News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The World Computer picks up where BTC has left off

- Quantum computing threatens Bitcoin's ECDSA/SHA-256 security via Shor’s/Grover’s algorithms, exposing 25% of its supply to private key decryption risks. - El Salvador mitigates risks by fragmenting $678M Bitcoin reserves across 14 wallets, using UTXO obfuscation and public dashboards for transparency. - NIST’s post-quantum standards (CRYSTALS-Kyber, SPHINCS+) and hybrid protocols enable quantum-resistant custody, adopted by firms like BTQ and QBits. - Global regulators (U.S., EU, China) accelerate quantu

- Strategy Inc. dismissed a class action lawsuit over Bitcoin accounting, highlighting legal defenses tied to compliance with FASB’s ASU 2023-08 fair-value standards. - The ruling underscores how ASU 2023-08 mandates real-time crypto valuation transparency but amplifies earnings volatility and operational complexity for institutional holdings. - With $110B in corporate Bitcoin, firms now face shifting legal risks toward accounting compliance, incentivizing aggressive crypto strategies if disclosure thresho

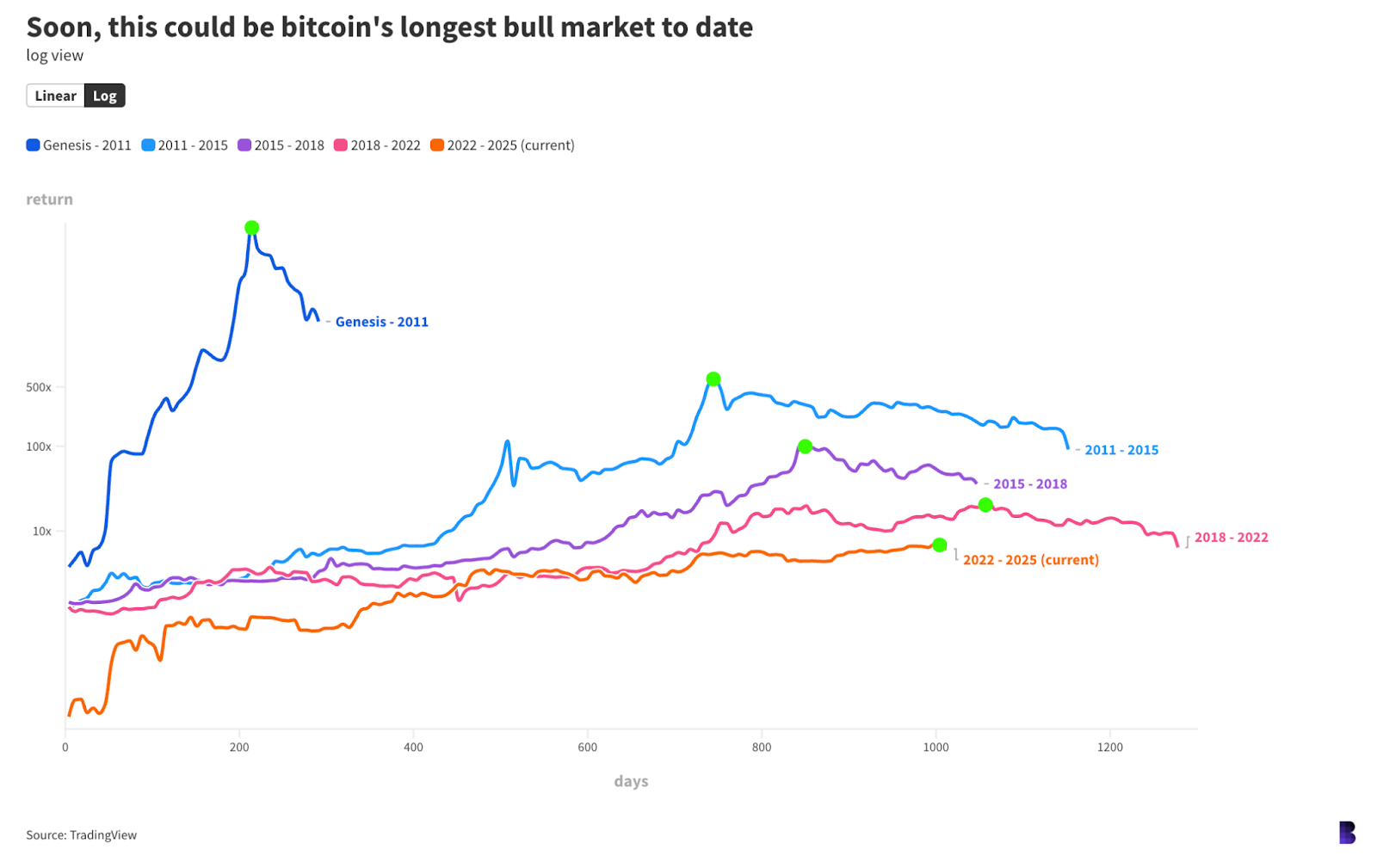

- Recent crypto selloff sees Bitcoin and Ethereum drop, but long-term investors view it as a contrarian buying opportunity amid macroeconomic and on-chain signals. - Fed's dovish policy hints and institutional confidence (74% Bitcoin held long-term) suggest market consolidation rather than freefall, echoing 2020-2024 bull cycles. - On-chain metrics like MVRV (2.1) and NVT (1.51) indicate accumulation phases, with historical correlations to pre-bull market corrections in 2017 and 2021. - Risks like exchange

- XRP and RTX emerge as top 2025 crypto contenders, competing on real-world utility and adoption paths. - XRP gains institutional traction via RWA tokenization ($131.6M+ on XRPL) and $2.5B+ cross-border payment volume through Ripple's ODL. - RTX disrupts PayFi with 1.2M users, 400K+ transactions, and 10% fee burn mechanism, targeting 7,500% returns by 2025. - XRP's $3.65-$5.80 price target depends on SEC stability, while RTX's $5-$7 goal relies on execution-driven user growth.

- Tokyo-listed Metaplanet faces funding strain as its stock price drops 54% since June, threatening its Bitcoin accumulation "flywheel" model. - The firm seeks $4.6B through overseas share offerings and preferred shares to boost Bitcoin holdings to 210,000 BTC by 2027. - Analysts warn the shrinking 2x Bitcoin premium and reliance on yield-hungry investors risk long-term sustainability of its strategy. - Recent FTSE Japan Index inclusion follows Q2 performance but may not offset challenges in volatile crypt

