News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 19)|First US Spot Dogecoin ETF Launched; Global Crypto Market Cap Rises to $4.1 Trillion; SEC Accelerates Spot Crypto ETF Approvals2Bitcoin Holds Above $115K Support as Analysts Outline $137K Resistance and $93K Downside3Research Report | Detailed Analysis and Market Capitalization of Plasma (XPL) Project

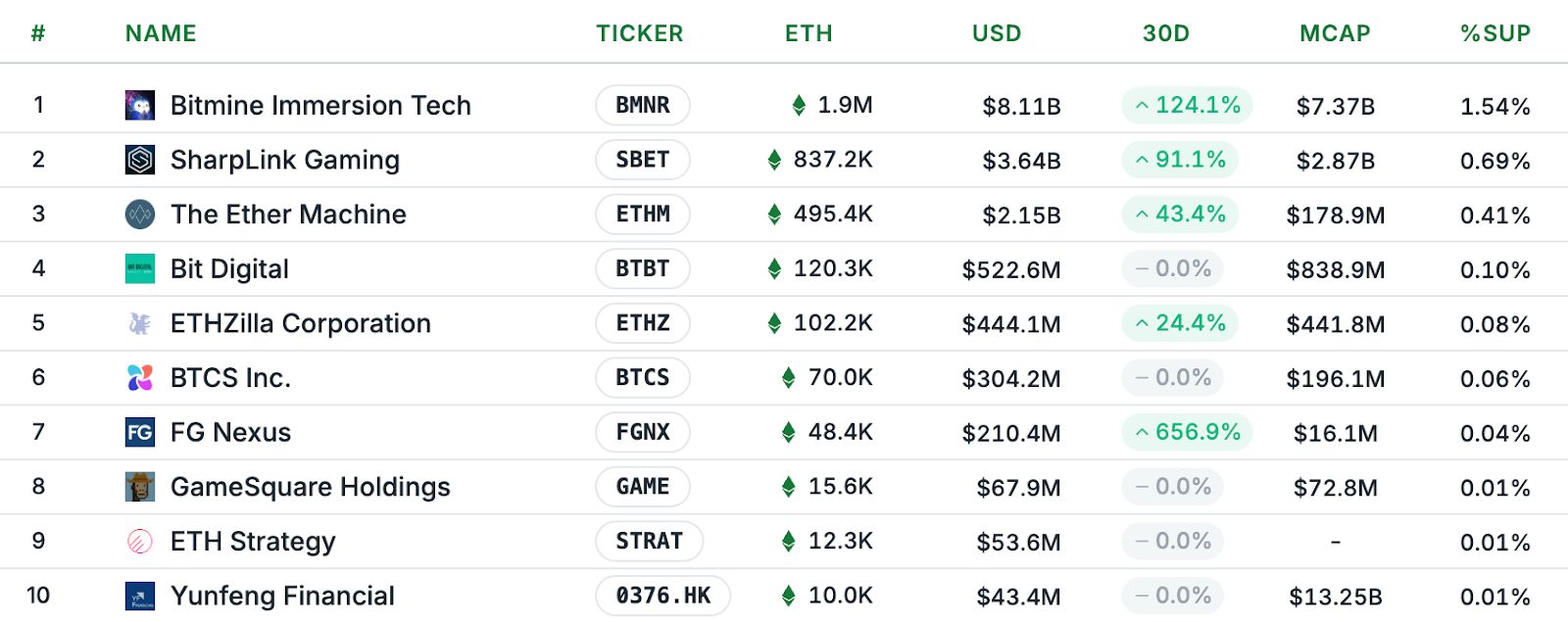

Yield-chasing ETH treasury firms are most at risk: Sharplink Gaming CEO

CryptoNewsNet·2025/09/03 06:05

XRP Ledger’s Entire Carbon Footprint Equals Just 1 Transatlantic Flight: Research

