deBridge Completes Full Integration of TRON Network

deBridge, a leading cross-chain infrastructure provider behind the deBridge liquidity transport protocol announced today full compatibility with the TRON network. This integration unlocks new liquidity pathways and expands stablecoin flow activity on TRON’s expansive ecosystem of decentralized finance and payments, allowing users to move assets between TRON and any supported chain instantly. This technical milestone … <a href="https://beincrypto.com/debridge-completes-full-integration-tron-network/

deBridge, a leading cross-chain infrastructure provider behind the deBridge liquidity transport protocol announced today full compatibility with the TRON network. This integration unlocks new liquidity pathways and expands stablecoin flow activity on TRON’s expansive ecosystem of decentralized finance and payments, allowing users to move assets between TRON and any supported chain instantly.

This technical milestone connects deBridge to TRON’s massive global user base of over 327 million user accounts which execute a daily transfer volume of over $23 billion, underscoring its capacity to support institutional-scale activity with the efficiency and speed required by the digital economy. TRON has seen notable adoption in emerging markets, supported by mobile-friendly wallets and strong stablecoin infrastructure.

“As a high-performance Layer 1 blockchain with approximately 3-second block times and fast finality, TRON’s architecture aligns perfectly with deBridge’s real-time bridging requirements,” said Jonnie Emsley, CMO at deBridge. “We are thrilled to enable efficient cross-chain transactions that can now tap into one of the most active onchain ecosystems in the world.”

The TRON network has become instantly composable with 25 other blockchains supported on deBridge, with three pillars facilitating full cross-chain interoperability, further enhancing the ecosystem’s ability to grow its user base:

- High-performance bridging: Users can transfer assets quickly to TRON and explore its dApps, with bridging designed for fast settlement, deep liquidity, and measures to help mitigate MEV and slippage.

- Transfers of authenticated messages: TRON can securely transfer messages via a decentralized infrastructure across all blockchains supported on deBridge.

- Secure asset custody: dePort, deBridge’s native bridge for assets, enables secure asset custody for users coming from the supported blockchains on deBridge. This allows projects or dApps to port tokens from any chain to enable utility in the TRON ecosystem.

“With deBridge, users gain direct access to innovative new dApps, while developers can seamlessly build and integrate across TRON and the broader blockchain ecosystems connected through deBridge,” said Sam Elfarra, Community Spokesperson for the TRON DAO. “This unlocks new possibilities for cross-chain collaboration, enhances interoperability, and paves the way for more connected and dynamic Web3 experiences.”

The collaboration between TRON DAO and deBridge marks a significant advancement in cross-chain infrastructure. As the network hosting the largest circulating supply of USDT, which accounts for over half of all Tether in circulation, TRON’s integration with deBridge is a key step toward enabling seamless stablecoin transfers across the multichain landscape.

Any EVM or SVM blockchain ecosystem can connect to deBridge by initializing deBridge IaaS, a turnkey, subscription-based solution for interoperability. To learn more about interoperability solutions on deBridge Iass, visit their website.

About deBridge

deBridge is the bridge that moves at lightspeed. By removing the bottlenecks and risks of liquidity pools, deBridge enables value and information to flow across the DeFiverse virtually instantly with deep liquidity and guaranteed rates.

About TRON DAO

TRON DAO is a community-governed DAO dedicated to accelerating the decentralization of the internet via blockchain technology and dApps.

Founded in September 2017 by H.E. Justin Sun, the TRON blockchain has experienced significant growth since its MainNet launch in May 2018. TRON hosts the largest circulating supply of USD Tether (USDT) stablecoin, exceeding $82 billion. As of August 2025, the TRON blockchain has recorded over 327 million in total user accounts, more than 11 billion in total transactions, and over $28 billion in total value locked (TVL), based on TRONSCAN.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The truth behind BTC's plunge: Not a crypto crash, but a global deleveraging triggered by the yen shock

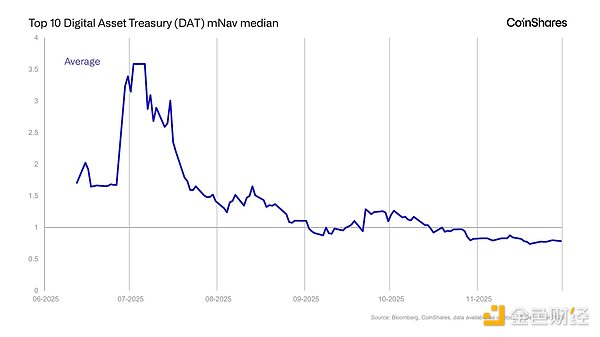

DAT: A Concept in Transition

From traditional market-making giants to core market makers in prediction markets, SIG's forward-looking layout in crypto

Whether it's investing or trading, SIG is always forward-looking.