News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- 2025 crypto success hinges on community-driven tokens with strategic partnerships, blending innovation and transparent growth. - Arctic Pablo Coin (APC) leads with deflationary mechanics, institutional audits, and 12,400% ROI potential via NFTs and DAO governance. - MoonBull ($MOBU) leverages Ethereum infrastructure and whitelist scarcity, offering Ethereum-grade security with AI-driven DeFi features. - Bitcoin Hyper ($HYPER) addresses Bitcoin's scalability via Solana's SVM, raising $12.5M with WBTC brid

- 2025 meme coin market evolves from viral humor to technical competition, with $74.5B valuation driven by tokenomics, scarcity, and DeFi integration. - Whitelist projects like MoonBull ($MOBU) and Arctic Pablo Coin (APC) create urgency via exclusive access, deflationary mechanisms, and private staking rewards. - ROI hinges on structured tokenomics and blockchain utility, as seen in MoonBull's Ethereum staking and Pepe Coin's NFT partnerships. - High-risk factors persist, including pump-and-dump schemes, b

- Hyperliquid’s HYPE token repurchased 8.7% of supply via $1.26B buybacks and burned 3,200 tokens in 24 hours, tightening float and creating bullish bias. - Whale wallets spent $35.9M to accumulate 641,551 HYPE tokens, driving 2.5–5.8% price surges and signaling institutional coordination. - Technical indicators show sustained upward momentum, with HYPE gaining 7.5% in August despite broader market declines, supported by $105M fee-funded buybacks. - Risks include Bitcoin correlation and whale manipulation

- Ethereum's institutional adoption accelerated in 2025 as corporate treasuries and ETFs controlled 9.2% of its supply, reshaping market dynamics. - 19 public companies and BlackRock's ETHA ETF dominated inflows, with $17.6B in corporate holdings and $27.66B in ETF assets by Q3 2025. - Regulatory clarity and yield-generating strategies reduced circulating supply, enhancing price resilience and positioning Ethereum as a regulated institutional asset. - Institutional accumulation created a flywheel effect, r

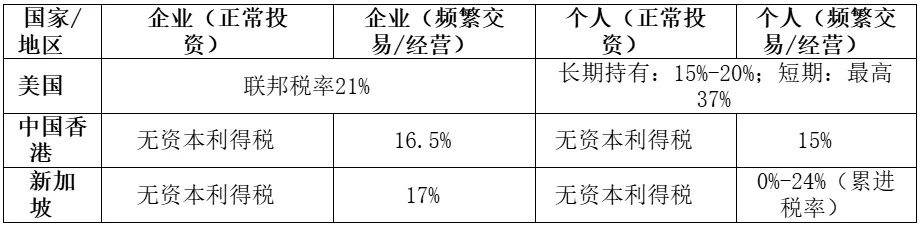

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.

- Ethereum’s price resilience and institutional adoption drive Tom Lee’s $60,000 5-year forecast, supported by $27.6B ETF inflows and 55.5% market dominance. - Regulatory clarity (SEC approval, CLARITY Act) and 29% staked ETH bolster institutional confidence, while Layer 2 upgrades boost scalability and TVS to $16.28B. - Macroeconomic tailwinds (Fed rate cuts) and Ethereum’s role in stablecoins (55% market share) position it as a foundational asset, though competition and volatility pose risks.

- 16:11Data: $168 million liquidated across the network in the past 24 hours, mainly long positionsChainCatcher News: In the past 24 hours, the total liquidation amount in the cryptocurrency market reached 168 million US dollars, with long positions liquidated for 111 million US dollars and short positions liquidated for 57.2838 million US dollars. A total of 93,542 people were liquidated globally, with the largest single liquidation occurring on Hyperliquid - ASTER-USD, valued at 1.5104 million US dollars.

- 16:11Data: If BTC breaks $114,220, the cumulative short liquidation intensity on major CEXs will reach $969 millions.According to ChainCatcher, citing data from Coinglass, if BTC surpasses $114,220, the cumulative short liquidation intensity on major CEXs will reach $969 millions. Conversely, if BTC falls below $104,841, the cumulative long liquidation intensity on major CEXs will reach $969 millions.

- 16:04Delin Holdings plans to acquire Bitcoin mining machines through the issuance of convertible bonds and warrants, and has signed a letter of intent with BM.On September 28, Derlin Holdings (01709.HK) announced that the company has entered into a formal agreement with the seller, Evergreen Wealth, regarding bitcoin mining machines. According to the agreement, the company has conditionally agreed to acquire, and the seller has conditionally agreed to sell, bitcoin mining machines (2,200 units of S21XP HYD bitcoin miners) for a total consideration of 21.8526 million US dollars. The consideration for the bitcoin mining machines will be paid through the issuance of the following: convertible bonds with a principal amount of 21.8526 million US dollars; 40 million warrants; and, upon achieving profit conditions, the company will issue 13.4425 million profit shares. At the same time, legally binding letters of intent have been signed with BM1 and BM2 to further purchase 1,900 units of S21e Hyd. and 1,095 units of S21e XP Hyd., with total considerations of 8.349 million US dollars and 10.8766 million US dollars, respectively. The above transactions are subject to authorization by a special general meeting of shareholders and approval by the Stock Exchange.