News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

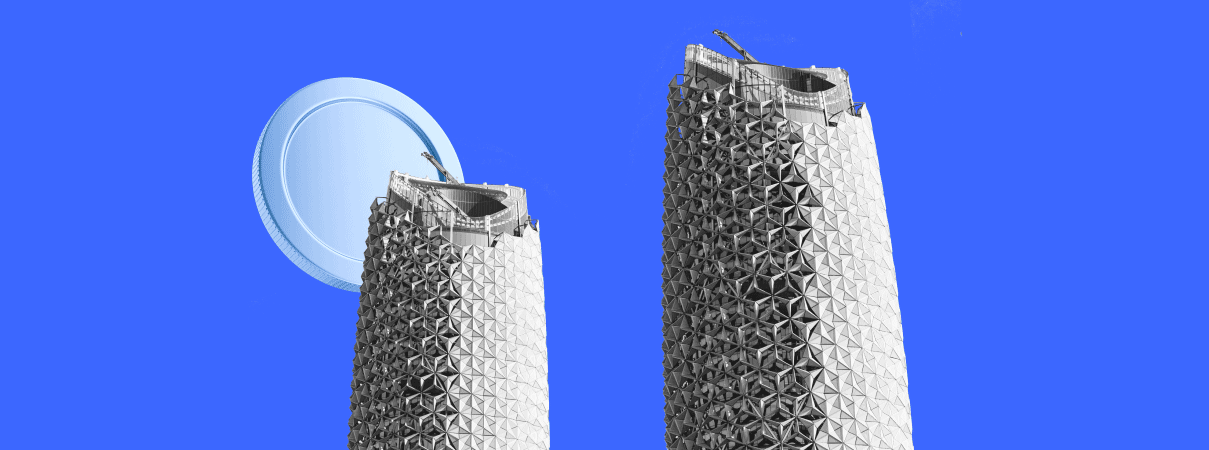

Hedera’s HBAR faces mounting pressure as both social and institutional interest fade. Without new demand, further losses appear likely.

Billions in bitcoin, ether and token buys collide with major Nasdaq listings

As WLFI adoption grows, BNB, Chainlink, and Bonk are positioned to capture liquidity, interoperability, and ecosystem growth opportunities.

A joint SEC-CFTC statement paves the way for Wall Street giants like NYSE and Nasdaq to host spot Bitcoin and Ethereum trading, signaling a new era for US crypto.

dappOS is a fundamental infrastructure based on a task execution network, enabling the creation of diverse user-centric intent products to enhance the user experience in the crypto space.

- 19:15Fitch: The Federal Reserve is fully supporting employment and will tolerate higher inflation in the short termAccording to Golden Ten Data, Olu Sonola, Head of U.S. Economic Research at Fitch, stated that the Federal Reserve is now fully supporting the labor market and has made it clear that it will enter a decisive and aggressive rate-cutting cycle in 2025. The message is very clear: growth and employment are the top priorities, even if this means tolerating higher inflation in the short term.

- 19:08Powell: The Federal Reserve Shifts Policy Focus from Inflation to EmploymentAccording to ChainCatcher, citing Golden Ten Data, Federal Reserve Chairman Powell emphasized that, given signs that the labor market is "truly cooling," the Fed is inclined to achieve "maximum employment" in its dual mandate. He pointed out that since April, the risk of persistently high inflation has decreased, partly due to a slowdown in job growth. At the same time, downside risks in the labor market have increased, and the number of new jobs appears to be below the "breakeven rate" needed to maintain the unemployment rate.

- 18:59Powell: The Tension Between Slowing Economic Growth and High InflationChainCatcher news, according to Golden Ten Data, Federal Reserve Chairman Powell discussed the factors behind the Fed's 25 basis point rate cut at a press conference. He pointed out that economic growth slowed in the first half of this year, while inflation has risen and remains at a high level. Powell also mentioned that downside risks to employment have increased and described the labor market as "lackluster and weak."