Bitcoin Price Prediction: BTC Price Over $100,000 AGAIN Soon?

Bitcoin Open Interest Surge: A Potential Breakout Signal

Recent data indicates a steady rise in Bitcoin's open interest within perpetual futures markets. This surge suggests heightened trading activity, which often precedes a Bitcoin price breakout . Analysts highlight that while a significant price movement is expected, the direction remains uncertain and dependent on further market signals.

Bitcoin and Ethereum Options Set to Expire

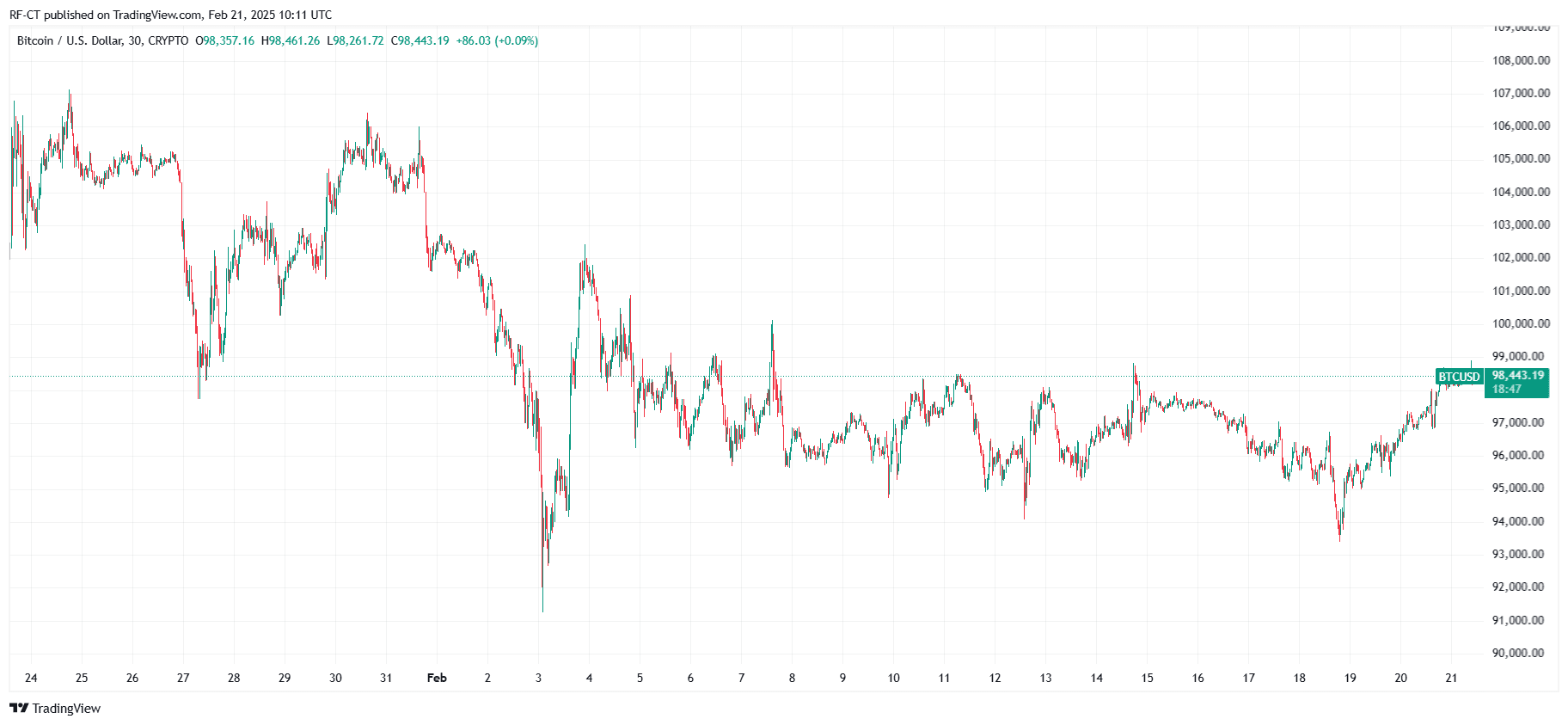

Today, Bitcoin and Ethereum options worth approximately $2.04 billion are set to expire. These expirations frequently cause increased market volatility as traders rebalance their positions. The maximum pain price—the level at which the most options expire worthless—is $98,000 for Bitcoin and $2,700 for Ethereum. Since Bitcoin is trading near these levels , its price action may be influenced by option settlement pressures.

Bitcoin Price Prediction: BTC Price Over $100,000 AGAIN Soon?

