News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 17)|Fed may announce 25 basis point rate cut at FOMC meeting; ZKsync to unlock 173 million tokens today; US and UK to deepen cooperation on crypto regulation2Bitcoin May Consolidate Around $115,000–$116,000 as Market Attempts to Stay Bullish, CoinStats Says3Cardano Shows Mixed Signals as Short-Term Charts Trend Bearish While Cycle Analysis Suggests Possible Early Bullish Phase

Yield-chasing ETH treasury firms are most at risk: Sharplink Gaming CEO

CryptoNewsNet·2025/09/03 06:05

XRP Ledger’s Entire Carbon Footprint Equals Just 1 Transatlantic Flight: Research

CryptoNewsNet·2025/09/03 06:05

Bitcoin Correction Could Deepen Before Recovery as Only 9% of Supply at Loss

CryptoNewsNet·2025/09/03 06:05

XRP (XRP) Price Prediction: Analysts Eye $3.60 Breakout As ETF Speculation Heats Up

CryptoNewsNet·2025/09/03 06:05

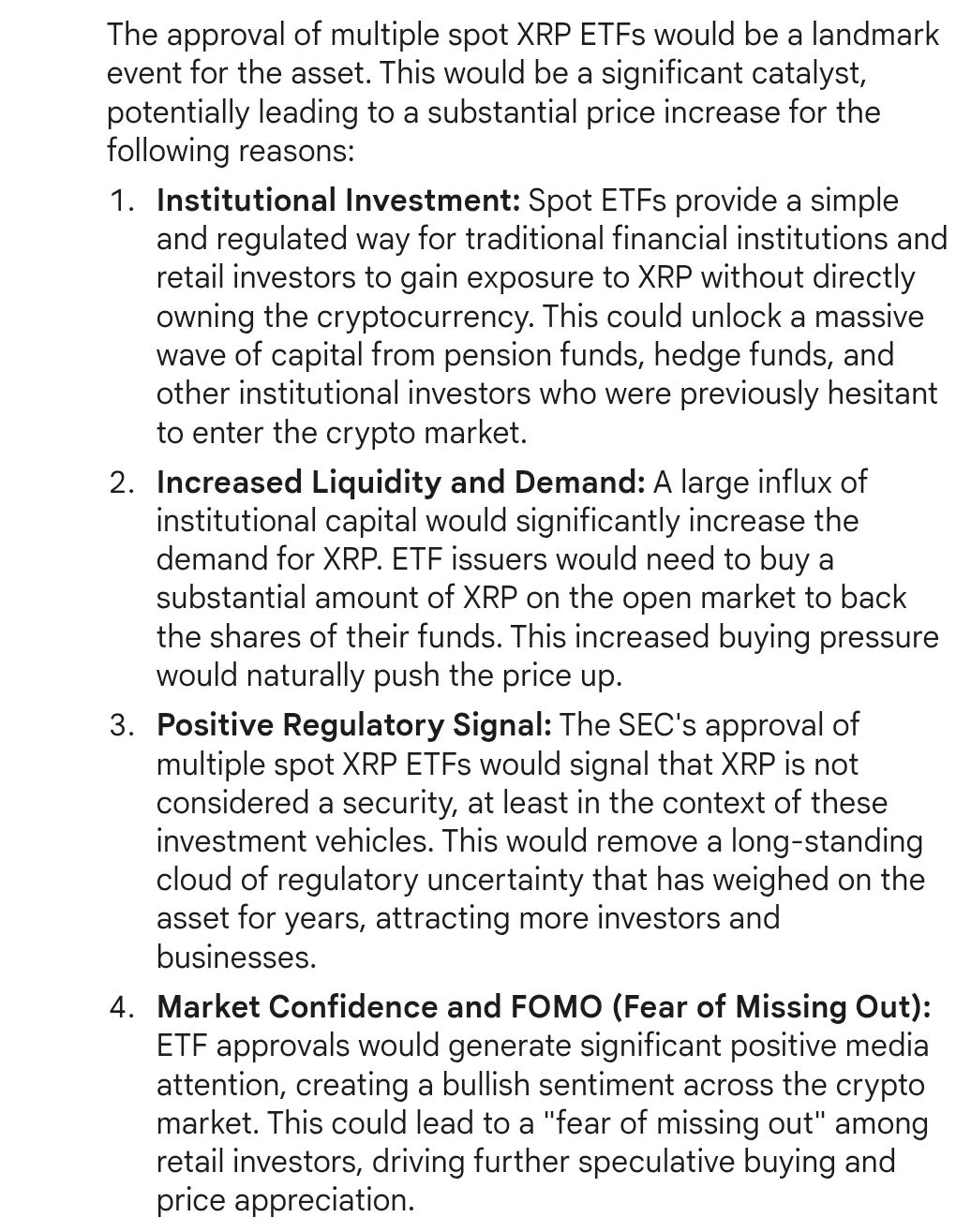

Here is XRP Price by December 2025 if SEC Approves ALL Spot XRP ETFs by October

CryptoNewsNet·2025/09/03 06:05

Something unusual is building in $9.81 billion of Bitcoin futures flows and it could break either way

CryptoSlate·2025/09/03 06:01

US SEC, CFTC clear path for registered firms to trade spot crypto

Coinjournal·2025/09/03 06:00

SharpLink buys 39,008 ETH for $177M at an average price of $4,531

Cointribune·2025/09/03 05:55

EU stablecoin regulations leave Europe vulnerable, says ECB chief

CryptoSlate·2025/09/03 05:39

Trust Wallet Brings Tokenized Stocks & ETFs Onchain for 200M+ Users Worldwide

Trust Wallet, the world’s leading self-custody Web3 wallet with over 200 million users, today announced the launch of tokenized real-world assets (RWAs)—unlocking seamless access to tokenized versions of U.S. stocks and ETFs for users around the globe*. Users can now discover, hold, and swap tokenized RWAs* that track the prices of leading equities and major … <a href="https://beincrypto.com/trust-wallet-tokenized-stocks-etfs-onchain/">Continued</a>

BeInCrypto·2025/09/03 05:30

Flash

