News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Despite gearing up for its version 23 upgrade, Pi Network’s PI token trades flat at $0.34. Weak inflows and bearish momentum raise the risk of a dip to $0.32 unless demand rebounds.

Bitcoin charts flash bullish reversal signs, hinting at a breakout towards $120K as momentum builds rapidly.The Bullish Crossover ExplainedTrendline Break Could Be the Trigger

Christian Rau says Mastercard views crypto as a payment method, not a revolution—focusing on safety and compliance.Stablecoins: A Step Forward, But Not a Replacement

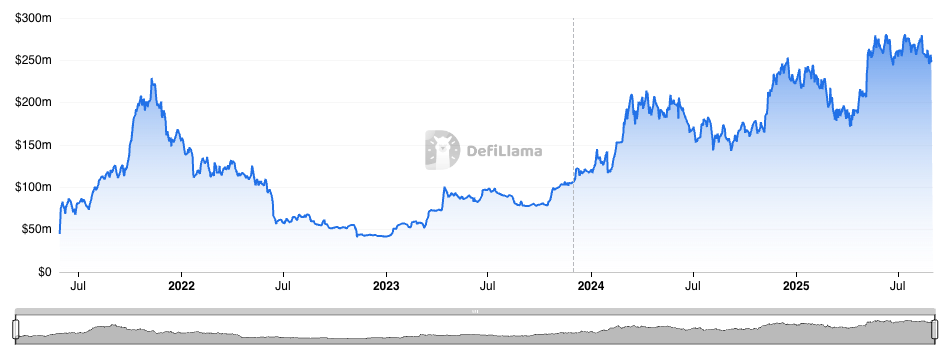

Solana's DEX volume soared to $144B in August, regaining its momentum and matching May’s bullish activity.Why the Spike in Solana DEX Volume?What This Means for Solana and DeFi

The Philippines files SB 1330 to place the national budget on blockchain, boosting transparency and accountability.How Blockchain Will Revolutionize Budget ManagementGlobal Implications and the Future of Public Finance

- 01:28Rezolve AI strengthens its digital asset payment initiative in collaboration with Tether through the acquisition of SmartpayChainCatcher news, according to Cointelegraph, fintech infrastructure company Smartpay, which supports stablecoin payments, has been acquired by the listed business platform Rezolve AI. The acquisition was announced on Tuesday, but financial terms were not disclosed. Rezolve stated that this move will strengthen its digital asset payment program in collaboration with USDT issuer Tether. The acquisition supports Rezolve's plan to build a blockchain-based payment network that allows consumers to pay with digital assets while enabling merchants to maintain instant fiat currency transactions.

- 00:48Today's Fear and Greed Index drops to 60, still at Greed levelJinse Finance reported that today's Fear and Greed Index has dropped to 60, with the level still classified as Greed. Note: The Fear and Greed Index ranges from 0 to 100 and includes the following indicators: volatility (25%) + market trading volume (25%) + social media sentiment (15%) + market surveys (15%) + Bitcoin's dominance in the overall market (10%) + Google search trend analysis (10%).

- 00:44Two spot ETH ETFs managed by Grayscale have staked an additional 272,000 ETH, valued at $1.21 billions.According to ChainCatcher, on-chain analyst Yu Jin monitored that two ETH spot ETFs managed by Grayscale staked an additional 272,000 ETH (1.21 billions USD) four hours ago. Since being allowed to stake, they have deposited a total of 304,000 ETH into staking. Currently, there are a total of 489,000 ETH waiting to be staked, which means Grayscale accounts for the majority of ETH pending staking activation. However, compared to the amount entering staking, there is much more ETH exiting: at present, a total of 2.427 millions ETH are queued and waiting to exit staking.