News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 18)|SEC Eases Listing Process for Digital Asset ETFs; Nothing secures $200 million in Series C funding; XRP and Dogecoin ETFs receive SEC approval.2Bitcoin Could Benefit From Further Fed Cuts, but FOMC Remains Divided on 2025 Rate Path3Ethereum Could Extend Rally From $3,900 Support Toward $5,800 as Open Interest Rises

VeThor ($VTHO) Eyes Breakout With 1,101% Rally Potential

VeThor ($VTHO) nears key breakout level, aiming for a potential 1,101% surge to $0.022693 in a bullish move.Why Traders Are Watching This LevelCan VeThor Sustain the Rally?

Coinomedia·2025/09/03 23:50

Bitmine’s ETH Holdings Soar to $8.13B After New Buy

Bitmine adds 74.3K ETH, boosting its holdings to 1.87M ETH worth $8.13B.Institutional Confidence in Ethereum GrowsWhat This Means for the Market

Coinomedia·2025/09/03 23:50

Can Crypto Astrology Really Predict Market Moves?

Crypto astrology is trending—can stars and planets really guide your trades?Skepticism vs. Strategy: Is There Any Value?Conclusion: A Starry Guide or Cosmic Nonsense?

Coinomedia·2025/09/03 23:50

'Biggest Opportunity for Mass Adoption': TON Treasury Loads Up on Telegram-Linked Coin

CryptoNewsNet·2025/09/03 23:45

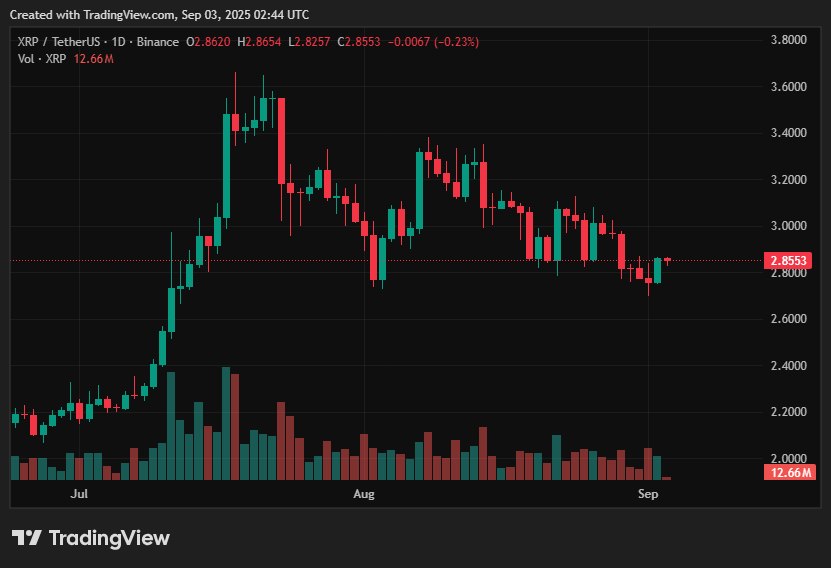

XRP price prediction: Can institutional support battle rate pressure?

CryptoNewsNet·2025/09/03 23:45

Don’t Miss Out: This Crypto Trio Could Explode

CryptoNewsNet·2025/09/03 23:45

ECB president calls to address risks from non-EU stablecoins

CryptoNewsNet·2025/09/03 23:45

ONDO price jumps as tokenized stocks and ETFs launch

Coinjournal·2025/09/03 23:40

Why Solana ecosystem entity card trading platform Collector Crypt token price is soaring

Coinjournal·2025/09/03 23:40

Polymarket secures regulatory clearance to relaunch in the US

Coinjournal·2025/09/03 23:40

Flash

- 22:17Hybrid DEX GRVT based on ZKsync completes $19 million Series A financingJinse Finance reported that hybrid decentralized exchange (DEX) GRVT has successfully completed a $19 million Series A funding round, further advancing its development in the compliant, high-performance crypto trading sector. This round was co-led by GRVT’s technology partner ZKsync and Further Ventures. Further Ventures is an investment firm backed by the Abu Dhabi sovereign wealth fund. Other major supporters include EigenCloud (formerly EigenLayer) and 500 Global. The GRVT team stated that the majority of the funds raised will be used for product development and engineering to expand its product range, including cross-chain interoperability, options markets, and tokenized real-world assets (RWAs). GRVT is described as a “hybrid” DeFi platform aiming to combine the user experience and regulatory compliance of centralized exchanges (CEXs) with the self-custody, privacy, and decentralization features of traditional DEXs. It positions itself as the world’s first licensed and regulated on-chain exchange. The platform launched its mainnet Alpha version on Ethereum Layer 2 network ZKsync at the end of 2024, initially focusing on perpetual contract trading and has now expanded to spot and options trading. GRVT is actively seeking multi-jurisdictional licenses, including the EU MiCA license, Dubai VARA license, and Abu Dhabi Global Market (ADGM) capital market license.

- 22:01White House considers more CFTC chair candidates as nomination process faces obstaclesChainCatcher news, according to Golden Ten Data, due to the confirmation process for Brian Quintenz to become chairman of the US Commodity Futures Trading Commission (CFTC) being stalled, the White House is considering other candidates. Sources familiar with the matter indicated that possible contenders include government officials focused on cryptocurrency policy. The CFTC oversees trillions of dollars in swap transactions, and with legislation currently under review by Congress, the agency may gain greater influence in the digital asset sector.

- 22:01The U.S. Supreme Court will hear oral arguments on the Trump tariff case on November 5.Jinse Finance reported that the U.S. Supreme Court has scheduled oral arguments for November 5 regarding the legality of Trump's broad imposition of global tariffs. This represents a major test of one of Trump's boldest assertions of executive power, which has always been a core part of his economic and trade agenda. Earlier this month, the justices announced they would hear the case after a lower court ruled that Trump had overstepped his authority by imposing most of the tariffs under a federal law intended to address emergencies.