News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Solana slips below $160 after DeFi Development Corp halts $1 billion fundraising plan for Solana purchase, but ETF optimism fuels a bullish long-term outlook.

Dogecoin price slipped over 7%, falling below $0.19, as broader crypto markets reacted to fresh selling pressure following the US CPI data release on June 11.

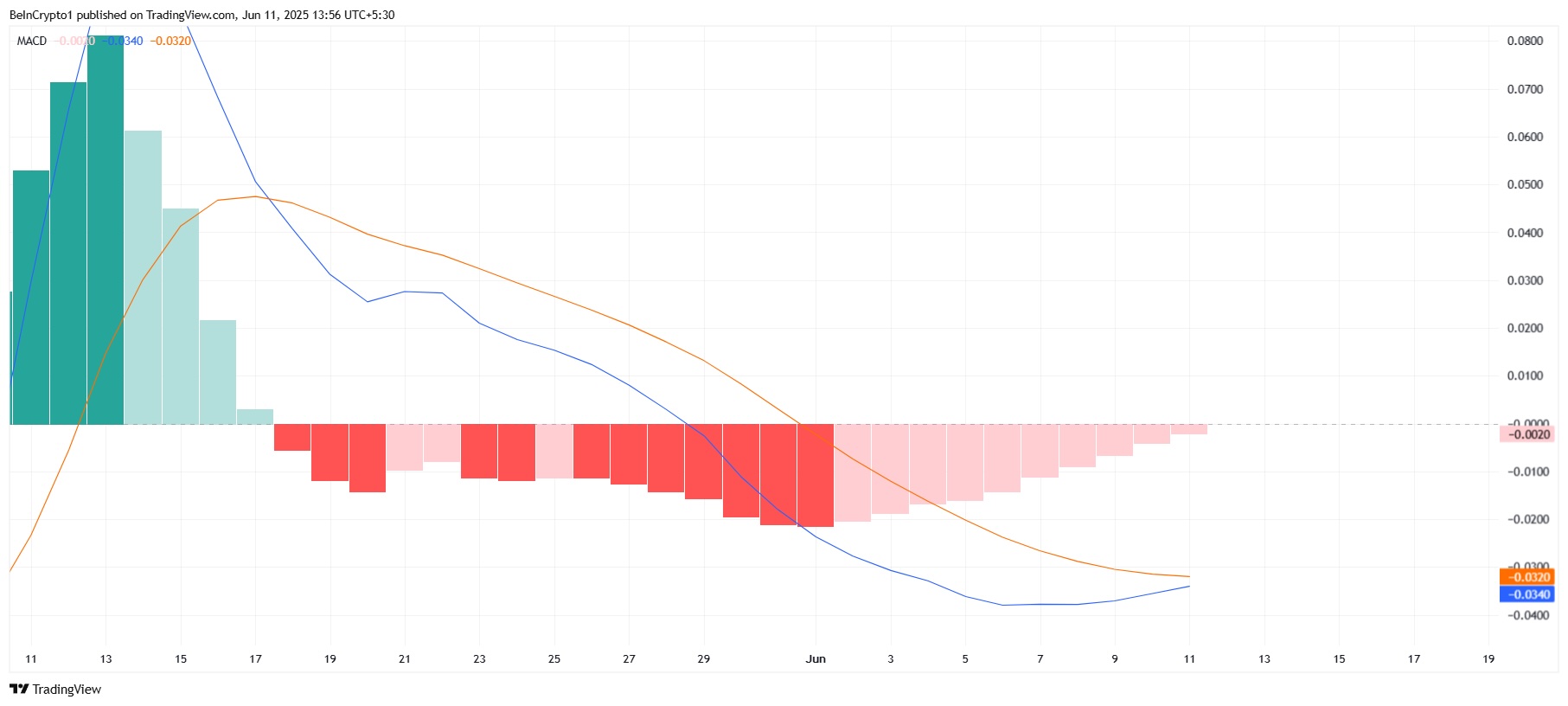

Pi Network’s price has defended the $0.60 support level despite strong selling pressure, with the MACD indicator signaling an approaching bullish crossover.

