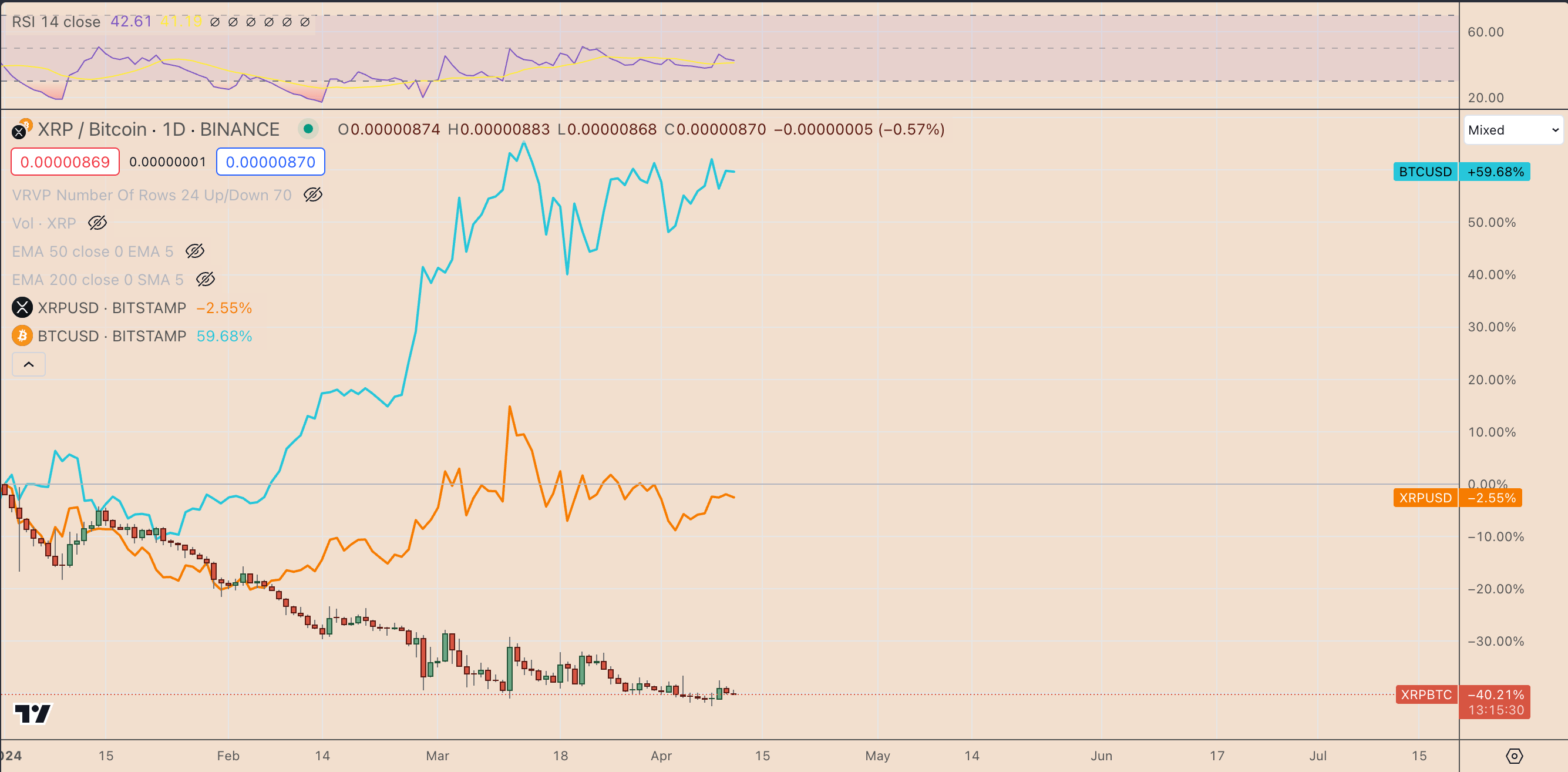

XRP ( XRP ) has lagged Bitcoin ( BTC ) so far in 2024 in terms of price performance, falling around 2.5% year-to-date (YTD) versus the top cryptocurrency's 60% gains in the same period. In turn, the XRP/BTC exchange rate is down 40% YTD.

