Bitcoin Price Eyes $100,000–$107,000 Support Zone Amid Heavy Liquidations

Bitcoin’s $100.000–107.000 support zone faces a major test amid mass liquidations, with $108.800 emerging as the short-term bull-bear threshold.

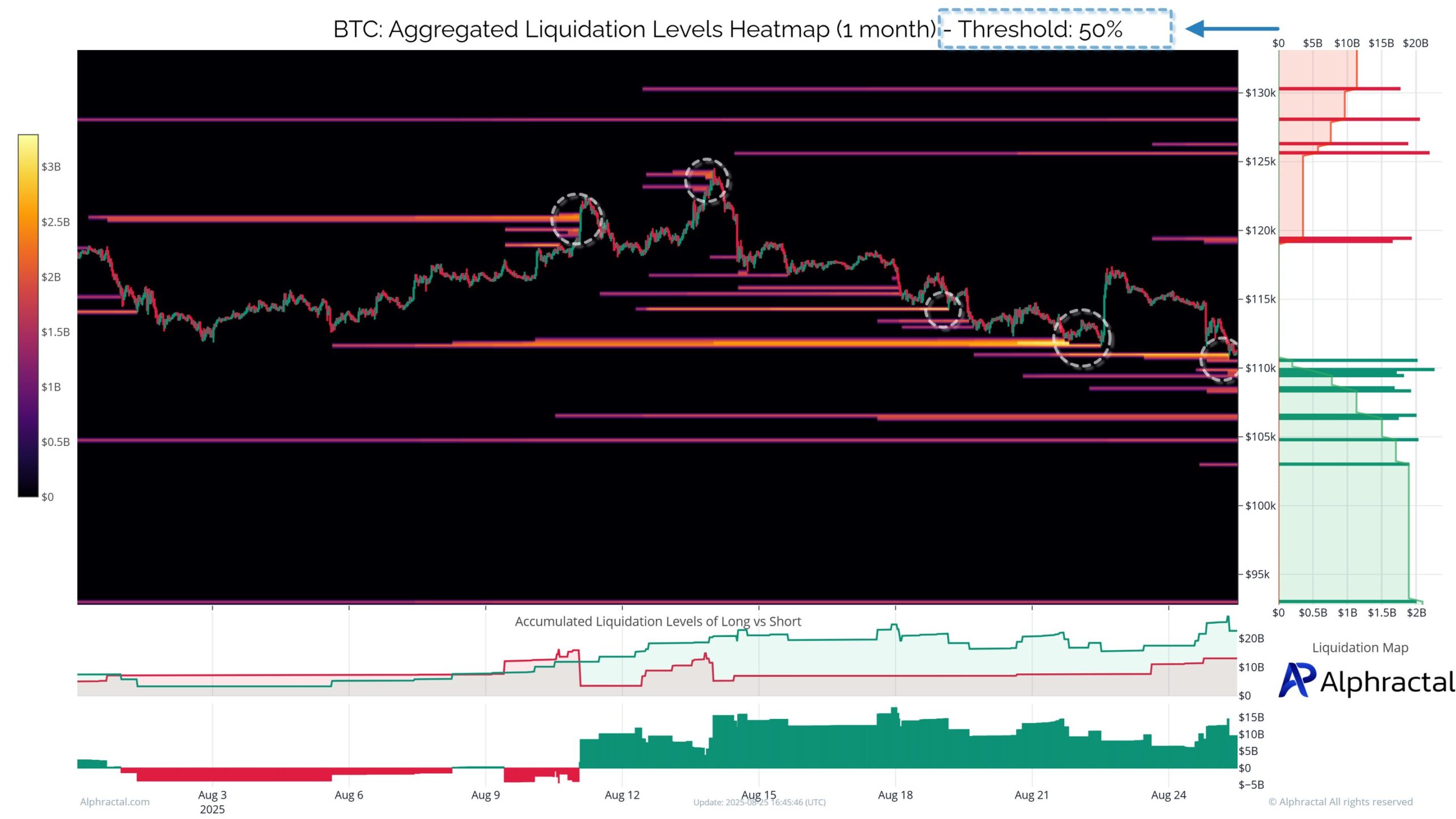

Over the past three months, the crypto market has witnessed a fierce “liquidity sweep,” with long and short positions using low to medium leverage being wiped out in succession.

