News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 20) | US to Release Nonfarm Payrolls and Unemployment Rate; Ethereum Advances Post-Quantum Cryptography; LayerZero and KAITO Tokens Face Major Unlocks Today2Bitcoin charts flag $75K bottom, but analysts predict 40% rally before 2025 ends33 SOL data points suggest $130 was the bottom: Is it time for a return to range highs?

VeChain’s New Tokenomics Tie VTHO Generation to Total VET Staked Across Network

CryptoNewsFlash·2025/11/15 16:03

The Zcash Frenzy May Be Nearing Its Limit, Says On-Chain Analyst

CryptoNewsFlash·2025/11/15 16:03

Dash Looks Ready to Run With Bullish Signs Seen in Exploding Altcoins

CryptoNewsFlash·2025/11/15 16:03

Crypto Heavyweights Back Trump’s Ballroom Project — Here’s Where That Leaves XRP Tundra in 2025

Cryptodaily·2025/11/15 16:00

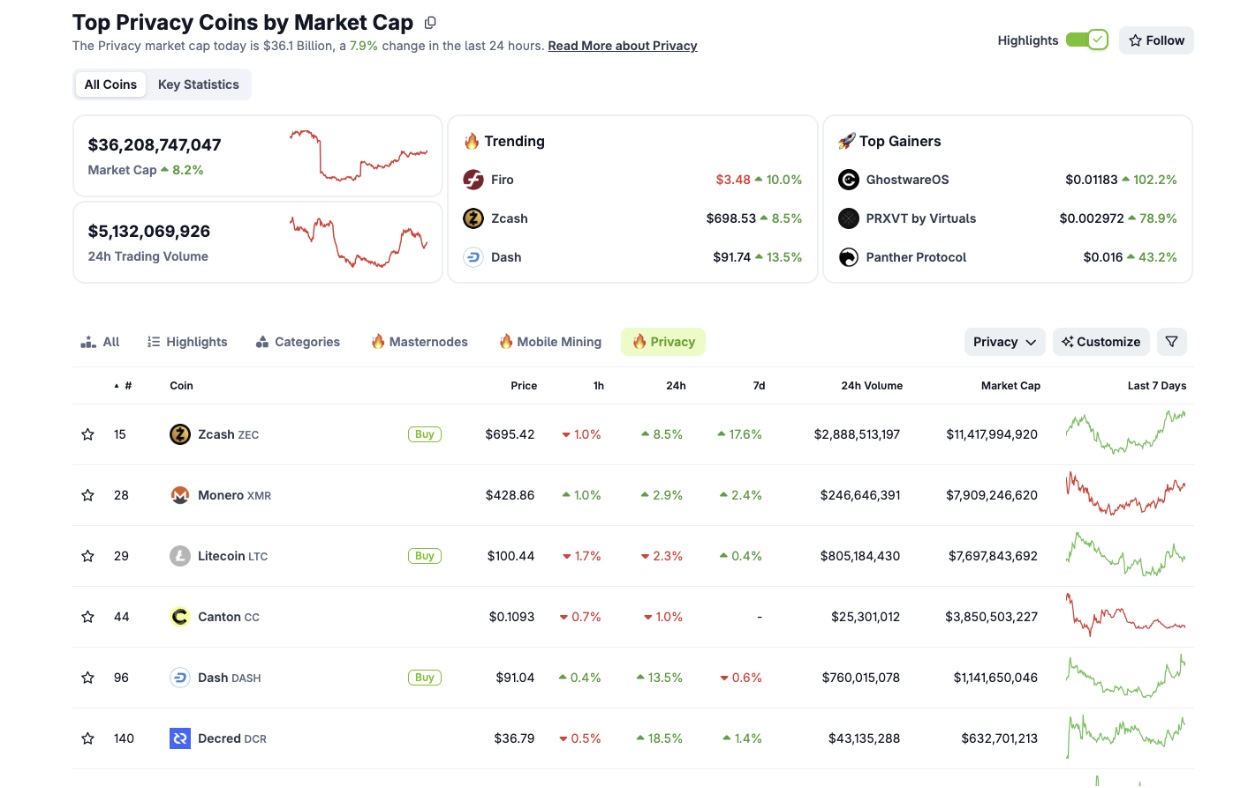

Crypto Privacy Coins Surge as Political Tension Builds Ahead of Congressional Vote

Privacy coins rallied sharply as markets brace for a pivotal U.S. Congress vote that may compel President Trump to release Epstein-related files.

