BTC falls below the 110,000 mark, is market capital quietly withdrawing?

A summary of market views from industry experts and institutions.

A summary of market views from industry leaders and institutions.

Written by: 1912212.eth, Foresight News

The market is cheering for the wealth effect of XPL, while the broader market is on shaky ground.

In the early morning of September 26, Bitcoin ultimately lost the crucial $110,000 level, dropping to a low of $108,631. ETH also fell below $4,000, reaching a low of $3,815. SOL broke below $200, with a low of $191.32. Most altcoins experienced another round of broad declines.

According to Coinglass data, $1.191 billions in open positions were liquidated across the network in the past 24 hours, with $1.073 billions in long positions liquidated. Of this, 75% were altcoins, and nearly 45% was ETH alone. The largest single liquidation occurred on Hyperliquid's ETH-USD, valued at $29.1176 millions.

On the macro US stock side, the Nasdaq fell 0.5%, the Dow Jones Index dropped 0.38%, and the S&P 500 fell 0.5%. Spot gold was priced at $3,741 per ounce, down slightly by 0.08%.

The market continues to lose key levels, shattering the altcoin season dreams of countless investors, and the bull market fantasy is quickly turning into concerns about a bear market. According to Alternative data, the current market fear index has dropped to 28, with panic spreading.

Fed Rate Cut Uncertainty, Trump Wields Tariff Stick Again

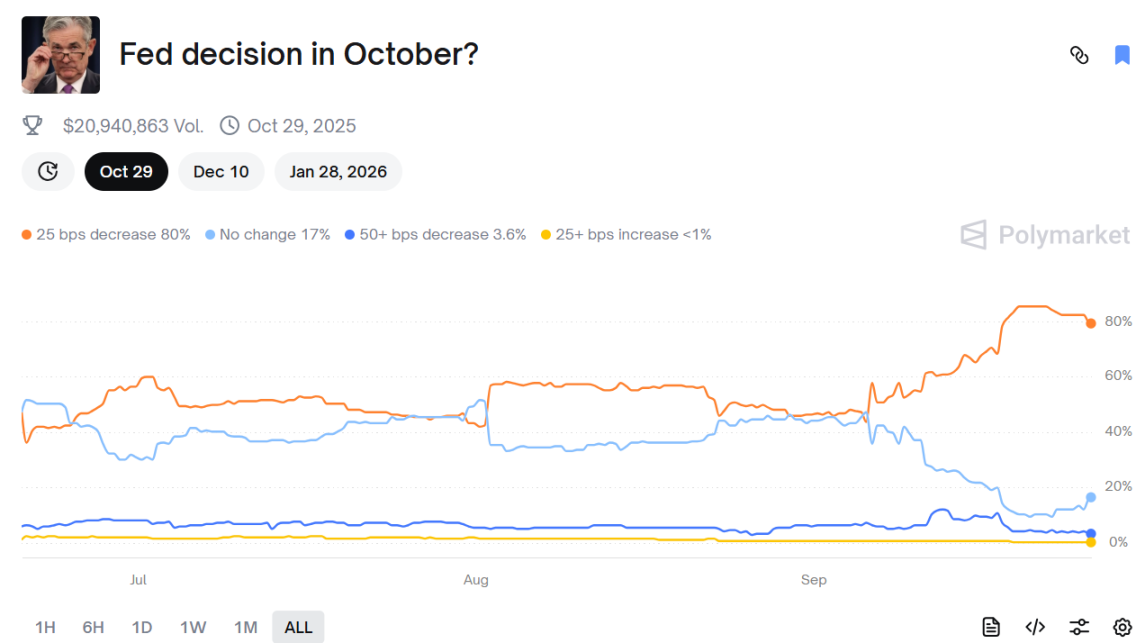

According to CME "FedWatch" data, after the release of US initial jobless claims and other data, the probability of the Fed cutting rates by 25 basis points in October dropped to 83.4% (down from 91.9% yesterday), while the probability of keeping rates unchanged rose to 16.6%.

On Polymarket, the probability of the Fed cutting rates by 25 basis points fell to 80%, while the probability of no rate cut rose to 17%.

In addition, internal personnel issues at the Fed remain unresolved. Trump wants to fire Fed Governor Lisa Cook. On Thursday, all living former Fed chairs, as well as several former US Treasury Secretaries, former White House economic advisers, and economists, urged the US Supreme Court not to allow Trump to dismiss Fed Governor Lisa Cook.