Why XRP price might jump 70% vs. BTC after the Bitcoin halving

Whale accumulation patterns and critical Bitcoin halving fractals suggest a significant rebound for XRP/BTC price in the upcoming months.

However, the pair shows signs of recovering in the days leading up to Bitcoin's halving in 2024 . A constellation of bullish signals may buoy this momentum, potentially amplifying it following the event.

XRP price post-halving fractal

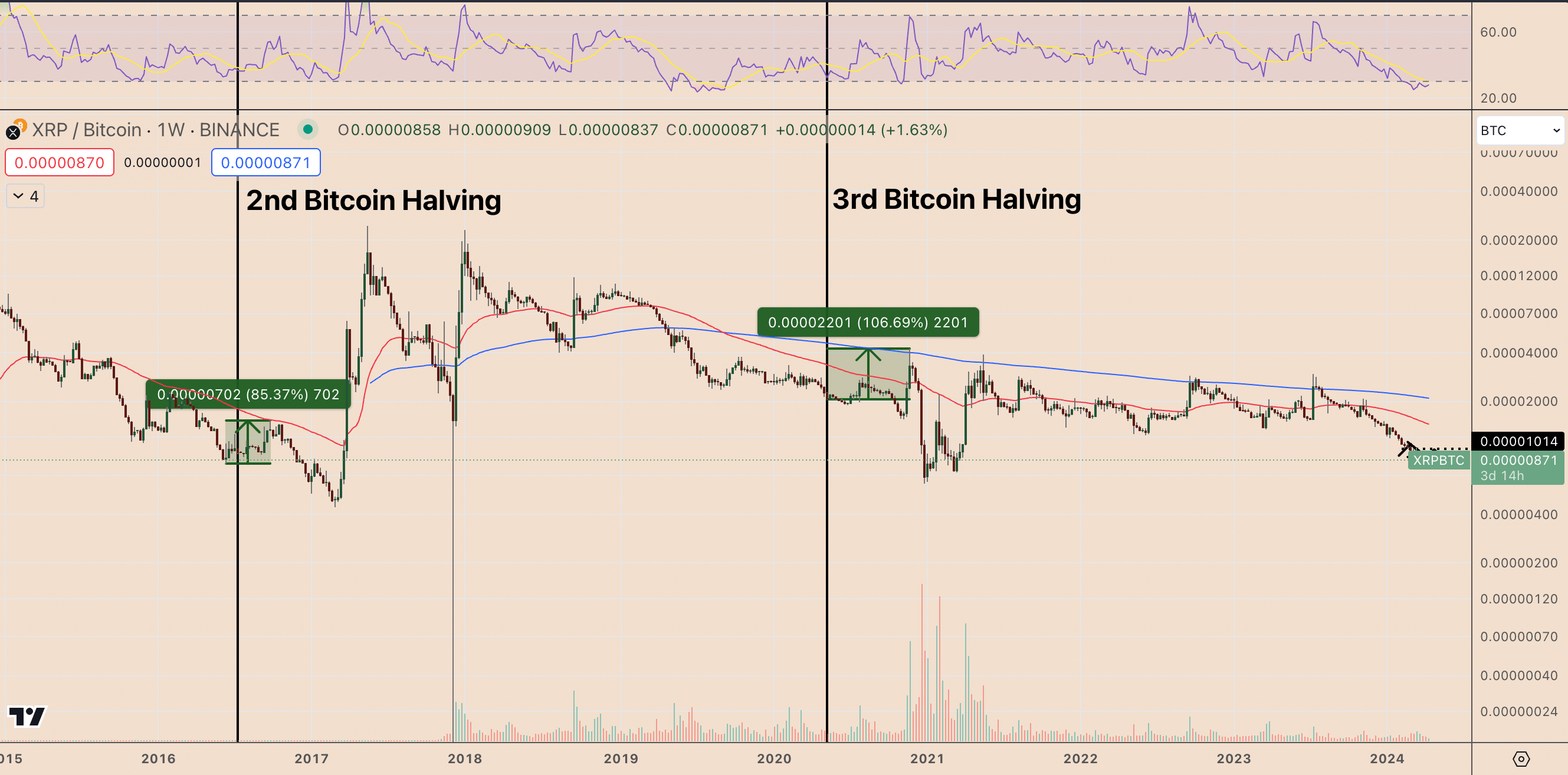

Historically, XRP has demonstrated a tendency to outperform Bitcoin in periods surrounding halving events.