- 06:49Questflow becomes an early partner of Google’s Agency Payment Protocol (AP2)ChainCatcher news, Google officially announced today the launch of the Agent Payments Protocol (AP2), aiming to provide a secure, trustworthy, and traceable payment framework for AI Agents' transactions. Questflow has become an early partner of this open protocol, empowering scheduling and commercialization capabilities among AI Agents. AP2 is an open standard jointly developed by Google and more than 60 leading global organizations, including Sui development team Mysten Labs, Ethereum Foundation, MetaMask, a certain exchange, as well as well-known fintech and payment companies such as Adyen, American Express, and Mastercard. The traditional payment system is difficult to meet the authorization, verification, and responsibility traceability needs of AI Agents. AP2 uses "task authorization" and records the entire transaction process with cryptographic signatures to ensure security and traceability. This protocol supports payment methods such as stablecoins and cryptocurrencies, facilitating new business experiences like smart shopping and personalized offers. Questflow will continue to work with Google and global partners to jointly promote the development of the AP2 protocol and accelerate the construction of the AI Agent economy.

- 06:37A mysterious trader bets on a 50 basis point Fed rate cut, marking the largest block trade in CME federal funds futures history.According to ChainCatcher, in the Federal Funds futures market on the Chicago Mercantile Exchange (CME), a "mysterious trader" is currently hedging against the risk of a super-dovish surprise in this week's Federal Reserve decision. According to researcher Ed Bolingbroke, on Monday, the front end of the curve saw the largest block trade ever in Federal Funds futures, involving October Federal Funds futures contracts with a total of 84,000 contracts, equating to a risk exposure of up to $3.5 million per basis point. CME confirmed this trade on the X platform, and it is reported that both the price and timing of this block trade are consistent with buyer characteristics. Given that the current swap market has fully priced in a 25 basis point rate cut, this move may suggest that the mysterious trader is hedging against the risk of a direct 50 basis point rate cut in Wednesday's Federal Reserve decision.