Furthermore, Trump stated on the 23rd of this month that the US is ready to wield the tariff stick again, intensifying market concerns. Previously, when Trump wielded the stick, risk assets often experienced declines.

With poor macro market sentiment, how will crypto assets perform going forward? Analysis institutions and some industry leaders have shared their insights.

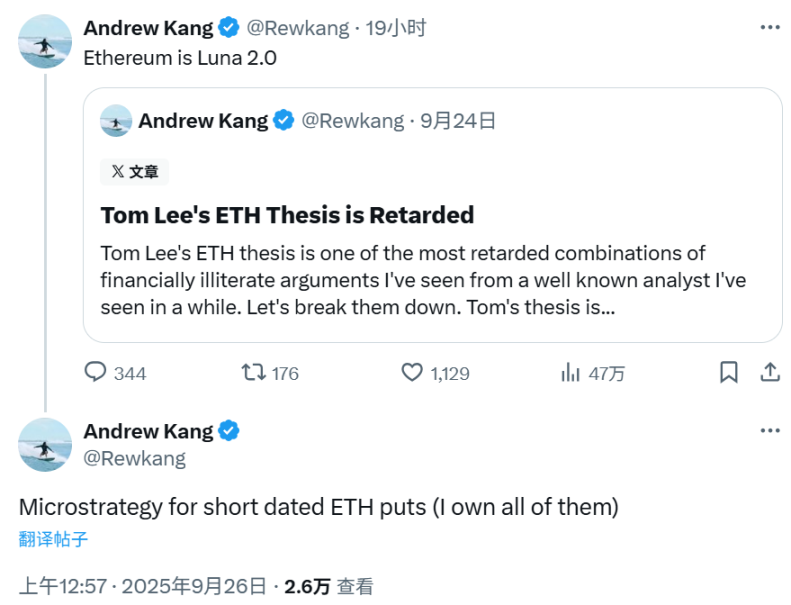

Andrew Kang: ETH Technicals Are Bearish, Has Bought a Large Amount of Short-Term ETH Put Options

Andrew Kang, founder of crypto venture capital firm Mechanism Capital, bluntly stated that Tom Lee's theory on ETH "sounds idiotic" and refuted it with five main points, stirring up waves in the industry: the adoption of stablecoins and RWA will not bring the expected returns; the analogy of Ethereum as "digital oil" is inaccurate; institutions buying and staking ETH? Pure fantasy; ETH equaling the total value of all financial infrastructure companies? Utterly absurd;

ETH's technicals are bearish. I would not rule out the possibility of it oscillating between $1,000 and $4,800 for a longer period. Just because an asset has previously experienced a parabolic rise does not mean it will continue indefinitely.

The long-term ETH/BTC chart is also misunderstood. It is indeed in a long-term range, but in recent years it has mainly been dominated by a downtrend, with a recent rebound at long-term support. The driving force behind the downtrend is that the Ethereum narrative has become saturated, and the fundamentals do not justify valuation growth—these fundamentals have not changed.

Altcoin Vector: Market Risk Aversion Sentiment Remains Stable

Data analytics firm Altcoin Vector stated that this round of movement has not ended expectations for an altcoin rally. Bitcoin is the "oxygen" for altcoins: once Bitcoin stabilizes and forms a bottom, it may drive altcoins higher. Although Bitcoin's price fell below $110,000, market risk aversion signals remain stable. No signs of structural fragility = the bottoming process may have already begun to emerge.