CryptoNewsNet·2025/09/03 06:05

Bitcoin Correction Could Deepen Before Recovery as Only 9% of Supply at Loss

CryptoNewsNet·2025/09/03 06:05

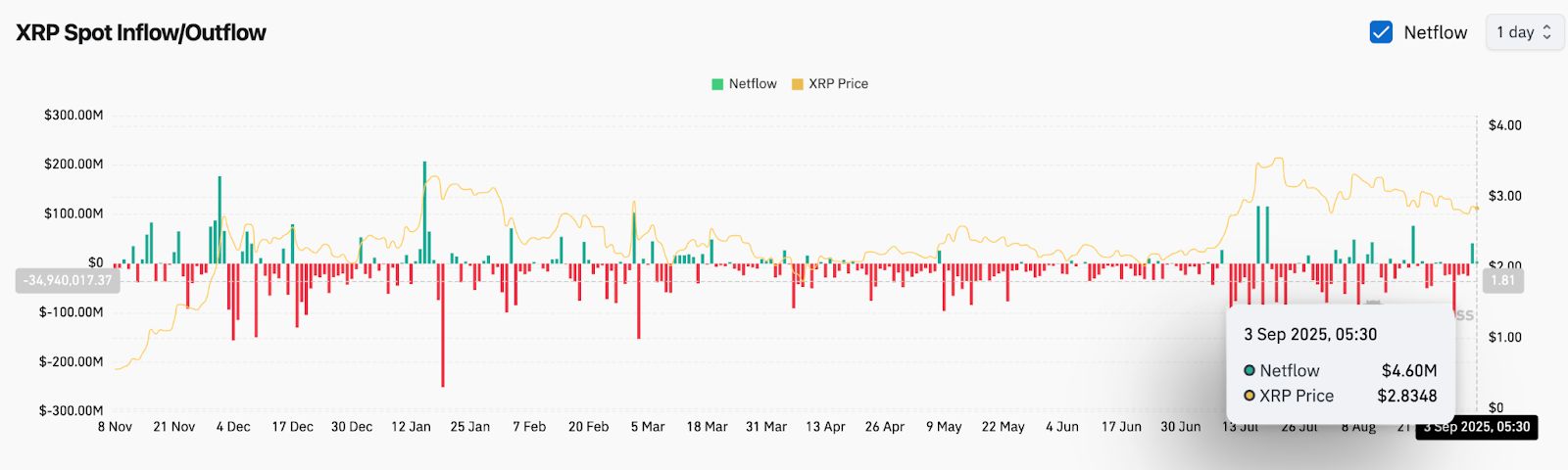

XRP (XRP) Price Prediction: Analysts Eye $3.60 Breakout As ETF Speculation Heats Up

CryptoNewsNet·2025/09/03 06:05

Here is XRP Price by December 2025 if SEC Approves ALL Spot XRP ETFs by October

CryptoNewsNet·2025/09/03 06:05

Something unusual is building in $9.81 billion of Bitcoin futures flows and it could break either way

CryptoSlate·2025/09/03 06:01

US SEC, CFTC clear path for registered firms to trade spot crypto

Coinjournal·2025/09/03 06:00

SharpLink buys 39,008 ETH for $177M at an average price of $4,531

Cointribune·2025/09/03 05:55

EU stablecoin regulations leave Europe vulnerable, says ECB chief

CryptoSlate·2025/09/03 05:39

Trust Wallet Brings Tokenized Stocks & ETFs Onchain for 200M+ Users Worldwide

Trust Wallet, the world’s leading self-custody Web3 wallet with over 200 million users, today announced the launch of tokenized real-world assets (RWAs)—unlocking seamless access to tokenized versions of U.S. stocks and ETFs for users around the globe*. Users can now discover, hold, and swap tokenized RWAs* that track the prices of leading equities and major … <a href="https://beincrypto.com/trust-wallet-tokenized-stocks-etfs-onchain/">Continued</a>

BeInCrypto·2025/09/03 05:30

Flash

- 04:46Société Générale: After the Fed decision, market focus returns to inflation dataJinse Finance reported that Société Générale stated the Federal Reserve's decision to cut interest rates by 25 basis points was in line with general expectations and was not disappointing. Although our unconventional forecast of a 50 basis point rate cut did not materialize, as we mentioned last week, if the September meeting decides on a 25 basis point cut, it is very likely that there will be additional 25 basis point cuts in both October and December, which is indeed confirmed by the median in the dot plot. We also note that the Federal Reserve expects the interest rate level to reach 3.38% by the end of 2026, which is consistent with our forecast but nearly 50 basis points higher than current market pricing. Next week, the market's focus will shift entirely to personal income and expenditure data and the Federal Reserve's preferred inflation indicator—the Personal Consumption Expenditures Price Index (PCE). (Golden Ten Data)

- 02:02Former SEC Chairman Gensler says he is "proud" of taking enforcement actions to regulate cryptocurrenciesChainCatcher news, according to Cointelegraph, former US SEC Chairman Gary Gensler admitted in an interview on Wednesday that he has no regrets about the way cryptocurrency enforcement was handled during his tenure at the agency. Gensler said he is "proud" of the right decisions he made regarding digital asset regulation during his time at the SEC, and reiterated his view that cryptocurrency is a "highly speculative and extremely risky asset." When talking about enforcement actions against cryptocurrency companies, Gensler stated: "We have always worked to ensure investor protection. However, during this period, we have also encountered many fraudsters: look at Sam Bankman-Fried, he is not the only one."

- 01:29Falcon Finance releases FF tokenomics: total supply of 10 billions, with 8.3% allocated for community airdrop and Launchpad sales.ChainCatcher news, Falcon Finance has released the FF tokenomics. The total supply is 10 billion tokens, managed by an independent foundation. The distribution is as follows: 35% allocated to the ecosystem, 32.2% to the foundation, 20% to the core team and early contributors, 8.3% for community airdrops and Launchpad sales, and 4.5% allocated to investors.