News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- China launches yuan-backed stablecoin pilot in Hong Kong and Shanghai to challenge dollar-dominated global trade and payments. - State-backed stablecoins use blockchain for cross-border settlements, with strict 100% reserve requirements and real-time monitoring under new regulatory frameworks. - Private firms like Conflux and PetroChina drive adoption through high-speed blockchain platforms and energy trade applications in BRI regions. - Initiative aims to reduce reliance on SWIFT and U.S. dollar, potent

- Bitcoin broke below a key multiyear support trendline, triggering "fakeout" fears as prices rebounded from a seven-week low of $108,665 to $113,208. - Technical analysts highlight conflicting signals: bullish inverse head-and-shoulders patterns vs. bearish double-top warnings and Fibonacci retracement risks. - Institutional selling contrasts with retail buying pressure, stabilizing prices amid a Binance Fear & Greed Index of 45 (moderate anxiety). - $117,000–$118,000 is the next critical target, with pot

- Elon Musk's lawyer Alex Spiro will chair a $200M Dogecoin treasury company backed by Miami-based House of Doge. - The initiative aims to institutionalize Dogecoin's market presence through traditional stock market exposure and corporate legitimacy. - Dogecoin's value remains heavily influenced by Musk's public statements, with the treasury model following crypto trends seen in Bitcoin investments. - Critics warn of regulatory risks and market manipulation concerns despite the growing $132B crypto treasur

- Bitcoin shows triple on-chain signals (whale selling decline, HODL Waves accumulation, technical support) suggesting a potential 4% price surge to $119,000. - Whale Exchange ratio dropped to 0.43 (lowest in two weeks), indicating reduced large-holder selling pressure and retail buyer dominance. - Medium-term holders increased BTC holdings despite volatility, reinforcing confidence in long-term price resilience. - Technical analysis highlights $115,400 support and $119,700 resistance levels as critical fo

- SPX token fell 12% as whale selling and weak technical indicators dominate bearish sentiment. - Institutional accumulation at $1.15 suggests contrarian buying, contrasting with Bitcoin/Ethereum's stable treasury growth. - $1.15 support zone faces pressure from massive whale offloading, with historical RSI strategies showing 145% returns but 25% drawdowns. - Market hinges on whether institutional confidence can outweigh bearish momentum and validate $1.15 as a recovery catalyst.

- Wall Street Pepe (WEPE) redefines meme coins through dual-chain migration (Ethereum/Solana) and deflationary tokenomics, addressing volatility and utility gaps seen in Dogecoin and Shiba Inu. - Its cross-chain model burns Ethereum tokens with every Solana transaction, maintaining a fixed 200 billion supply and enabling 1:1 peg activation at $0.001 per token. - NFT integration grants governance rights and exclusive perks (e.g., Alpha Chat access), creating a flywheel effect that links NFT adoption to toke