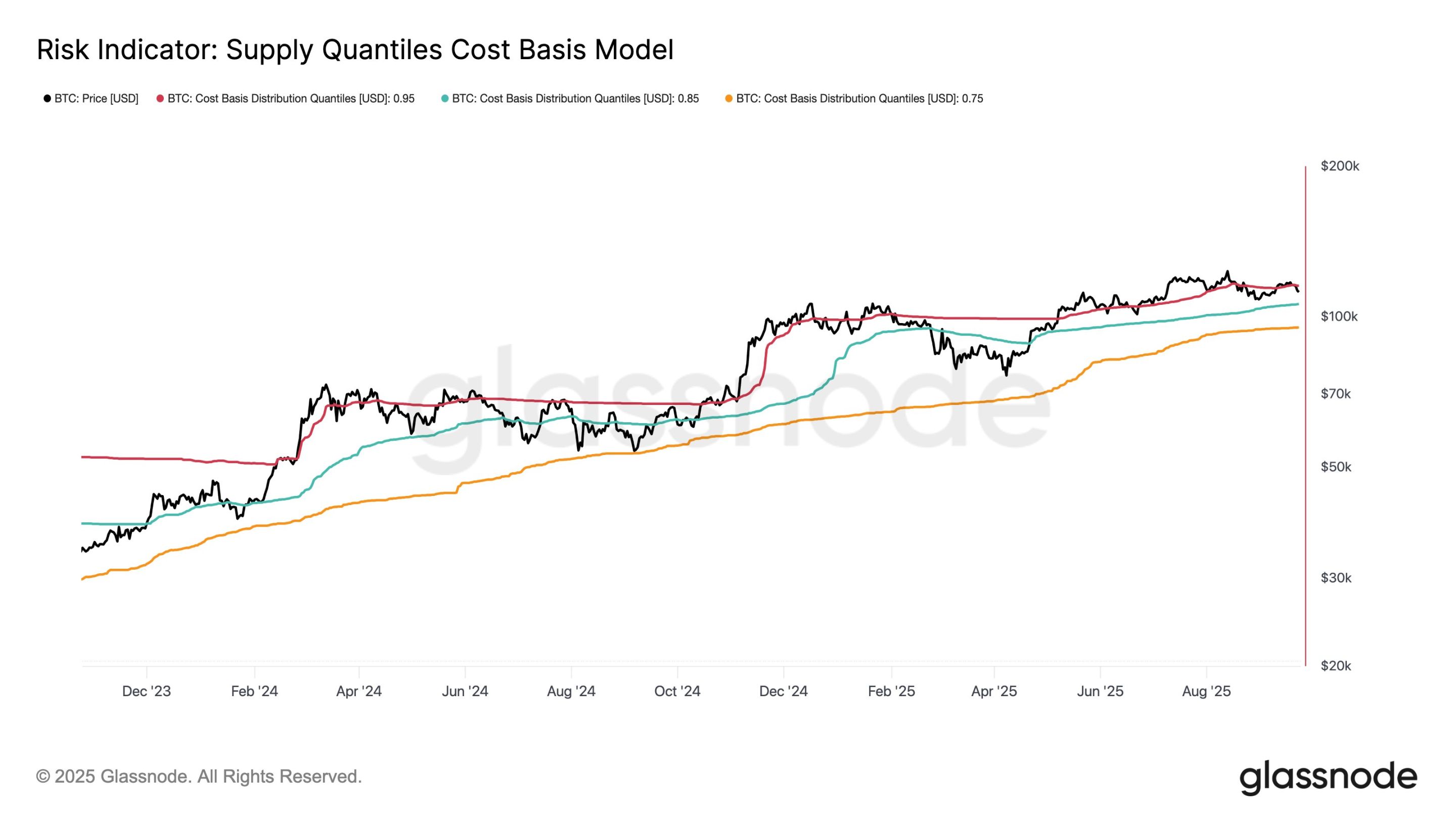

glassnode: BTC May Fall Toward the $90,000 to $105,000 Range

glassnode recently tweeted that Bitcoin has fallen below the 0.95 cost basis percentile, a key risk zone that often marks the arrival of profit-taking. If it can regain this level, it indicates renewed market strength; if not, there is a risk of the price sliding to lower support in the $105,000 to $90,000 range.

Matrixport: As Long as BTC Stays Above $109,899, the Bull Market Remains Intact

Matrixport stated that the fifth Bitcoin bull market is different from previous ones, as this time the price movement is driven by institutions rather than retail investors. A notable feature of this cycle is that there have been three small bull markets nested within the broader uptrend—compared to only two during 2020-2021. A simple and effective indicator of trend health is the 21-week moving average, which serves as the dividing line between bull and bear markets. This level is currently at $109,899. As long as Bitcoin stays above this level, the bull market remains intact—but falling below it could mark the beginning of a more challenging phase.

Santiment: The Real Opportunity to Buy the Dip Is When the Public Stops Being Optimistic and Starts Panic Selling

According to data tracking platform Santiment, mentions of "buying the dip" on social media surged to the highest level in nearly a month in recent days, which is typically a sign of bullish sentiment among retail investors. The platform monitors relevant keyword frequency on Reddit, Telegram, and X (formerly Twitter). Santiment believes such a surge in mentions is a contrarian indicator, suggesting the current BTC pullback may intensify.

Santiment noted in its market analysis report: "Price action often runs counter to public expectations. If retail investors believe $112,200 is a buying opportunity, the market may need to endure more pain. The real opportunity to buy the dip is when the public stops being optimistic and starts panic selling."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.