News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

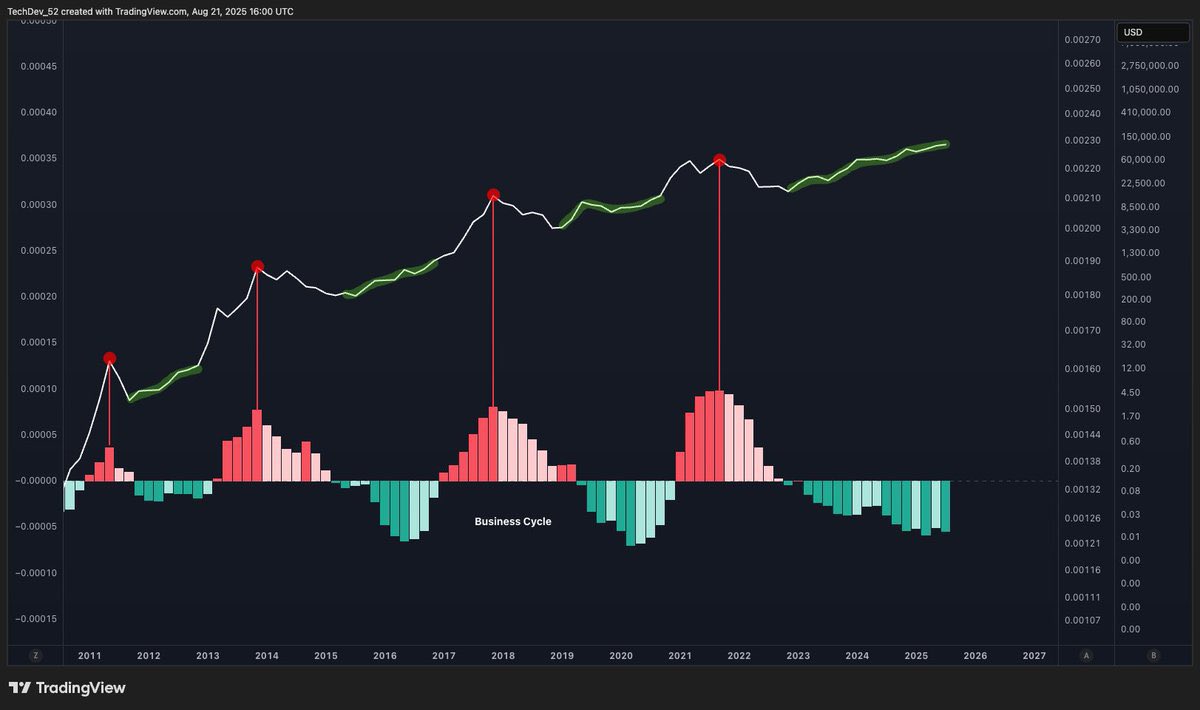

Altcoins show a double bottom with MACD flip, echoing the 2018–2021 supercycle that delivered 15x gains.Altcoins Repeat Familiar Bullish PatternWhy This Setup Looks Stronger NowWill Altcoins Deliver Another 15x?

Chainlink ($LINK) is catching up to Hyperliquid ($HYPE) in market cap. Here's what it means for both tokens.Chainlink Market Cap Nears HyperliquidWhat’s Fueling the Surge?Could Chainlink Take the Lead?

A Satoshi-era Bitcoin whale flips $437M in BTC into ETH, amassing over 641K ETH in a week, signaling a major crypto market move.Massive Shift from BTC to ETH by Satoshi-Era Whale$2.94B in ETH Accumulated in One WeekWhat This Means for the Market

Story (IP) is on fire with a sharp rally, but on-chain data suggests the momentum may lack strong support. A pullback looms unless demand strengthens.

This is more like a consortium blockchain dedicated to stablecoins.

USD.AI generates yields through AI hardware collateralization, filling the gap in computing resource financing.