This reflects the reality that the current market lacks a clear dominant force, and it is driven primarily by bidirectional liquidity hunts.

Mass Liquidations for Bitcoin

According to data from Alphractal, 94% of traders were liquidated during this period. When applying a 50% Liquidity Threshold filter, only densely concentrated liquidity zones remain. This indicates that price has actively “sought out” large order clusters to clear positions.

Ethereum has experienced a similar scenario, with both long and short positions heavily impacted over the past 30 days.

Bitcoin liquidation heatmap. Source:

Alphractal

Bitcoin liquidation heatmap. Source:

Alphractal

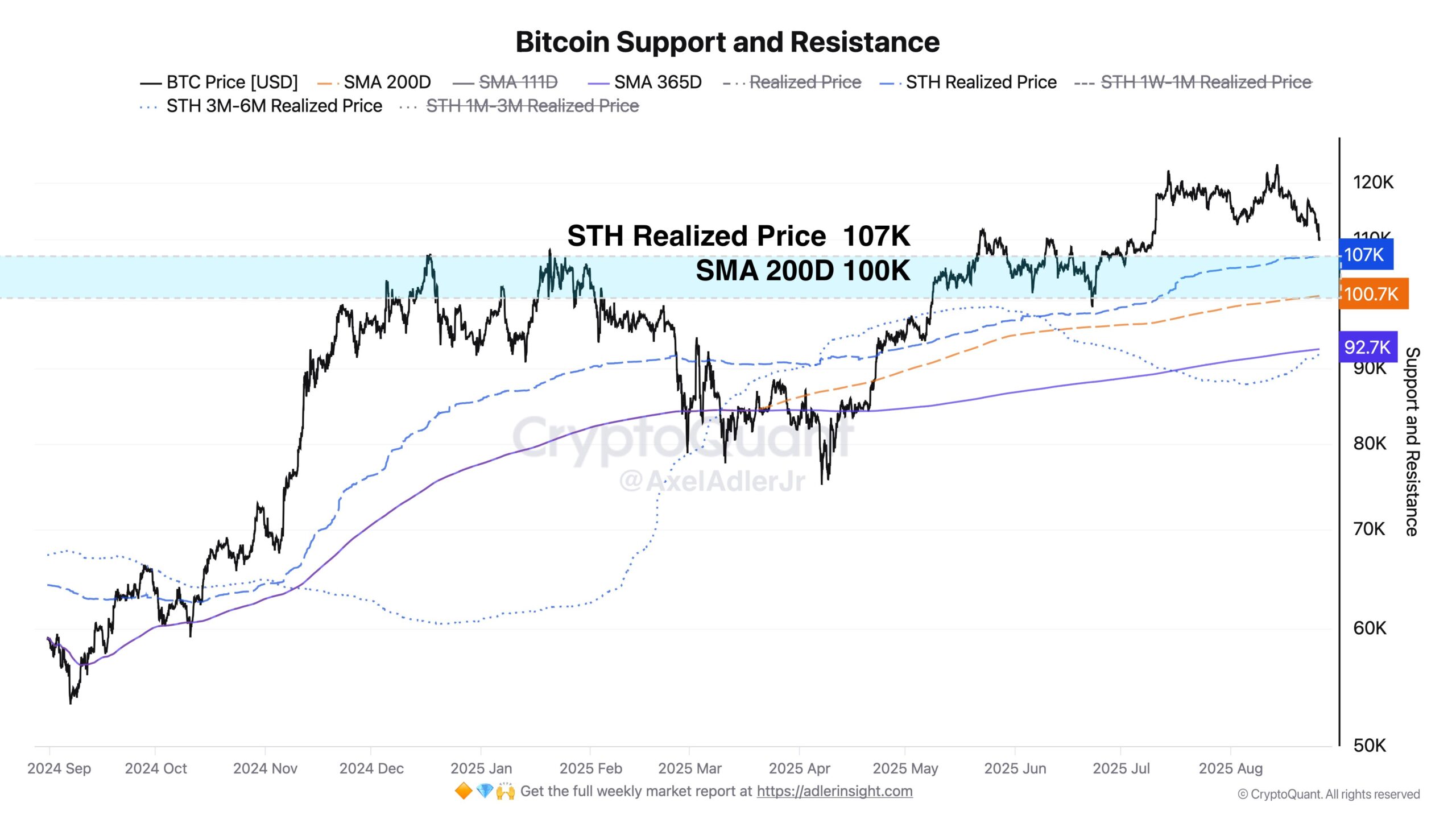

For Bitcoin, the most prominent feature is the formation of a massive long cluster around $104,000–$107,000. This concentrated liquidity zone aligns with the $100,000–$107,000 support zone, which Analyst Axel Adler Jr. identified based on on-chain data.

Bitcoin on-chain data. Source:

Axel Adler Jr

Bitcoin on-chain data. Source:

Axel Adler Jr

Specifically, this level marks the intersection of the Short-Term Holder Realized Price (the average cost basis for short-term investors) and the 200-day SMA. This factor bolsters the reliability of this support zone’s “defensive” role. Many experts predict that if this zone is breached, a deeper retreat to the $92,000–$93,000 range will occur.

“The nearest strong support zone is the 100K–107K range, where the STH Realized Price and SMA 200D intersect. Below that is additional support around 92–93K, a deeper support level reflecting the cost basis of short-term investors who held coins for 3 to 6 months. This will become a key second line of defense if the market loses the 100K–107K level.” Axel Adler Jr stated.

As BeInCrypto reported, Bitcoin’s spot taker activity has turned sell-dominant, highlighting fading buy-side demand and risk of a drop toward $107,557 support.

Conversely, the $108,800 level is the short-term dividing line between a bull and bear market. According to Murphy Chen, this represents the short-term cost basis for investors.

