News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- TOKEN6900 emerges as SPX6900's successor in 2025, leveraging FOMO-driven liquidity and $3.1M presale success to target 1000x gains. - Investors shift capital from SPX6900 (down 45% in March 2025) to TOKEN6900's $0.0071 tokens, fueled by satirical branding and 33% APY staking rewards. - Market rotation reflects broader trend: meme coins with viral narratives outperform legacy projects as SPX6900 faces bearish momentum and whale liquidations. - TOKEN6900's 300% social media growth contrasts with S&P 500's

- Avalanche (AVAX) surges with 493% C-Chain throughput growth, 57% active address increase, and 42.7% lower fees post-upgrade. - U.S. government adopts AVAX for GDP data anchoring, while Grayscale files AVAX ETF to unlock institutional capital and global custodians expand AVAX integration. - AVAX consolidates at $23–$25 with $27–$28 breakout potential, supported by 68% historical success rate at resistance levels and $9.89B DeFi TVL growth. - Strategic entry points with 5% volatility buffer align with CLAR

- China launches yuan-backed stablecoin pilot in Hong Kong and Shanghai to challenge dollar-dominated global trade and payments. - State-backed stablecoins use blockchain for cross-border settlements, with strict 100% reserve requirements and real-time monitoring under new regulatory frameworks. - Private firms like Conflux and PetroChina drive adoption through high-speed blockchain platforms and energy trade applications in BRI regions. - Initiative aims to reduce reliance on SWIFT and U.S. dollar, potent

- Bitcoin broke below a key multiyear support trendline, triggering "fakeout" fears as prices rebounded from a seven-week low of $108,665 to $113,208. - Technical analysts highlight conflicting signals: bullish inverse head-and-shoulders patterns vs. bearish double-top warnings and Fibonacci retracement risks. - Institutional selling contrasts with retail buying pressure, stabilizing prices amid a Binance Fear & Greed Index of 45 (moderate anxiety). - $117,000–$118,000 is the next critical target, with pot

- Elon Musk's lawyer Alex Spiro will chair a $200M Dogecoin treasury company backed by Miami-based House of Doge. - The initiative aims to institutionalize Dogecoin's market presence through traditional stock market exposure and corporate legitimacy. - Dogecoin's value remains heavily influenced by Musk's public statements, with the treasury model following crypto trends seen in Bitcoin investments. - Critics warn of regulatory risks and market manipulation concerns despite the growing $132B crypto treasur

- Bitcoin shows triple on-chain signals (whale selling decline, HODL Waves accumulation, technical support) suggesting a potential 4% price surge to $119,000. - Whale Exchange ratio dropped to 0.43 (lowest in two weeks), indicating reduced large-holder selling pressure and retail buyer dominance. - Medium-term holders increased BTC holdings despite volatility, reinforcing confidence in long-term price resilience. - Technical analysis highlights $115,400 support and $119,700 resistance levels as critical fo

- SPX token fell 12% as whale selling and weak technical indicators dominate bearish sentiment. - Institutional accumulation at $1.15 suggests contrarian buying, contrasting with Bitcoin/Ethereum's stable treasury growth. - $1.15 support zone faces pressure from massive whale offloading, with historical RSI strategies showing 145% returns but 25% drawdowns. - Market hinges on whether institutional confidence can outweigh bearish momentum and validate $1.15 as a recovery catalyst.

- Wall Street Pepe (WEPE) redefines meme coins through dual-chain migration (Ethereum/Solana) and deflationary tokenomics, addressing volatility and utility gaps seen in Dogecoin and Shiba Inu. - Its cross-chain model burns Ethereum tokens with every Solana transaction, maintaining a fixed 200 billion supply and enabling 1:1 peg activation at $0.001 per token. - NFT integration grants governance rights and exclusive perks (e.g., Alpha Chat access), creating a flywheel effect that links NFT adoption to toke

