"Regulation and Rates Set to Power 2028 Crypto Bull Run"

- Arthur Hayes predicts crypto bull market could extend to 2028, driven by $10T USD stablecoin supply growth by 2028. - U.S. GENIUS Act and EU MiCA regulations are key enablers, legitimizing stablecoins and fostering global adoption. - U.S. strategy aims to redirect $10-13T Eurodollar market into government-controlled stablecoins, enhancing Treasury bond demand. - DeFi platforms like Ethena and Hyperliquid may benefit from stablecoin liquidity, outpacing traditional banking yields. - Rising stablecoin adop

Arthur Hayes, former CEO of BitMEX and prominent figure in the cryptocurrency industry, has forecasted that the current bull market in digital assets could extend until 2028. Central to his prediction is the anticipated growth of the USD stablecoin supply, which he expects to reach $10 trillion by 2028, potentially catalyzing a DeFi bull run. This forecast was shared during a keynote at Tokyo’s WebX conference on August 25. Hayes emphasized that the expansion of stablecoins, which are digital assets pegged to the value of traditional assets like the U.S. dollar, is poised to drive this extended market cycle.

According to Hayes, a significant factor contributing to this growth is the legal and regulatory developments surrounding stablecoins. The passage of the U.S. GENIUS Act in July 2025 provided a foundational legal framework for payment stablecoins, enhancing their legitimacy and encouraging broader adoption. Simultaneously, the European Union has introduced its Markets in Crypto-Assets (MiCA) regulation, further promoting a regulatory environment favorable to stablecoin innovation on a global scale. Hayes argued that these regulatory advancements are critical in integrating stablecoins into mainstream financial systems and prolonging the bull market.

The U.S. government is also taking an active role in shaping the future of stablecoin adoption. Hayes highlighted the U.S. strategy to redirect a substantial portion of the $10-13 trillion Eurodollar market into government-controlled stablecoin ecosystems. This initiative, he noted, is part of a broader fiscal policy aimed at consolidating control over offshore dollar deposits. Treasury Secretary Scott Bessent is expected to play a pivotal role in this effort, urging countries to adopt U.S.-backed stablecoins. Through this strategy, the U.S. aims to leverage stablecoin reserves to purchase Treasury bonds, ensuring a steady buyer base and enhancing its influence over global monetary policy.

Hayes further explained that as the Federal funds rate decreases to 2%, the U.S. government could facilitate an environment where the stablecoin supply expands significantly, reaching up to $10 trillion. This growth, he suggested, could fuel the bull market through 2028 by providing a stable and scalable platform for transactions. The increased liquidity from stablecoins is expected to create new investment opportunities, particularly in the decentralized finance (DeFi) sector. Hayes pointed to several promising DeFi platforms, including Ethena, Hyperliquid, Ether.Fi, and Codex, as potential beneficiaries of this liquidity surge. These platforms are anticipated to offer yield-generating opportunities that traditional banking systems may not be able to match.

The expanding stablecoin ecosystem also raises important questions about its implications for traditional banking and monetary policy. As stablecoins become more prevalent, they could reduce the availability of deposits in traditional banks, limiting their ability to lend and support economic growth. This shift could pose challenges for central banks, as they may find it more difficult to manage interest rates and liquidity when stablecoins compete directly with traditional financial instruments. Despite these potential challenges, Hayes remains optimistic about the future of the crypto market, emphasizing the role of innovation, regulatory clarity, and institutional adoption in sustaining the bull cycle.

As the global financial landscape continues to evolve, stablecoins are expected to play a pivotal role in transforming how value is transferred and stored. The growth in stablecoin supply, coupled with regulatory advancements and institutional interest, is likely to create a more robust and inclusive financial system. Hayes advised investors to monitor capital flows from centralized exchanges to decentralized platforms as a sign of this ongoing transformation. This shift not only opens up new opportunities for investment but also redefines the nature of financial services, offering innovative solutions that were previously unattainable under traditional banking structures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The truth behind BTC's plunge: Not a crypto crash, but a global deleveraging triggered by the yen shock

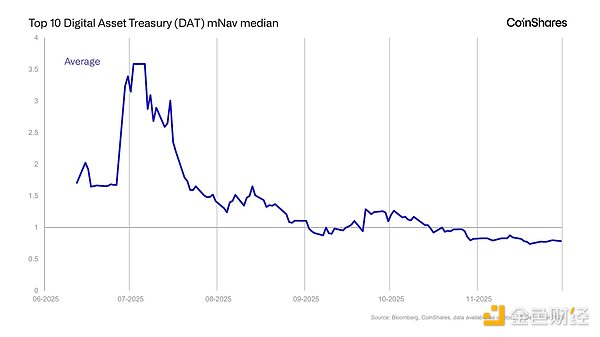

DAT: A Concept in Transition

From traditional market-making giants to core market makers in prediction markets, SIG's forward-looking layout in crypto

Whether it's investing or trading, SIG is always forward-looking.