A stable close above this threshold signals a significant reduction in selling pressure. However, losing this level could trigger a short-term sell-off.

STH-RP’s bull-bear dividing line and price dynamics. Source:

Murphy Chen

STH-RP’s bull-bear dividing line and price dynamics. Source:

Murphy Chen

In other words, the $108,800 zone is the “gateway” that determines whether Bitcoin sustains its upward momentum or enters a deeper correction phase.

“Currently, at $108,000, it’s a 13% drop from the high. If STH-RP is breached, theoretically there would still be 10-15% downside space. Without the cooperation of negative events of the same magnitude, the correction amplitude may not exceed the previous two instances,” Murphy Chen stated.

The market has liquidated 94% of accounts over the past three months. This highlights the dangers of high-leverage trading during a market dominated by liquidity hunts.

As the 50% filter highlights, trading near large liquidity clusters often carries high risk. This makes defensive strategies, stop-loss placement, and position management more critical.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2026: The Year of Federal Reserve Regime Change

The Federal Reserve will shift away from the technocratic caution characteristic of the Powell era and move toward a new mission that explicitly prioritizes lowering borrowing costs to advance the president’s economic agenda.

Bitcoin (BTC/USD) Price Alert: Bitcoin Breaks Major Resistance - Next Stop $100,000?

![[Bitpush Daily News Selection] Trump actively hints at Hassett as the next Federal Reserve Chairman; Bloomberg: Strategy may consider offering bitcoin lending services in the future; Strategy CEO: Strategy sets $1.4 billion reserve through stock sale to ease bitcoin selling pressure; Sony may launch a US dollar stablecoin for payments in gaming, anime, and other ecosystems](https://img.bgstatic.com/multiLang/image/social/44682a8c7537c9a9b467e17ed74a704d1764777241317.jpg)