- Walrus (WAL) forms a wedge pattern near $0.38 support, with Grayscale Trust launch boosting institutional confidence. - Technical indicators show bullish momentum as price consolidates between $0.3765 and $0.3978 Fibonacci levels. - On-chain upgrades with Space & Time and Pipe Network enhance WAL's utility in AI/media storage ecosystems. - Neutral market sentiment (Fear & Greed Index 48) contrasts with surging 37.7% volume post-Grayscale adoption. - Breakout above $0.44-$0.46 with increased volume could

- Pump.fun allocates 30% of fees from 1% memecoin transaction charges to repurchase PUMP tokens, reducing circulating supply by 4.66% via $62M buybacks since July 2025. - Deflationary strategy drove 54% price recovery from August lows and 12% monthly gains, creating a flywheel effect through scarcity and staking rewards. - Legal risks ($5.5B securities fraud lawsuit) and plunging weekly revenue ($1.72M) threaten sustainability, with single $12M buyback days straining finances. - 73% Solana memecoin launchp

- 14:55Data: Galaxy Digital affiliated address withdraws another 13 million ASTER tokens, worth approximately $29.12 millionAccording to ChainCatcher, on-chain analyst @ai_9684xtpa has monitored that a Galaxy Digital-related address has once again withdrawn 13 million ASTER tokens, valued at $29.12 million. The total amount of ASTER tokens currently held by this address has increased to 46 million, with a total value of $103 million. In the past 24 hours, the number of tokens accumulated by this address accounts for 2.77% of ASTER's circulating supply.

- 13:39Amplify ETFs submits Solana and XRP Covered Call ETF applications to the US SECJinse Finance reported that exchange-traded fund solutions provider Amplify ETFs has announced the submission of an application to the U.S. Securities and Exchange Commission for Solana and XRP options income ETFs, seeking to balance income and capital appreciation by investing in the price returns of XRP and SOL as well as covered call option strategies.

- 13:37The audit of the U.S. Strategic Bitcoin Reserve is overdue by 172 days.According to Jinse Finance, market sources report that the audit of the US Strategic Bitcoin Reserve has been overdue for 172 days.