News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 21) | U.S. September Nonfarm Payrolls Unexpectedly Increase by 119,000; BTC Falls Below $86,000, Crypto Market Sees $834M in Liquidations; OpenAI Launches ChatGPT Group Chat Feature Globally2Bitcoin slump to $86K brings BTC closer to ‘max pain’ but great ‘discount’ zone3Bitcoin, stocks crumble after Nvidia earnings and Fed uncertainty over next rate cut

LINK ETF confirmed for 2025? XRP and SOL launches move up Chainlink timeline

CryptoSlate·2025/11/13 11:30

Hedera integrates ERC-3643 standard to enhance asset tokenization compliance capabilities

PANews·2025/11/13 11:02

Key Market Intelligence on November 13th, how much did you miss out on?

1. On-chain Volume: $82.2M inflow to Arbitrum today; $71.9M outflow from BNB Chain 2. Largest Price Swing: $11.11, $ALLO 3. Top News: Trump Signs Bill, U.S. Government Shutdown Declared Over

BlockBeats·2025/11/13 10:50

In the DeFi Buyback Wave: Uniswap, Lido Caught in "Centralization" Controversy

On the backdrop of increasing centralization concerns as platforms like Uniswap and Lido are adopting token buyback programs, protocols are facing questions related to governance and sustainability.

BlockBeats·2025/11/13 10:30

Rethinking Sideways Trading: Major Cryptocurrencies Are Undergoing a Massive Whale Shakeout

Ignas also pays special attention to lending protocols that generate fees.

Chaincatcher·2025/11/13 10:11

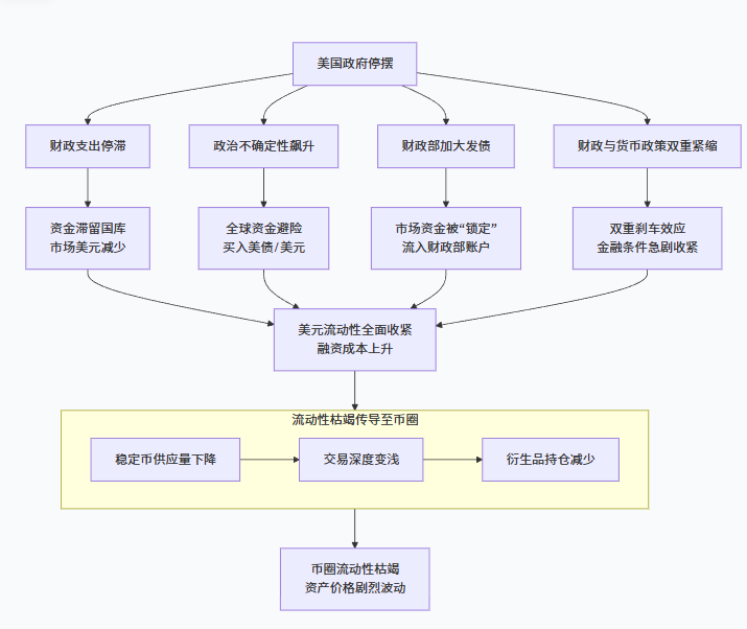

How could a U.S. government shutdown strangle crypto market liquidity?

AICoin·2025/11/13 10:06

Unexpected Change! The Independence of the Federal Reserve Faces Unprecedented Challenge

AICoin·2025/11/13 10:06

The Graph Delivers Production-Ready Data Infrastructure for TRON Enterprise Applications

CryptoSlate·2025/11/13 10:00

The Leading Stablecoin Issuer Circle Releases Q3 Financial Report: What are the Key Highlights?

As of the end of the third quarter, USDC's circulation has reached $73.7 billion, representing a staggering 108% year-over-year growth.

BlockBeats·2025/11/13 09:35

Flash

- 17:04U.S. stocks continue to rise, with the Dow Jones up 1%According to ChainCatcher, citing Golden Ten Data, U.S. stocks continued their upward trend, with the Dow Jones Industrial Average rising by 1%.

- 16:48Michael Saylor responds to "possible removal by MSCI": Index classification cannot define StrategyJinse Finance reported that Michael Saylor, founder and executive chairman of Strategy, responded on social media to concerns about the risk of being removed from the MSCI index. He stated that Strategy, as a publicly traded operating company, is fundamentally different from funds, trusts, and holding companies. Strategy not only owns a $500 million software business, but also uniquely utilizes bitcoin as productive capital for treasury management. Index classifications cannot define Strategy. The company's long-term strategy is clear, its belief in bitcoin is unwavering, and its mission has always been to become the world's first digital currency institution based on sound money and financial innovation.

- 16:47University of Michigan survey: U.S. consumer confidence drops to one of the lowest levels in historyJinse Finance reported that U.S. consumer confidence fell in November to one of its historical lows, as Americans became more pessimistic about their own financial situations. According to data from the University of Michigan, the final value of the consumer confidence index in November dropped to 51 from 53.6 in October, only slightly higher than the preliminary value. The current conditions index fell by 7.5 points to a record low of 51.1. Consumers' views on their personal finances were the most pessimistic since 2009. Survey director Joanne Hsu stated, "Consumers remain frustrated by persistently high prices and declining incomes." The data shows that consumers expect prices to rise at an annual rate of 4.5% over the next year, marking the third consecutive month of slowdown. They expect the average annual price increase over the next five to ten years to be 3.4%, compared to 3.9% in October. Although Americans' concerns about inflation have eased somewhat, they still feel anxious about the high cost of living and job security. The report shows that the probability of personal unemployment risk has risen to its highest level since July 2020. The number of continued unemployment insurance claims rose to a four-year high at the beginning of this month, indicating that it is becoming more difficult for unemployed Americans to find new jobs.