For instance, the XRP/BTC pair rose by over 100% after the third Bitcoin halving in May 2020. Similarly, the pair jumped 85% around the second Bitcoin Halving in July 2016.

These patterns elevate the prospect of XRP outperforming Bitcoin following the upcoming halving on April 19.

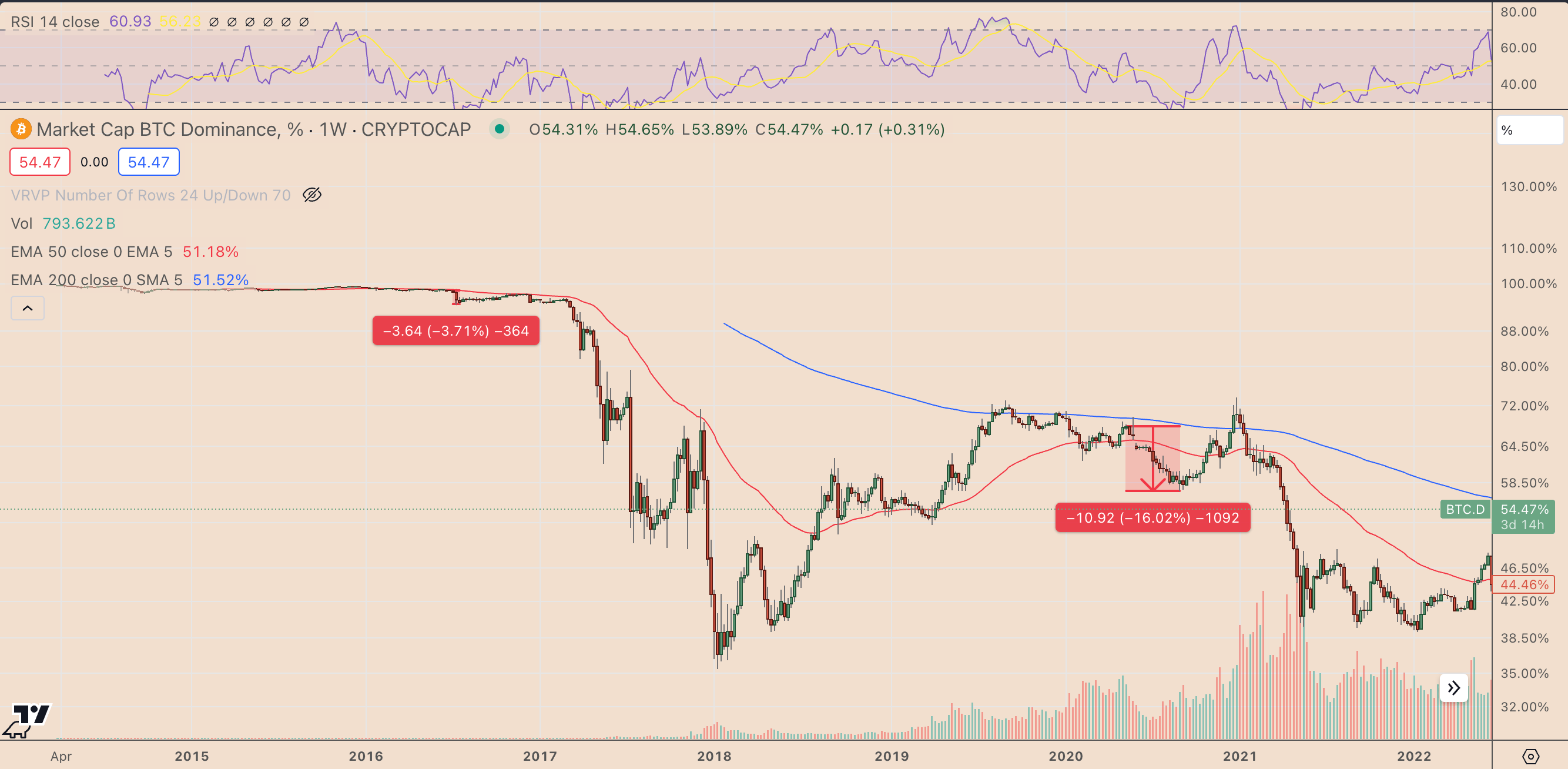

The observed gains in XRP/BTC largely stem from a reduction in Bitcoin's dominance post-halving. This trend suggests that traders frequently rotate their investments from Bitcoin to altcoins following the event, ushering in a period commonly referred to as altseason .

One reason is that altcoins can offer significant short-term gains due to their lower market caps and higher volatility compared to Bitcoin.

