BTC Market Pulse: Week 34

Bitcoin faced sharp volatility last week, surging to $117K before retreating to $111K. Spot momentum weakened, futures leverage contracted, and ETF flows turned negative with $1B outflows. On-chain demand softened as activity fell, profits faded, and caution grew across traders and institutions.

Overview

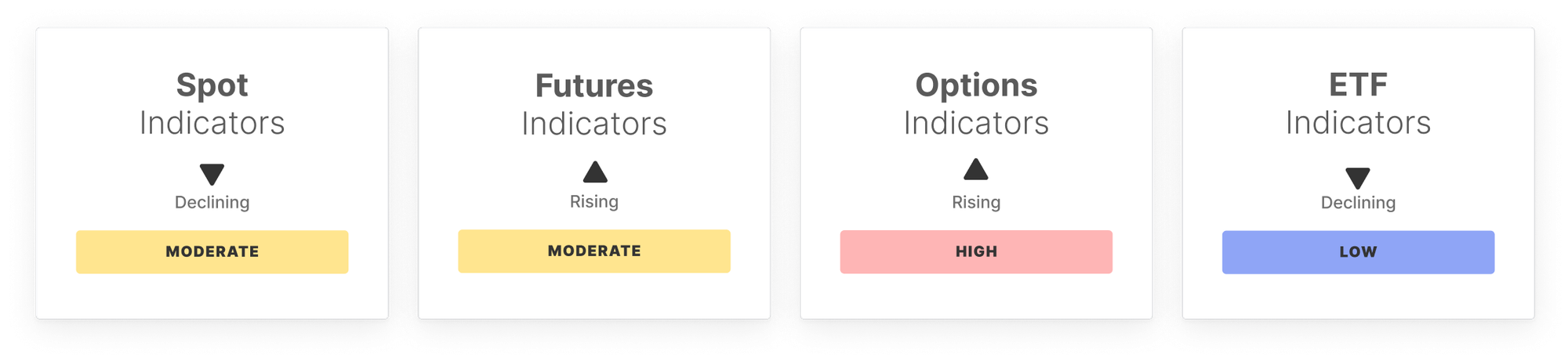

Over the past week, Bitcoin's market saw significant volatility, with prices surging to $117k before a sharp leg down to $111k. In the spot market, momentum weakened as the RSI slipped toward oversold conditions, cumulative selling pressure deepened, and volumes remained steady but uninspired, all pointing to fragile buyer conviction.

In the futures market, open interest contracted, signaling reduced leverage, while funding payments spiked as longs pressed their advantage. Net positioning improved modestly, easing some sell pressure, yet uncertainty lingers as speculative appetite softens.

The options market reflected rising caution. Open interest climbed modestly, but volatility spreads narrowed sharply, suggesting complacency. At the same time, 25-delta skew broke higher, highlighting a rush for downside protection as traders hedged against potential declines.

Flows through US-listed spot ETFs painted a more bearish picture. Netflows reversed to a sharp $1.0B outflow, trade volumes moderated, and ETF MVRV ratios weakened, showing profit pressure mounting and TradFi demand cooling after weeks of heavy inflows.

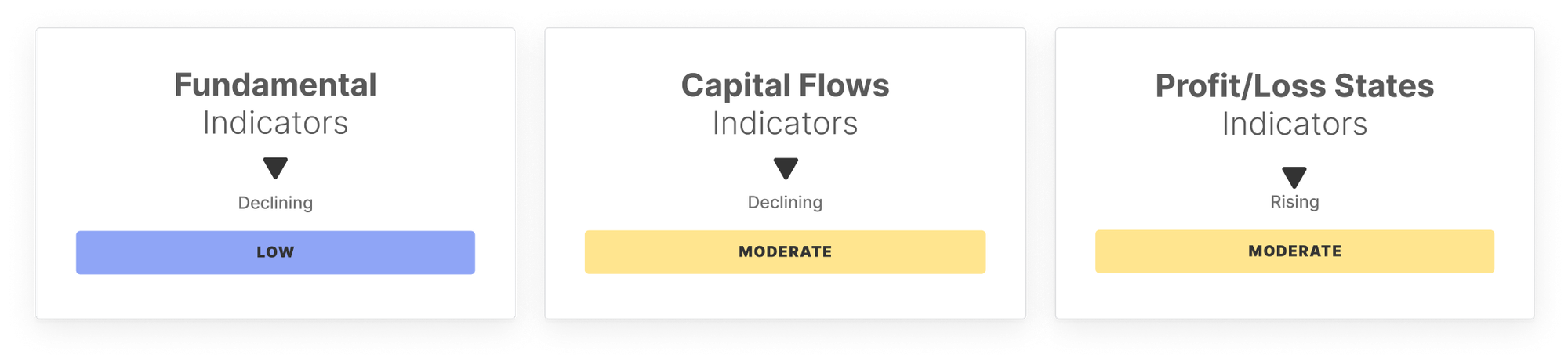

On the on-chain demand side, daily active addresses and transaction fees fell, reflecting softer network usage, while transfer volumes spiked on volatility-driven reallocations. This divergence suggests subdued organic activity, offset by short-term speculative repositioning.

Capital flow metrics pointed to cooling momentum. Realized Cap inflows slowed, Hot Capital Share stalled near the high band, and the STH/LTH supply ratio edged higher, showing modest short-term rotation but little long-term conviction.

Profit and loss states also softened. The share of supply in profit fell sharply, NUPL retreated from euphoric levels, and Realized P/L dropped toward balance. Together, these trends highlight fading unrealized gains and weaker conviction, with the market stepping away from extremes and leaning into caution.

In sum, the market structure has shifted from euphoria toward fragility. Spot and futures show weakening momentum, options highlight hedging demand, and ETF flows reveal institutional caution. On-chain signals confirm softer demand, slower capital inflows, and fading profitability. With volatility elevated, the coming weeks hinge on whether sidelined liquidity returns to stabilize the market, or if selling cascades into deeper consolidation.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The former legendary project ORE returns: new economic model launched, surging over 30 times in a single month

Solana co-founder Toly retweeted a post to highlight the advantages of ORE, including continuous miner incentives, staking rewards coming from protocol revenue rather than inflation, and fees being fed back into the ecosystem.

The Trillion-Dollar Battle: Musk vs. Ethereum, Who Should Win?

It is not a contest between "personal heroism" and "technical protocols", but a competition between "equity option returns" and "network adoption rate".

US Government Shutdown Ends + Cash Handouts, Will Crypto See a Liquidity Boom?

According to Polymarket data, the market estimates a 55% probability that the U.S. government shutdown will end between November 12 and 15.

The once-mythical ORE makes a comeback, surging 30 times in a single month this time

The mining protocol that caused congestion on the Solana network has returned to the stage with a brand new economic model after a year of silence.