10x Research: Lower U.S. inflation data on June 12 (3.3%) could drive Bitcoin up

10x Research posted that traders are complaining, saying that although the price of Bitcoin is only 7% away from its historical high, there's no sign of improvement. Many Bitcoins are being withdrawn from trading platforms, and the stablecoin impulse is sending out a warning signal.

The cryptocurrency market trading volume has dropped to $50 billion, and the financing rate is just slightly positive. Undoubtedly, interest rates are very low. Federal Reserve policy and inflation data are seen as two key variables that could push Bitcoin to new highs. On June 5th, the Bank of Canada may initiate a global interest rate cut cycle providing a blueprint for the Fed while U.S inflation data on June 12th needs to show lower figures (3.3%) in order to drive up Bitcoin prices.

The sharp decline in balances on Bitcoin trading platforms indicates that whales are moving Bitcoins off these platforms in anticipation of price increases. In the past month alone, 88,000 Bitcoins have been moved off trading platforms leaving only 2.5 million remaining - this is at its lowest level since March 2018. The outflow of funds from trading platforms began on May 15th which coincides with US registered investors managing over $100 million having to file their quarterly Form13F within 45 days after quarter-end.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rumble Q3 Financial Report: Revenue at $24.8 million, holding 210.82 bitcoins

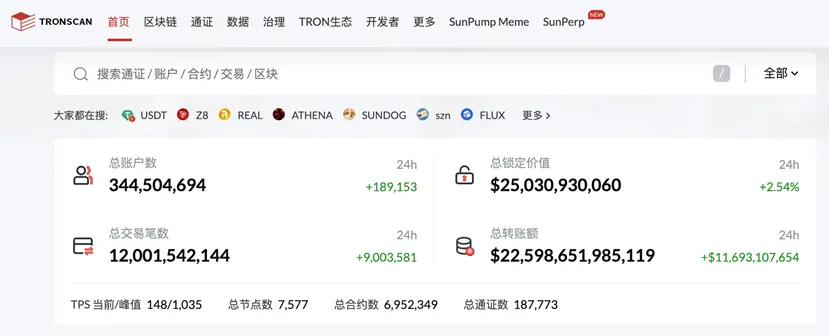

Total TRON transactions surpass 12 billion

ZEC surpasses $680, up over 15% in 24 hours