XRP's technical patterns flip bullish

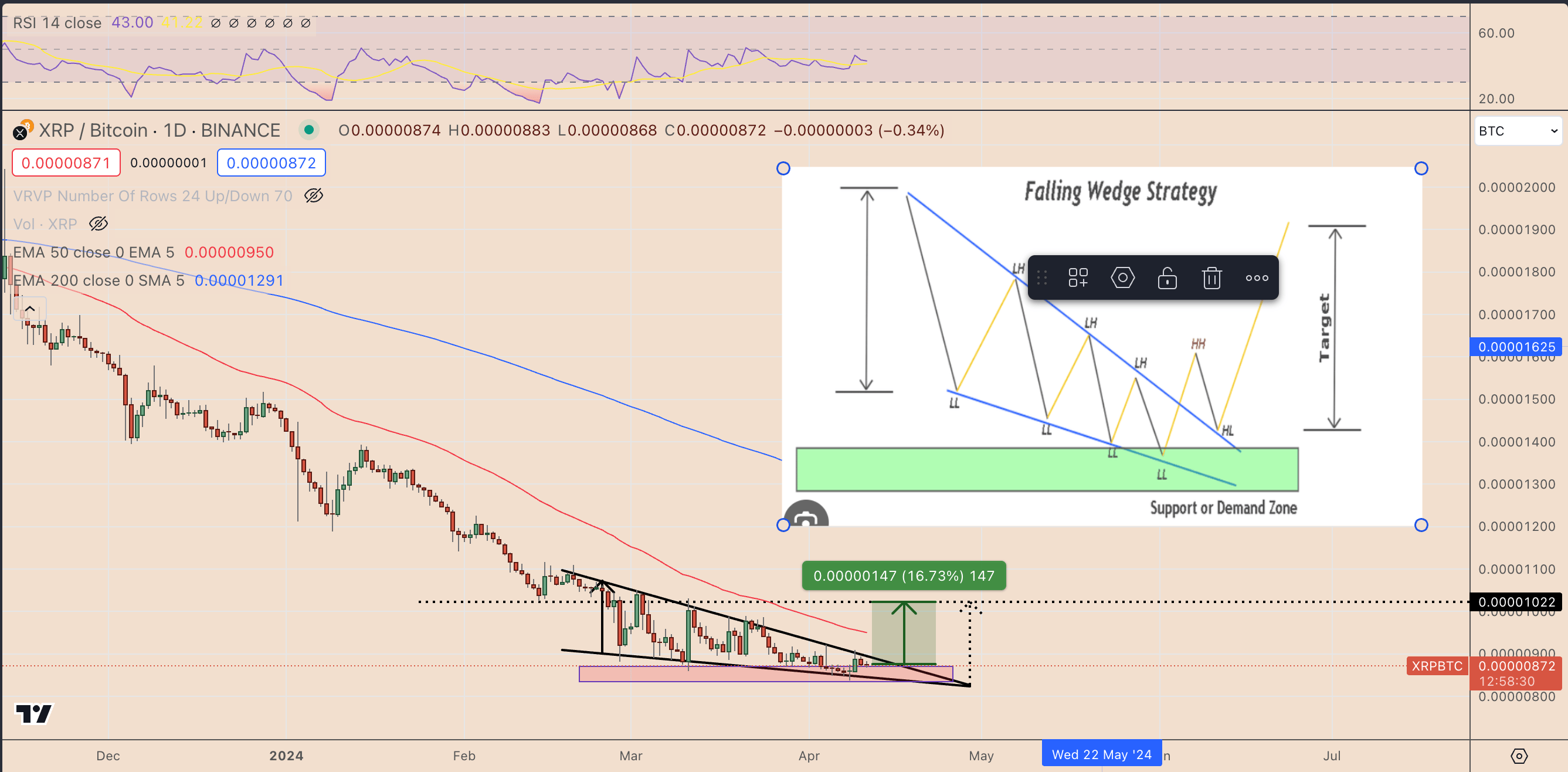

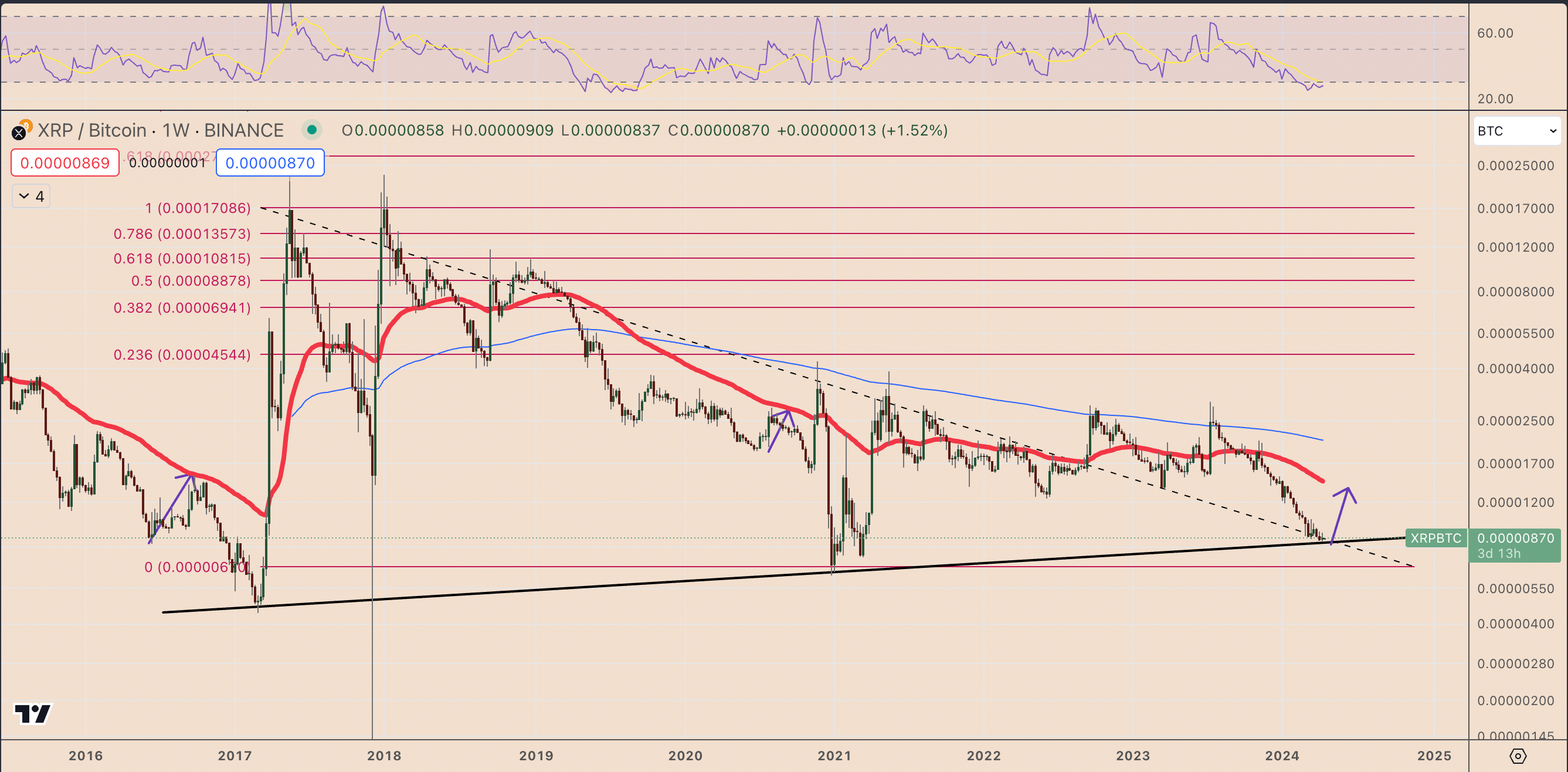

XRP/BTC has been trending inside a falling wedge pattern since February, characterized by its price fluctuating inside the area defined by two descending, converging trendlines.

A falling wedge pattern is typically a bullish reversal setup that resolves after the price breaks above its upper trendline and rises to length equal to the maximum distance between its upper and lower trendline.