Coinspeaker·2025/11/15 16:00

Largest Hyperliquid Whales Are Shorting Amid Wild Market Volatility

Massive short positions by top Hyperliquid whales, combined with surging fear and panic across social media, suggest the crypto market might be inching toward a turning point.

Coinspeaker·2025/11/15 16:00

Tether Eyes a €1B Robotics Deal — A Giant Leap Beyond Stablecoins

Kriptoworld·2025/11/15 16:00

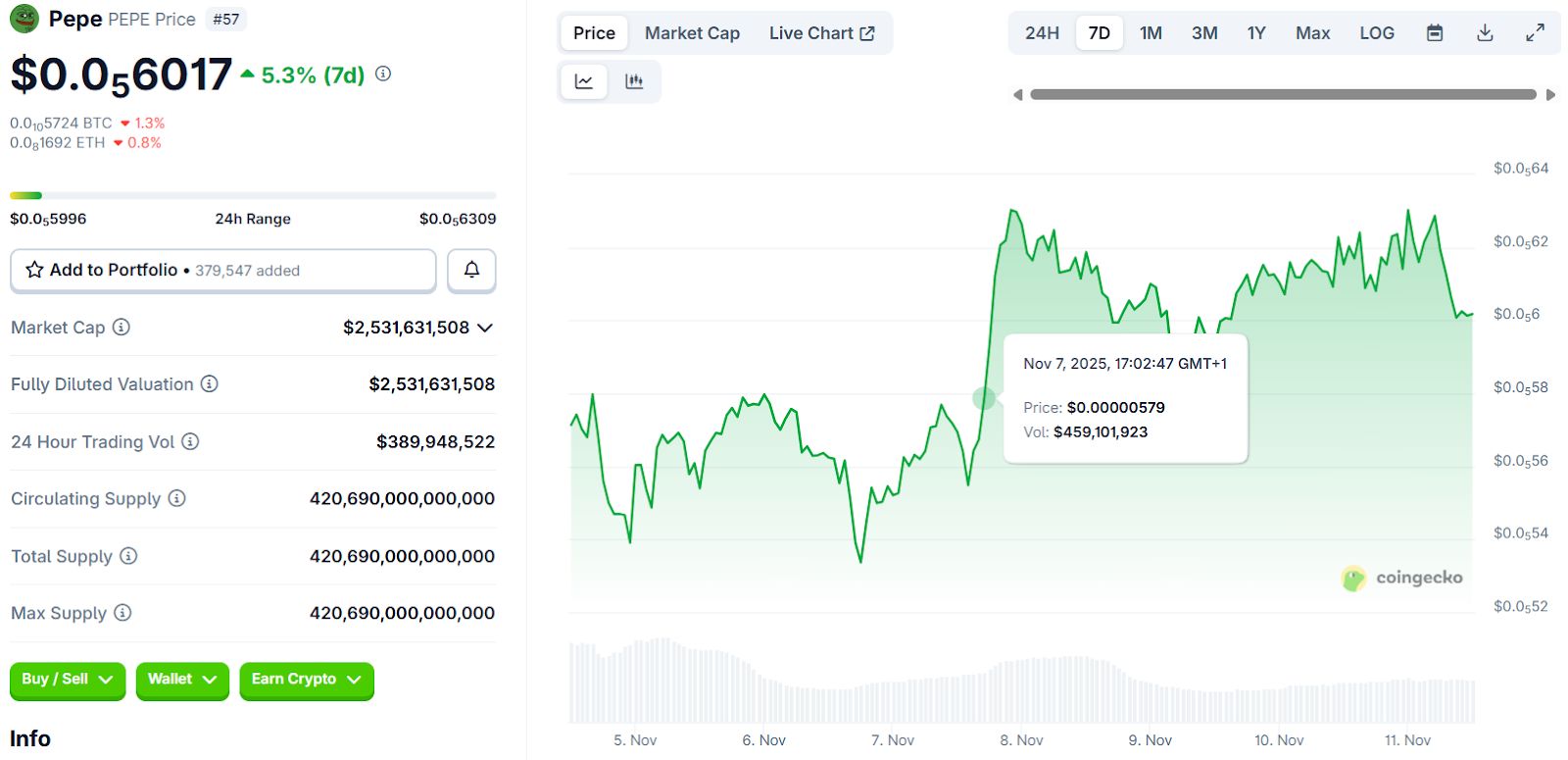

Top Meme Coins for 2025: Shiba Inu, Pepe Coin, and 3 Hidden Gems Investors Love

Cryptodaily·2025/11/15 16:00

Bitcoin hits six-month low near $95,000; analysts optimistic for bullish turn

Quick Take Bitcoin fell to a six-month low on Sunday mainly due to tight liquidity, analysts said. Market experts forecasted a liquidity expansion as the U.S. government resumes normal operations, which is expected to improve prices.

The Block·2025/11/15 16:00

Flash

- 11:26GAIB launches official buyback program in response to external institutions' early token salesAccording to ChainCatcher, GAIB, a project focused on AI and robotics infrastructure economy, issued an official statement today regarding the incident of external institutions selling tokens in advance on the day of TGE, and announced the launch of the official GAIB buyback plan. In the statement, GAIB emphasized that the approximately five wallets identified by the community, each selling about 1 million GAIB, do not belong to the team, advisors, or any internal entities. All tokens belonging to the team and core contributors are currently fully locked, and the GAIB team has not sold any tokens. After an internal investigation, it was found that these wallets belong to external market institutions from multiple regions. According to their cooperation agreements prior to TGE, the tokens they obtained were only to be used for post-launch community activity incentives and were explicitly prohibited from being sold in advance. However, some institutions violated the agreement and sold tokens without authorization on the day of TGE, constituting a serious breach of contract. GAIB has issued formal notices to the relevant institutions, requiring