News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Revealing key data such as network utilization and storage volume, showcasing its ecosystem and economic dynamics.

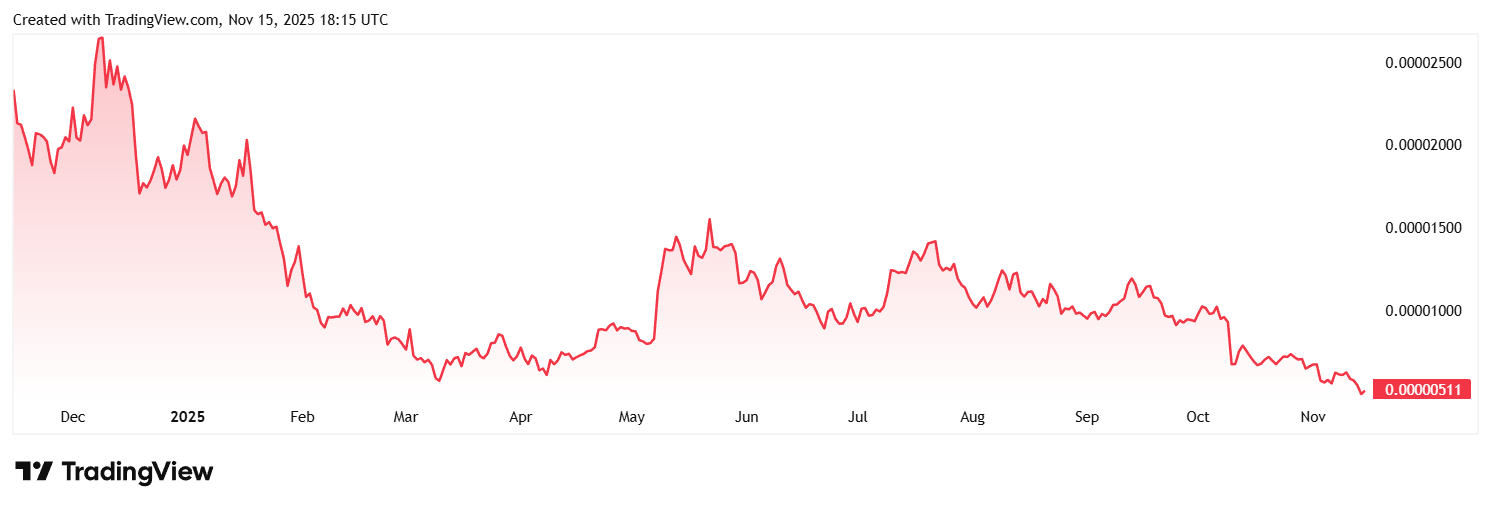

Some "whale" wallets are showing regular selling patterns, which may be related to profit-taking rather than panic signals, but the market's ability to absorb these sales has weakened.

Quantum computers may break bitcoin within five years. How will the crypto world respond to this existential crisis?

After Howard Lutnick became the Secretary of Commerce in the Trump administration, his family's investment bank, Cantor, is heading toward its most profitable year ever.

Quick Take More than $1 billion in crypto liquidations have occurred in the last 24 hours, with long positions accounting for the majority of the wipeout. Analysts warn that BTC must reclaim $95,000–$100,000 to avoid further structural weakening as onchain stress and ETF flows intensify.

Bitcoin fell below $92,300 as a congressional probe into President Trump triggered risk-off sentiment. Short-term holders transferred over 65,000 BTC to exchanges, adding $610 million in potential sell pressure.

Quick Take Senate Banking Chair Tim Scott said he aims to have committees vote on the crypto market structure bill next month. Scott added that he hopes to bring the bill to the Senate floor in early 2026 for President Trump’s sign-off.

Quick Take The Sky community voted to allocate up to $2.5 billion to projects incubated by the Framework-backed Obex initiative. Framework is co-leading the $37 million funding round into the Obex incubator with LayerZero and Sky Ecosystem.

- 08:40Hyperliquid launches HIP-3 growth model, new market fees reduced by 90% to boost liquidityAccording to ChainCatcher, as reported by CoinDesk, the decentralized exchange Hyperliquid has launched the HIP-3 growth model, allowing anyone to deploy new markets without permission and significantly reducing fees to boost liquidity. This feature reduces the taker fees for newly launched markets by more than 90%, from the usual 0.045% down to 0.0045%-0.009%. For users with top-tier staking and trading volume levels, fees can be further reduced to 0.00144%-0.00288%.

- 08:40BlackRock IBIT sees a record single-day outflow of $523 millionChainCatcher reports, the iShares Bitcoin Trust (IBIT) under BlackRock recorded its largest single-day net outflow since its inception in January 2024 on Tuesday. IBIT saw a capital outflow of $523.15 million yesterday, surpassing the previous record of $463 million set on November 14. The ETF has experienced net outflows for five consecutive days, totaling $1.43 billion. As the world's largest spot bitcoin ETF (with net assets of $72.76 billion), IBIT has been in an outflow trend since late October. On a weekly basis, the fund has seen net outflows for four consecutive weeks, amounting to $2.19 billion. This capital outflow coincides with a recent sharp decline in bitcoin, which earlier this week fell below $90,000 from its all-time high of $126,080 set in early October. Despite the continuous outflows, Vincent Liu, CIO of Kronos Research, stated that institutional investors are rebalancing rather than completely abandoning bitcoin.

- 08:35Safello's TAO ETP listed on the Swiss Stock ExchangeJinse Finance reported that cryptocurrency exchange Safello announced that its physically backed and staked TAO exchange-traded product (ETP) has been listed on the SIX Swiss Exchange. This ETP is now available for trading on European trading platforms and online brokers. The Safello Bittensor Staked TAO ETP is issued by DDA ETP AG under a cooperation agreement signed earlier this year, and is now listed on the SIX Swiss Exchange, trading in US dollars. Trading began at market open, with the trading code STAO and a management fee of 1.49%.