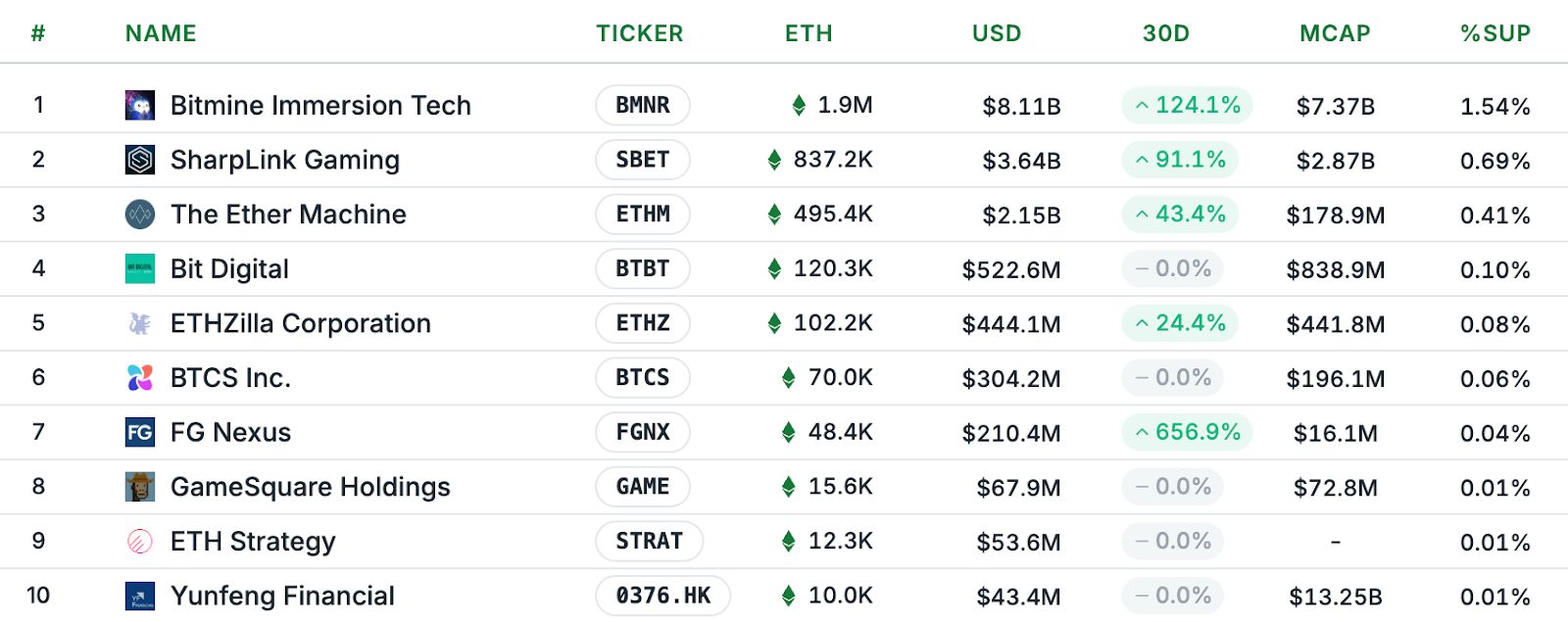

- 06:37Ethereum treasury company The Ether Machine submits S-4 filing to the US SEC to advance its listing planAccording to ChainCatcher, as reported by The Block, Ethereum treasury company The Ether Machine announced on Tuesday that it has submitted a draft registration statement on Form S-4 to the U.S. Securities and Exchange Commission to advance its goal of going public in the United States. The S-4 registration form is used to register securities issued in connection with mergers, consolidations, or acquisitions. For The Ether Machine, this draft registration is related to its proposed business combination with special purpose acquisition company Dynamix Corporation, which trades on Nasdaq under the ticker symbol ETHM. The Ether Machine had already announced its plan to go public through a business combination as early as July this year and stated that it expects to complete the transaction in the fourth quarter. The company announced that the transaction is subject to customary closing conditions, including approval from Dynamix shareholders, and will be put to a vote at an upcoming special shareholders' meeting.