a full buyback of all GAIB tokens sold, provision of on-chain buyback proof, and full responsibility for the consequences of the breach. However, the relevant institutions have not provided a clear response. GAIB will immediately launch the official buyback plan, with the team directly starting to repurchase the tokens that were sold in violation of the agreement on the market, ensuring that the interests of the community are not affected by any third-party actions. In the statement, GAIB said: "We will not let the community bear any consequences. The buyback plan is our commitment to responsibility and transparency." GAIB will announce the latest progress to the community as soon as further details on the buyback execution are obtained.

- 11:18edgeX announces strategic partnership with polymarketChainCatcher reported that the decentralized derivatives trading platform edgeX has announced a strategic partnership with the world's largest prediction market, polymarket. This collaboration will seamlessly integrate polymarket's prediction scenarios into the edgeX mobile App, enabling more ordinary traders to participate in event predictions with one click and enjoy a smoother, anytime, anywhere trading experience. On this basis, both parties will jointly explore innovative leveraged prediction products, combining leveraged products with prediction markets for the first time. This will allow users to make judgments on major events, trending topics, and market trends with higher capital efficiency. Such products will offer more flexible position management, sharper price discovery capabilities, and further expand the application boundaries of prediction trading.

- 10:54Vitalik calls for the development of more adversarial UI designs that stand on the user's sideChainCatcher news, Ethereum co-founder Vitalik Buterin stated that more adversarial UI design from the user's perspective is needed. He hopes to see operating systems with plugins that can overlay the interfaces of all ride-hailing/food delivery apps, displaying the all-inclusive price for each service, including taxes, other additional fees, and expected tips.