News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The passage of the GENIUS Act in the United States has introduced a regulatory framework for the stablecoin market, sparking enthusiastic responses within the cryptocurrency community, while sounding an alarm for the traditional banking industry.

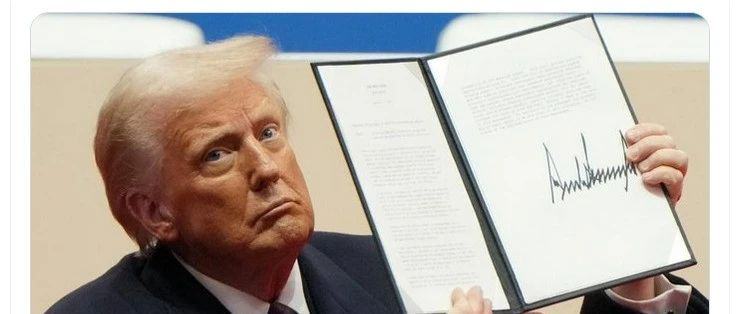

On August 25, 2025, U.S. President Donald Trump announced the immediate dismissal of Federal Reserve Board member Lisa Cook.

Japan Post Bank, the largest deposit institution in Japan, has announced that it will launch a tokenized deposit currency called DCJPY in fiscal year 2026.

A survey commissioned by British insurance company Aviva has revealed the potential influence of cryptocurrencies in the UK's retirement investment sector. More than a quarter of UK adults indicated they are willing to include cryptocurrencies in their retirement portfolios, and 23% are even considering withdrawing existing pension funds to invest in this high-risk asset.

On August 28, 2025, the second Asia Bitcoin Conference grandly opened in Hong Kong, attracting top figures from the global virtual currency industry to gather together.

On August 29, 2025, the Ethereum Foundation announced the suspension of public grant applications for its Ecosystem Support Program (ESP).

Bank of China (Hong Kong) Limited (referred to as "BOCHK") has officially announced that it will apply for a stablecoin issuance license, aiming to become one of the first approved institutions.

- 06:51Ohio Approves Cryptocurrency Payments for State Government FeesOn September 25, according to Decrypt, the Ohio State Depository Board has unanimously approved a vendor proposal to support the use of cryptocurrencies, including bitcoin, for the payment of state government fees and services. Secretary of State Frank LaRose stated that the relevant departments process hundreds of thousands of transactions annually and have received increasing demand for cryptocurrency payment options. This initiative is part of Ohio's push for digital asset legislation, including the Blockchain Protection Act and the bitcoin reserve proposal.

- 06:46Nine European banks plan to jointly launch a MiCA-compliant euro stablecoinChainCatcher news, according to CoinDesk, nine European banks including ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International have announced the establishment of a new company, with plans to issue a euro stablecoin regulated under MiCA in the second half of 2026. The company will apply for an electronic money institution license from the Dutch central bank, aiming to become the European standard for digital payments and open to more banks joining. The stablecoin will support low-cost, near real-time cross-border payments and digital asset settlements.

- 06:23SunPerp has launched SUNDOG/USDT contract tradingChainCatcher News, according to official sources, the TRON ecosystem decentralized perpetual contract exchange SunPerp has added a USDT-margined contract trading pair: SUNDOG/USDT, supporting up to 20x leverage. Reportedly, SunPerp is the first Perp DEX in the TRON ecosystem. With its unique hybrid architecture, high-speed trade matching capabilities, fully on-chain asset custody model, and the industry's lowest trading fees, it aims to perfectly combine the smooth experience of centralized exchanges with the asset sovereignty and transparency of decentralized finance. Currently, SunPerp is in its public beta phase. As of September 24, the platform has surpassed 6,000 users, with a total trading volume exceeding 14.6 million USDT. Risk Warning