NEAR Protocol surged in user activity, surpassing Ethereum and Binance Chain in growth. With 46 million monthly active users in May 2025, it ranks as the second Layer 1 platform. Coinglass reported a 14.14% volume rise to $495.52M, showing strong investor confidence.

Mechanism Capital’s Andrew Kang warns that ETH treasury strategy firms may underperform like ETH ETFs, which failed to meet high demand expectations He predicts many will trade at significant net asset value (NAV) discounts by 2026 due to low adoption Despite a recent $281 million ETF inflow, Kang believes most ETH investment products won’t perform

Bitcoin is consolidating near $107K after facing resistance at the $110K level. Long-term models like PlanB’s S2F continue to predict a major bull run ahead. Analysts see the $106K level as critical short-term support for the uptrend.

Fartcoin dominates Pump.fun with $62.42M in 24-hour volume and more than 49K transactions. RICO ranks second with $10.76M in volume and over 57K transactions, showing strong growth. Meme coins like LABUBU and VOID rise due to strong community support and increasing interest.

Stablecoin market cap has hit an all-time high of $228 billion, marking a 17% rise in 2025 alone. Major institutions like Societe Generale and US Bancorp are entering or reviving stablecoin operations. Interest in stablecoins among Fortune 500 and SMBs has more than tripled, as per a Coinbase report.

EGRAG CRYPTO has predicted that XRP price may soar up to $27 amid broader market volatility.

- 08:13Analyst: If BTC Falls Below Short-Term Holder Cost of $106,000, a Deeper Correction May FollowAccording to ChainCatcher, CryptoQuant analyst Axel Adler Jr stated that Bitcoin continues to retreat from its historical highs. The one-year MVRV Z-Score has dropped to near neutral, currently slightly below zero, indicating that unrealized profits on the network have compressed compared to the one-year average, with more supply now at breakeven or in a loss position. The key support level for Bitcoin is at the realized price of short-term holders, $106,000. If the price falls below $106,000, short-term holders as a whole will be in a loss position, and the market faces the risk of a deeper correction. A recovery signal would be the Z-Score consistently rising above zero, along with the price reclaiming the $118,000 level.

- 08:07BenFen Public Chain Enables Rapid RWA Issuance and One-Click On-Chain Integration of Multiple Physical AssetsAccording to ChainCatcher, the stablecoin payment public chain BenFen has announced official support for one-click issuance and on-chain integration of RWAs (Real World Assets) in its major version upgrade. This feature maintains a unified framework with the existing one-click stablecoin issuance, further solidifying BenFen’s positioning as a “stablecoin + RWA infrastructure public chain.” The new version optimizes the Move virtual machine and cross-chain engine, maintaining tens of thousands of TPS and sub-second confirmation, while also providing foundational support for asset tokenization and compliant custody. Through built-in contracts and standardized processes, issuers can map real-world assets such as real estate, bonds, and stocks into on-chain tokens with a single click. Combined with custody, auditing, and KYC procedures, this ensures a secure mapping between off-chain assets and on-chain certificates. This means that the previously high-threshold, process-heavy RWA tokenization can now be achieved through simple operations, enabling on-chain tokenization, liquidity, and global settlement capabilities. In addition, BenFen supports one-click stablecoin issuance, using stablecoins to pay for gas, and sponsoring transaction gas fees, significantly lowering the barriers to issuance and usage, and enhancing the usability of asset tokenization. BenFen is undergoing a comprehensive upgrade to become a stablecoin financial operating system—a one-stop center for the issuance of stablecoins and RWAs, and a universal gateway for global payments and asset circulation.

- 07:57Data: "Machi Big Brother" Jeff Huang Opens 3x Leveraged Long Position on YZY Token in the Past Hour, Currently Facing an Unrealized Loss of $41,000According to ChainCatcher, on-chain analyst Ai Yi (@ai_9684xtpa) has monitored that "Machi Big Brother" Jeff Huang's address opened a 3x leveraged long position on the YZY token within the past hour. Specific data shows that this position holds 570,000 YZY tokens, valued at approximately $642,000, with an entry price of $1.22 per token, currently showing an unrealized loss of $41,000. At the same time, this address's long positions in Bitcoin, Ethereum, PUMP, and HYPE tokens have accumulated a total unrealized loss of about $7 million.