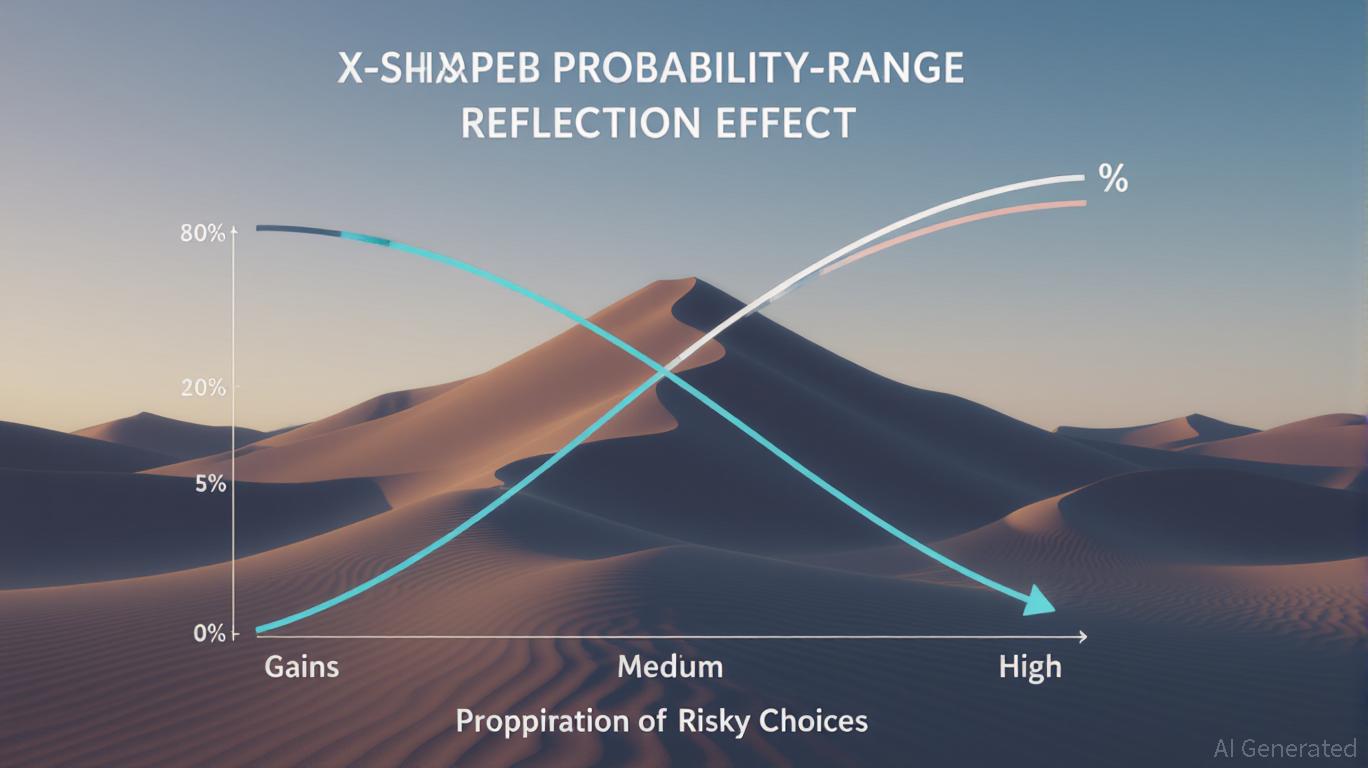

- The probability-range reflection effect (UXRP) explains how investors' risk preferences shift across six domains based on probability levels and gain/loss contexts. - Low-probability losses trigger risk-seeking behavior (e.g., distressed assets), while high-probability gains favor risk-averse choices (e.g., stable dividends). - Strategic allocations vary by scenario: defensive assets in stable markets, contrarian plays during downturns, and diversified hedging in uncertain conditions. - Domain-specific a

- Pepenode ($PEPENODE), a mine-to-earn meme coin, raises $500K in presale with whale support, offering hardwareless Ethereum-based mining via virtual nodes. - Users earn tokens through interactive node upgrades, with 70% token burn on upgrades creating deflationary scarcity and 2% referral rewards driving viral growth. - Positioned as a "next-gen Pepe coin," it combines gamification with utility, contrasting speculative meme coins by linking value to user activity and cross-token rewards. - With 14,854 pre

- U.S. "de minimis" tariff exemption removal hikes costs for consumers and businesses, targeting imports under $800. - Small businesses face financial strain, resorting to layoffs or alternative revenue streams to offset rising import duties. - Global South economies risk destabilization as U.S. tariffs disrupt cheap export markets, prompting currency devaluation fears. - IMF and OECD cut 2025 growth forecasts, citing tariff-driven uncertainty and uneven corporate impacts like Nike's $100M+ cost hikes.

- Japanese firm Gumi invests $17M in XRP for cross-border payments and liquidity via SBI partnership. - Growing institutional adoption includes $20M-$500M XRP allocations by firms like Nature’s Miracle and Trident, shifting from speculation to operational use. - SEC’s 2024 XRP commodity reclassification spurred 92 ETF filings in 2025, projecting $4.3–$8.4B inflows and reduced regulatory risks. - XRP’s sub-5-second settlement and $0.0004 fees outperform SWIFT, with Ripple’s ODL processing $1.3T in Q2 2025 t

- 04:54Sky Founder: Sky Core Significantly Reduces Expenses Through Simplification, Current Protocol Annualized Profit Reaches $338 MillionChainCatcher news, Sky (formerly MakerDAO) founder Rune Christensen stated on social media, "After Sky Core's simplification has significantly reduced core expenses, the profit page has been updated. Based on the annualized calculation of the past three months' fees, and with real-time display of stable fee income and savings rate expenditure, the current annualized profit has reached $338 millions."

- 04:41Galaxy Digital deposited 500,000 SOL worth $103 million into a certain exchange over the past 5 days.According to ChainCatcher, Lookonchain monitoring shows that Galaxy Digital has deposited 500,000 SOL, worth $103 million, into an exchange over the past five days.

- 04:14Data: The current Crypto Fear & Greed Index is 48, indicating a neutral state.According to ChainCatcher, citing data from Coinglass, the current Crypto Fear & Greed Index stands at 48, up 1 point from yesterday. The 7-day average is 47, while the 30-day average is 57.