News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The US crypto regulatory framework is undergoing a redistribution of authority, with clear divisions of responsibility between the CFTC and SEC: the SEC focuses on securities, while the CFTC is responsible for the spot market of digital commodities. The advancement of new bills and the arrangement of hearings indicate that the regulatory boundaries have been formally clarified in official documents for the first time. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

A Ukrainian drone attack has caused the suspension of oil exports at Russia's Novorossiysk port, interrupting a daily supply of 2.2 million barrels. As a result, international oil prices surged by over 2%.

The twilight of financialization: when debt cycles can only create nominal growth.

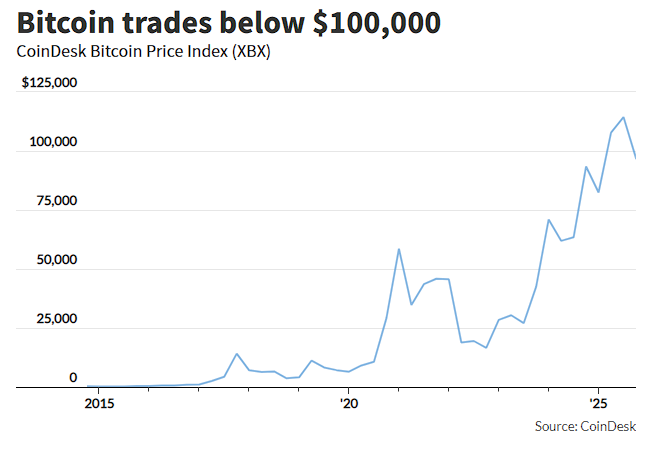

Compared with the capital inflows into tech stocks and gold's sharp rebound after a plunge, bitcoin was a clear exception in Friday's market: it defied the trend by dropping 5%, hitting a six-month low, and has now declined for three consecutive weeks. This contrast highlights the unusual situation in the bitcoin market: even as it maintains a high correlation of 0.8 with the Nasdaq 100 Index, bitcoin exhibits an asymmetric pattern of "falling more on declines and rising less on rallies." Meanwhile, intensified whale sell-offs and concentrated selling by long-term holders are jointly suppressing bitcoin.

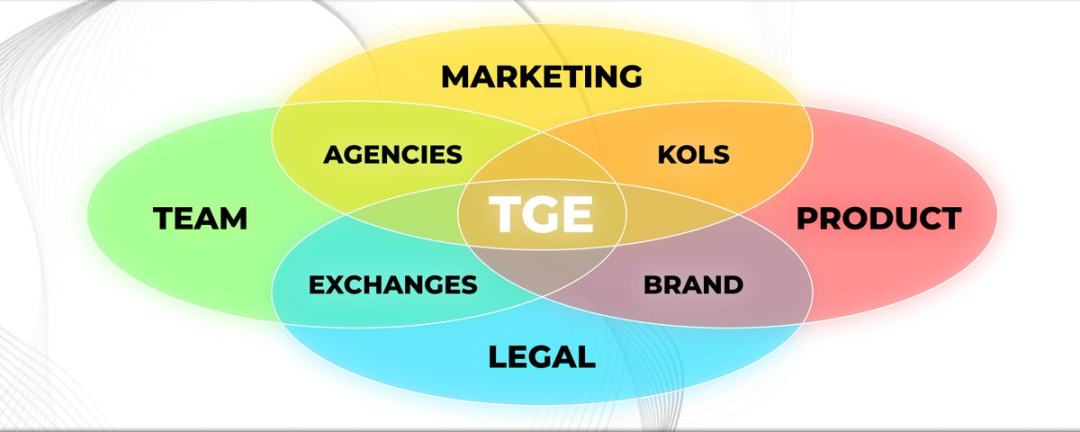

Doing these things is a prerequisite for a successful TGE.

- 2025/11/21 23:36Overview of Major Overnight Developments on November 2221:00-7:00 Keywords: a certain exchange, Federal Reserve, S&P 500 1. Goldman Sachs partner: Signs of capitulation among bulls in the US stock market; 2. A certain exchange will launch multiple altcoin futures products in December; 3. The S&P 500 Index and Nasdaq Index both hit their lowest levels in over two months at one point; 4. The Federal Reserve extends the consultation period for improvements to the stress testing program, providing banks with more time for feedback; 5. US banks benefit from relaxed regulations, Jefferies predicts $2.6 trillion in lending capacity will be released; 6. US Bureau of Labor Statistics: Cancellation of October CPI release, November CPI will be published on December 18; 7. Federal Reserve December rate cut vote is at an "impasse", Cook, who is under pressure from Trump, may become the key vote.

- 2025/11/21 23:24US SEC approves listing and trading of Bitwise 10 Crypto Index ETF on ArcaForesight News reported that the U.S. Securities and Exchange Commission has approved a proposed rule change by NYSE Arca, allowing it to list and trade the Bitwise 10 Crypto Index ETF. The assets covered by this Bitwise fund include BTC, ETH, XRP, SOL, ADA, SUI, LINK, AVAX, LTC, and DOT.

- 2025/11/21 23:23GAIB Foundation: Currently commissioning a third party to recalculate airdrop rewards, expected to be completed in 7-10 daysForesight News reported that the GAIB Foundation stated it is actively recalculating airdrop rewards and has commissioned a third-party organization to assist with this work. The goal is to design and implement a plan to ensure users receive fair rewards for their contributions. GAIB expects this process to take approximately 7-10 days. Progress will be updated promptly if any key milestones are reached.