Applying the same rule of technical analysis on the ongoing XRP/BTC price trends adjusts it breakout target for April/May to 0.00001022 BTC, up around 16.75% from the current levels.

In the 2024 outlook on a weekly timeframe, XRP's price objective against Bitcoin is projected to reach its 50-week Exponential Moving Average (50-week EMA, represented by the red wave in the chart below) at 0.00001449 BTC. This marks a substantial 70% increase from its present price points by June.

Notably, traders have consistently set their sights on this same 50-week EMA wave as their bullish target following the previous two Bitcoin halvings.

XRP whales return to accumulation

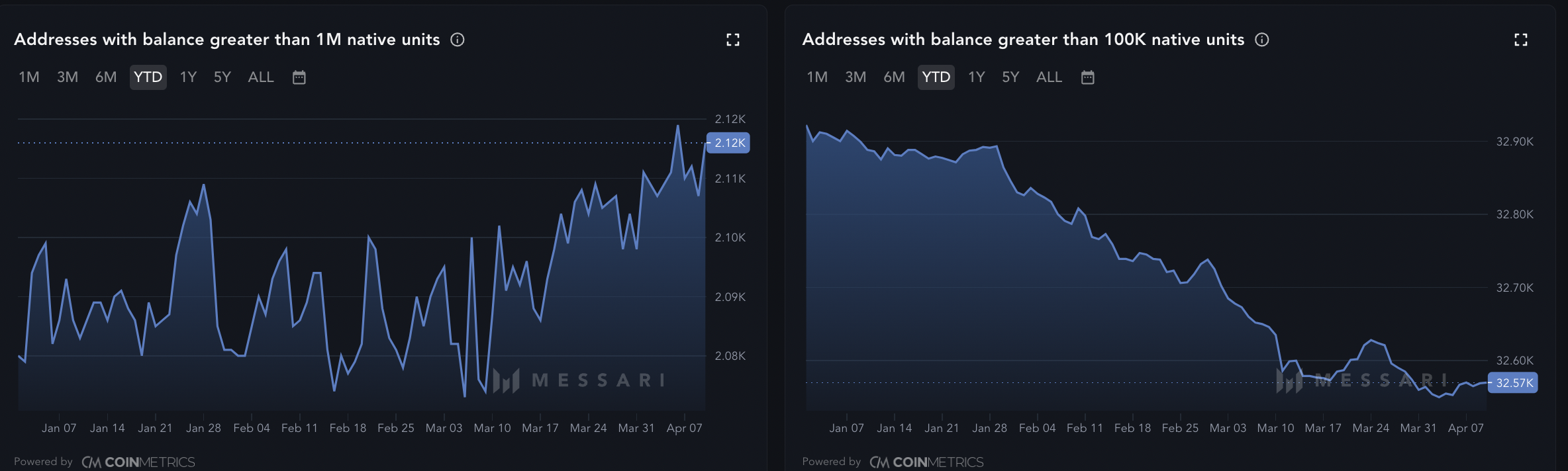

XRP is meanwhile also seeing aggressive accumulation by its wealthiest investors.

For example, since the onset of March, there has been a noticeable uptick in the number of entities holding more than 1 million XRP tokens, and from April, the segment of holders with at least 100,000 XRP tokens has also begun to increase.

This trend underscores the rising bullish sentiment among whales in anticipation of the Bitcoin halving.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.