ETH Breaks 23-Week High with $2.7B Flowing into New Hands

- 11 new wallets collected over 722K ETH in weeks, worth nearly $2.77B, as quiet buying continues.

- ETH outpaced BTC by hitting a 23-week high after climbing 40 percent from yearly lows.

- Institutions are buying ETH in large amounts while retail investors are leaving the market.

Over 722,152 ETH, worth approximately $2.77 billion, has flowed into 11 newly created wallets since July 9, signaling a silent yet powerful shift in Ethereum ownership. Within this trend, three new wallets alone acquired 73,821 ETH (valued at $283 million), according to crypto analyst Crypto Rover. This massive inflow is not retail-driven; instead, it points to targeted institutional activity unfolding beneath the market surface.

New Wallets, Deep Pockets: The Institutional Trail

Detailed on-chain data shows 3 large OTC transfers from Galaxy Digital to a single wallet starting with “0xdf…908,” amounting to over 39,652 ETH. These include 19K ETH ($72.97M), 9.9K ETH ($38.02M), and 10.6K ETH ($40.91M)—executed off-exchange, likely to avoid slippage and public scrutiny.

In parallel, Kraken’s hot wallet sent 1.3K ETH ($5M) to a newly generated address. Blockchain history shows this address has been receiving consistent weekly transfers, now totaling over 7,000 ETH, further reinforcing accumulation patterns by non-retail actors.

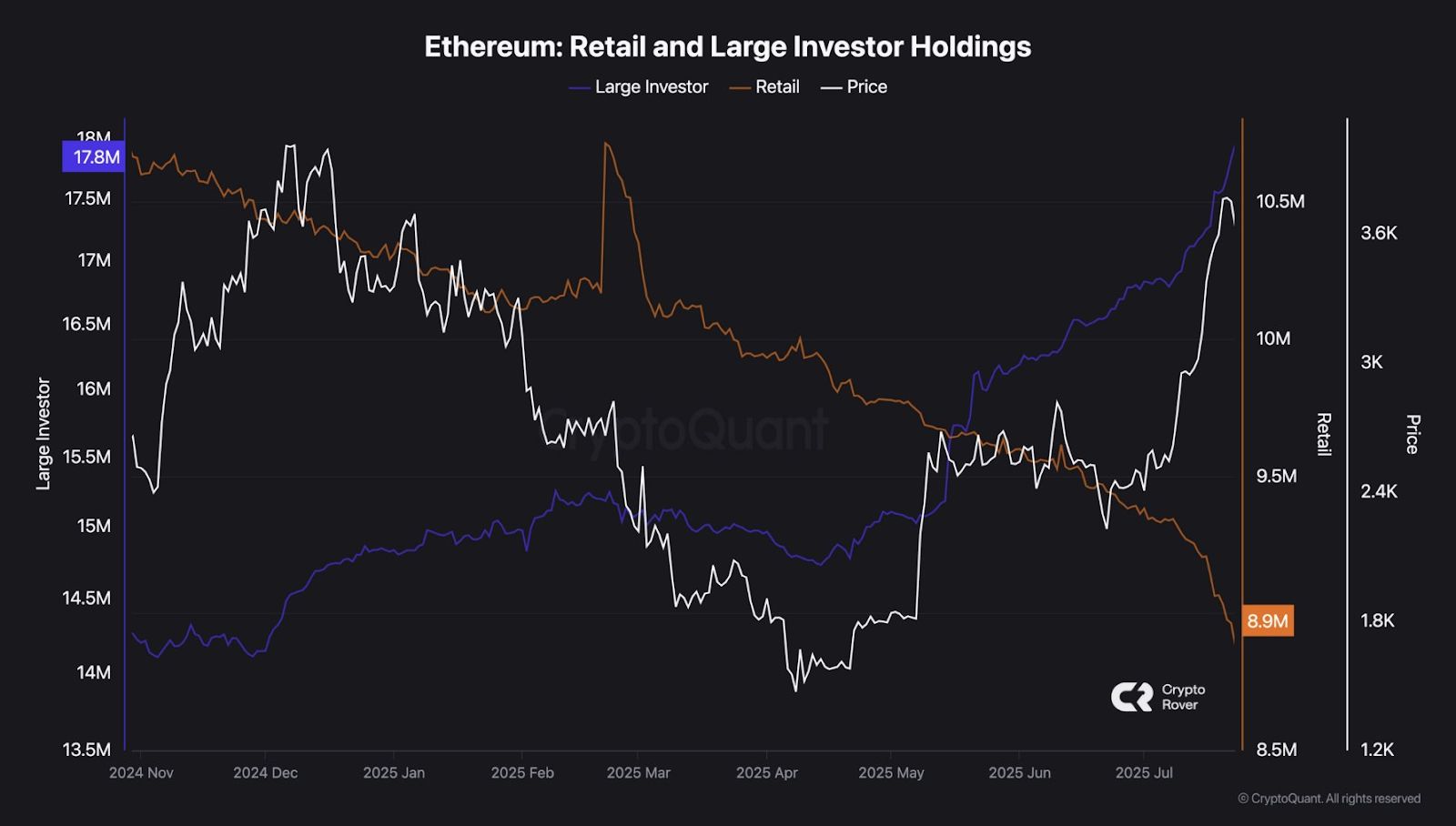

Furthermore, on July 30, crypto analyst Rover shared a CryptoQuant chart highlighting the widening gap between retail and institutional holdings. According to the chart, big investors control more than 17.8 million ETH, while the retail investors hold 8.9 million worldwide. This sharp contrast underscores the accelerating institutional accumulation of Ethereum, potentially reshaping the asset’s future ownership landscape.

Source:

X

Source:

X

ETH/BTC Hits 23-Week High, Signals Capital Rotation

Ethereum has also gained significant strength relative to Bitcoin. The ETH/BTC pair climbed 40% from its 2025 bottom of 0.023 BTC to its current value of 0.03239 BTC. This marks its highest in 23 weeks.

Source:

TradingView

Source:

TradingView

The price activity is currently looking to make a break above 0.0345 BTC. Momentum confirmations reflect the strength in the rally—MACD is very bullish, with the histogram being green in the last six weeks.

Institutional activity seems to be shifting towards ETH at the expense of BTC, which is experiencing whale selling and the inability to attract new funds. Ethereum has advantages in structure-based features, i.e., staking yields, token burning, and DeFi utility, thereby being more appealing to treasuries and long-term holders.

Related: Biotech Firm Rebrands as ETHZilla, Bets $425M on Ethereum

Quiet Accumulation, Loud Implications: Who’s Leading?

With over $2.7 billion in ETH absorbed quietly in a matter of weeks, the crypto market faces a pivotal question: Could Ethereum now be leading the cycle? The boosted ETH/BTC ratio, together with the excessive OTC inflows, the weakening retail holdings, and the adoption by corporate treasuries, suggests that Ethereum is gaining prominence as a strategic asset.

Compared to Bitcoin’s slowing pace and ongoing large-holder exits, Ethereum appears to be the preferred bet for long-term exposure. Analysts are now closely watching ETF inflows, options positioning, and spot market liquidity. If Ethereum breaks above $4,200 with continued institutional support, a rally toward $5,000 by year-end appears increasingly likely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Signs Potential Mid-Cycle Bottom As Fear Grips the Market

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.

BREAKING:

BREAKING: