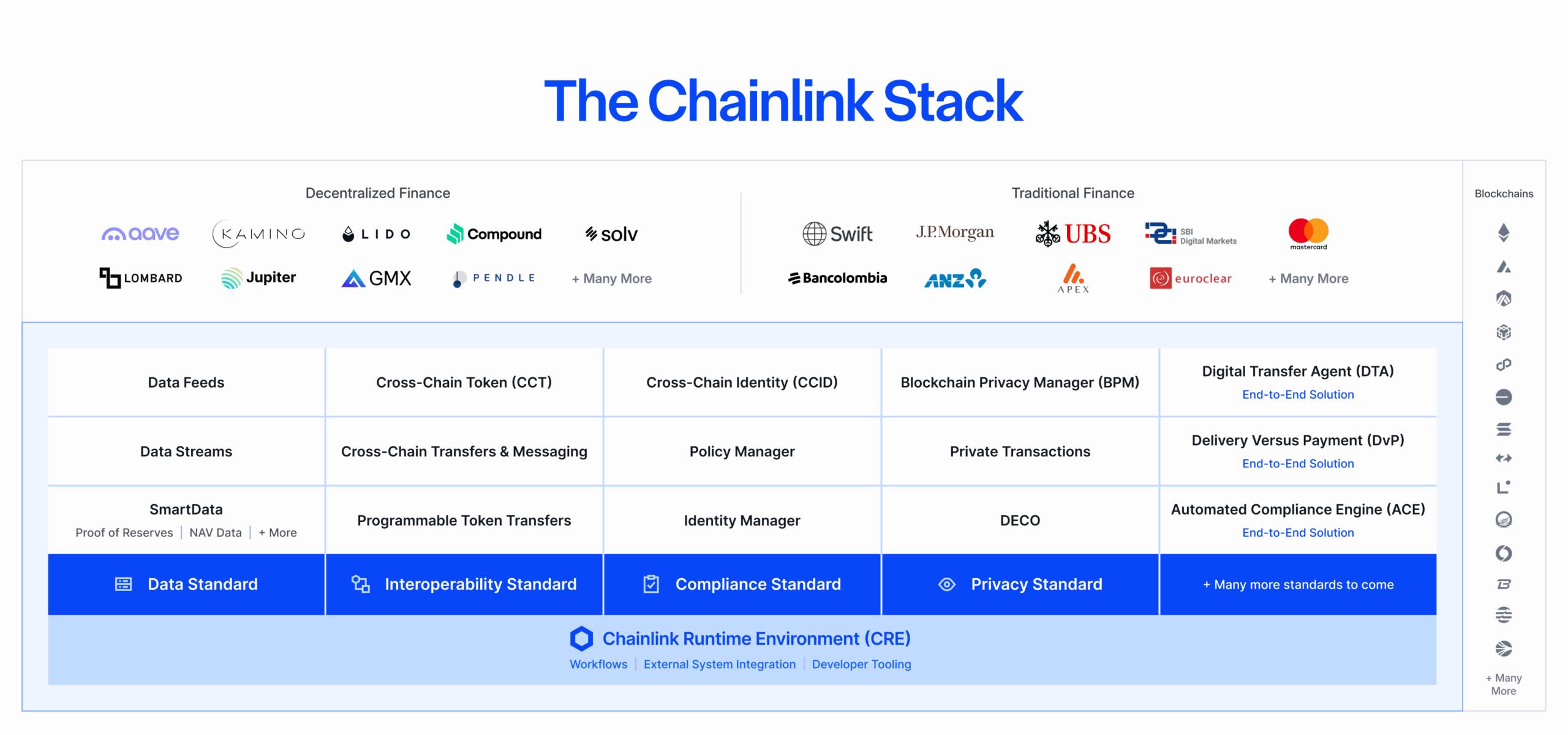

Chainlink's LINK Rallies 12% to New 2025 High Amid Token Buyback, Broader Crypto Rally

CryptoNewsNet·2025/08/22 18:01

Ethereum Soars to New Heights: Historic Moments Unfold – ATH on the Horizon – Here’s Why and the Current Situation

CryptoNewsNet·2025/08/22 18:01

Ether Price Prediction: Arthur Hayes Unleashes Stunning $20K Forecast

BitcoinWorld·2025/08/22 18:00

WLFI ETH Purchase: World Liberty Makes a Bold $5M Ethereum Investment

BitcoinWorld·2025/08/22 18:00

Google Drive Unleashes Powerful AI Video Editing with Vids Shortcut

BitcoinWorld·2025/08/22 18:00

Bitcoin OG’s Astounding $84 Million Ethereum Flip on Hyperliquid

BitcoinWorld·2025/08/22 18:00

Fed Rate Cuts: Why Caution Prevails and September Looks Unlikely

BitcoinWorld·2025/08/22 18:00

Crypto Market Cap Soars: An Impressive $4 Trillion Recovery

BitcoinWorld·2025/08/22 18:00

TON gains momentum with $780 million treasury and Ledger staking integration

Coinjournal·2025/08/22 17:55

Powell puts September rate cut on the table as Bitcoin rises 2% and Fed odds swing to 90%

Coinjournal·2025/08/22 17:55

Flash

- 00:58A single entity has accumulated 2,800 bitcoin in the past two weeks at an average price of $101,700.On November 19, according to monitoring by Emmett Gallic, a single entity has accumulated a total of 2,800 bitcoin (worth $264 million) through multiple addresses over the past two weeks. Most of the bitcoin accumulated was withdrawn from a certain exchange, and in the past 24 hours, another 45 bitcoin were withdrawn from this CEX at an average price of $101,700.

- 00:57Tom Lee: The market will approach a bottom this weekJinse Finance reported that Tom Lee stated in a recent interview with CNBC, "The market will approach a bottom this week." In response, Bitwise Chief Investment Officer Matt Hougan agreed with this view and said that now is a "once-in-a-lifetime long-term buying opportunity." Matt Hougan believes that investors are overly concerned about AI valuations, macroeconomics, tariffs, and other events.

- 00:40SG-FORGE, the crypto division of Société Générale, completes its first blockchain-based digital bond issuance in the USChainCatcher news, the crypto business division of Société Générale, SG-FORGE, announced the completion of its first blockchain-based digital bond issuance in the United States, expanding its on-chain capital markets business footprint. This short-term bond issuance is linked to the Secured Overnight Financing Rate (SOFR) and was purchased by trading firm DRW. The digital bond utilizes tokenization technology from Broadridge Financial Solutions and operates on the privacy-enabled blockchain infrastructure Canton Network, developed by Digital Asset. This marks the first time Broadridge's new platform has been used for real-time securities issuance, while Canton Network enables instant settlement while retaining the legal structure of traditional finance. Société Générale stated that it has been active in the European digital bond sector since 2019, and this transaction paves the way for its entry into the U.S. market, potentially facilitating the on-chain issuance of more complex products such as structured notes in the future.