By TradingView -

BTCUSD_2025-02-21 (1M)

By TradingView -

BTCUSD_2025-02-21 (1M)

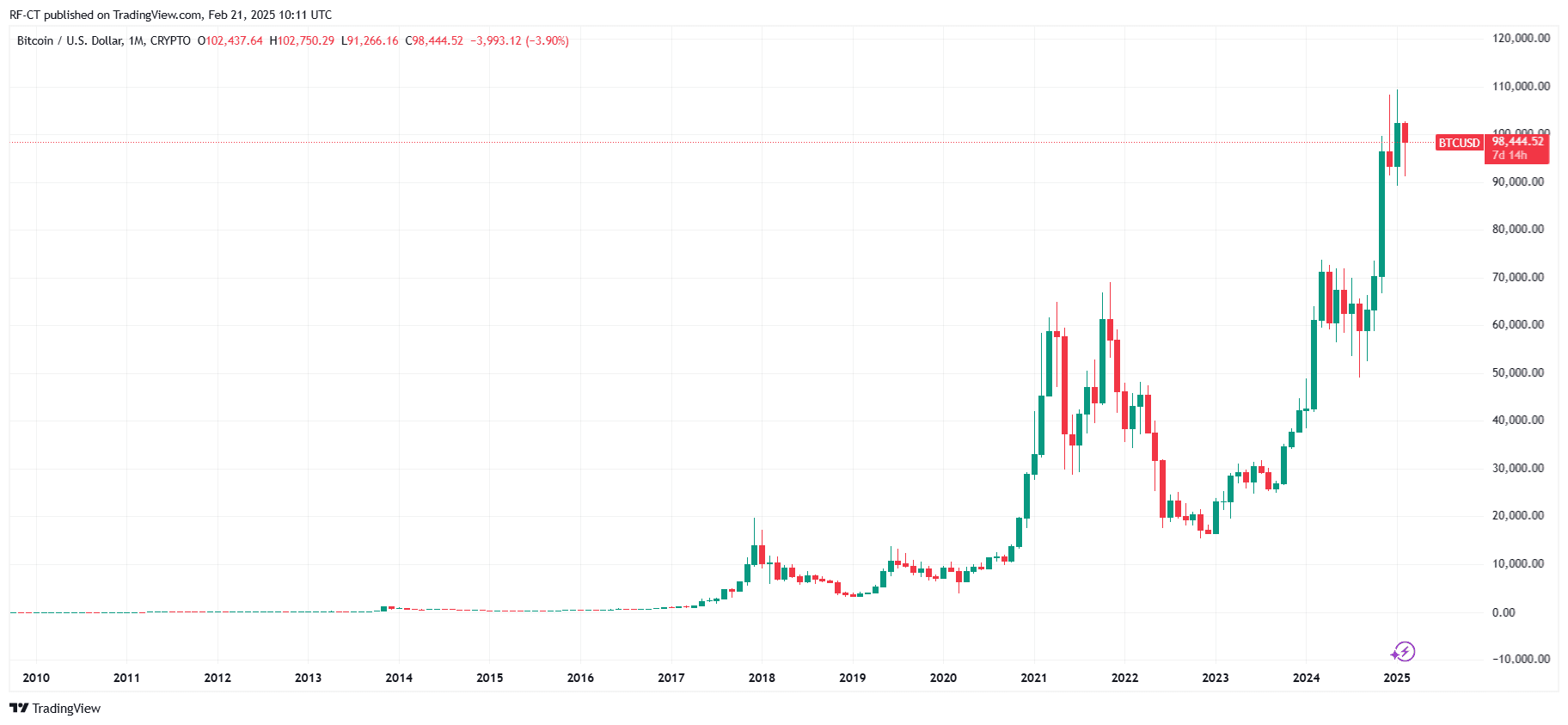

Key Price Levels and Market Outlook

Currently, Bitcoin is trading around $98,774 , with strong support levels between $91,000 and $95,000. The resistance level is near $103,900. If Bitcoin surpasses $100,000, it could trigger bullish momentum and push prices toward new highs. Conversely, if Bitcoin falls below $91,000, increased selling pressure might drive further declines. Traders are closely monitoring these key levels amid heightened activity in Bitcoin futures and options markets.

By TradingView - BTCUSD_2025-02-21 (All)

By TradingView - BTCUSD_2025-02-21 (All)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The former legendary project ORE returns: new economic model launched, surging over 30 times in a single month

Solana co-founder Toly retweeted a post to highlight the advantages of ORE, including continuous miner incentives, staking rewards coming from protocol revenue rather than inflation, and fees being fed back into the ecosystem.

The Trillion-Dollar Battle: Musk vs. Ethereum, Who Should Win?

It is not a contest between "personal heroism" and "technical protocols", but a competition between "equity option returns" and "network adoption rate".

US Government Shutdown Ends + Cash Handouts, Will Crypto See a Liquidity Boom?

According to Polymarket data, the market estimates a 55% probability that the U.S. government shutdown will end between November 12 and 15.

The once-mythical ORE makes a comeback, surging 30 times in a single month this time

The mining protocol that caused congestion on the Solana network has returned to the stage with a brand new economic model after a year of silence.