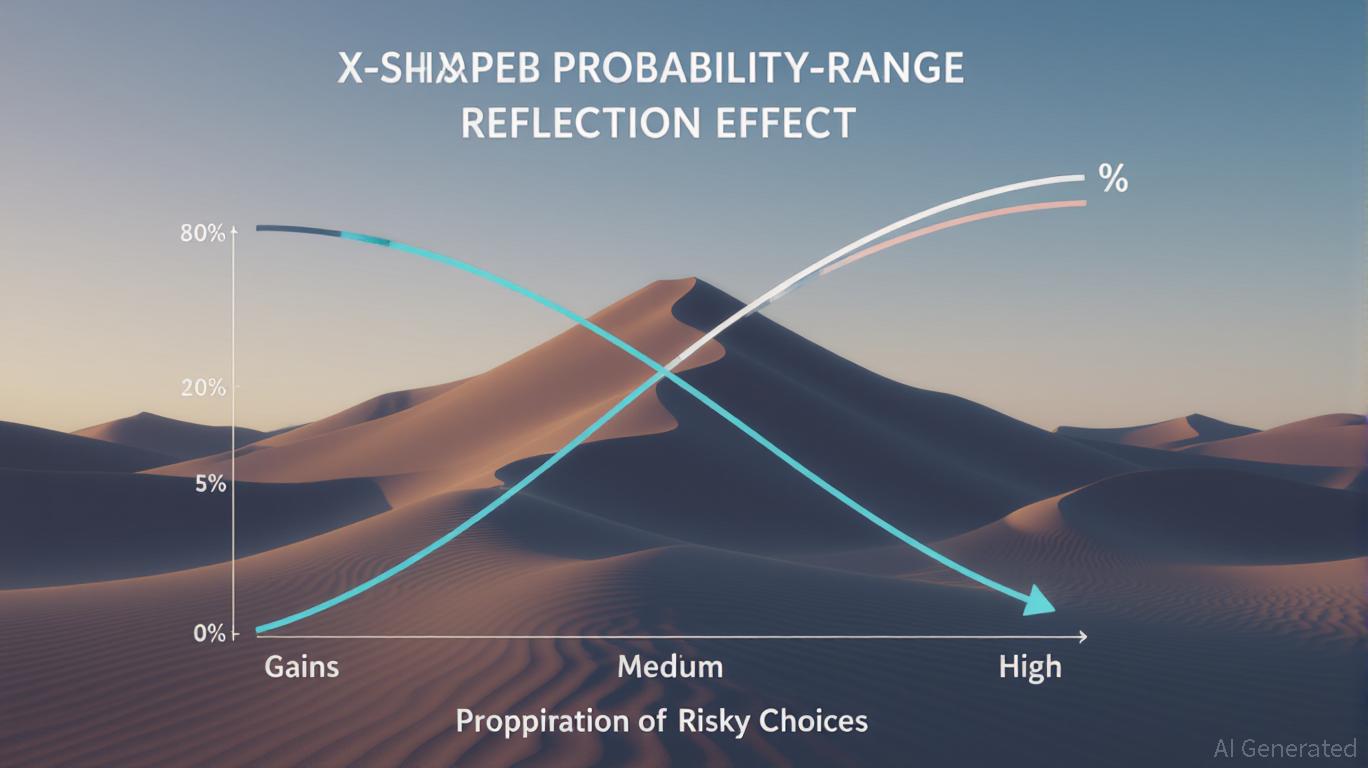

- The probability-range reflection effect (UXRP) explains how investors' risk preferences shift across six domains based on probability levels and gain/loss contexts. - Low-probability losses trigger risk-seeking behavior (e.g., distressed assets), while high-probability gains favor risk-averse choices (e.g., stable dividends). - Strategic allocations vary by scenario: defensive assets in stable markets, contrarian plays during downturns, and diversified hedging in uncertain conditions. - Domain-specific a

- Pepenode ($PEPENODE), a mine-to-earn meme coin, raises $500K in presale with whale support, offering hardwareless Ethereum-based mining via virtual nodes. - Users earn tokens through interactive node upgrades, with 70% token burn on upgrades creating deflationary scarcity and 2% referral rewards driving viral growth. - Positioned as a "next-gen Pepe coin," it combines gamification with utility, contrasting speculative meme coins by linking value to user activity and cross-token rewards. - With 14,854 pre

- 19:14WLFI whale deposits another 2,000 ETH to a certain exchange, having sold 4,000 ETH in the past two daysBlockBeats News, on October 2, according to on-chain analyst Ai Yi (@ai_9684xtpa), WLFI whale 0xe8b...1a9f3 once again deposited 2,000 ETH to a certain exchange. In the past two days, it is suspected to have sold 4,000 ETH, worth approximately $17.1 million. Two hours ago, this address received another 3,454 ETH redeemed from Lido, and subsequently deposited 2,000 of them to a CEX. It currently still holds 7,850 ETH, valued at $34.61 million.

- 19:14An address bought 2Z at a high price and sold at a loss, cutting losses at 41.8%.BlockBeats News, on October 2, according to on-chain analyst Ai Aunt (@ai_9684xtpa), address BLhQ4..Z2QYy chased 2Z and lost $209,000 in 50 minutes. He bought $499,000 worth of 2Z at an average price of $0.93. Ten minutes after buying, the candlestick chart started to decline sharply. Finally, 12 minutes ago, he decided to liquidate his position, resulting in a 41.8% loss in assets.

- 19:14CME Group to Launch 24/7 Cryptocurrency Futures and Options TradingBlockBeats News, October 2, according to a certain information platform, the Chicago Mercantile Exchange Group is about to launch round-the-clock cryptocurrency futures and options trading.This expansion will allow traders to access the cryptocurrency market almost 24/7, going beyond traditional U.S. trading hours.