Ethereum (ETH) Price Prediction for September 26

The market is totally red at the end of the week, according to CoinStats.

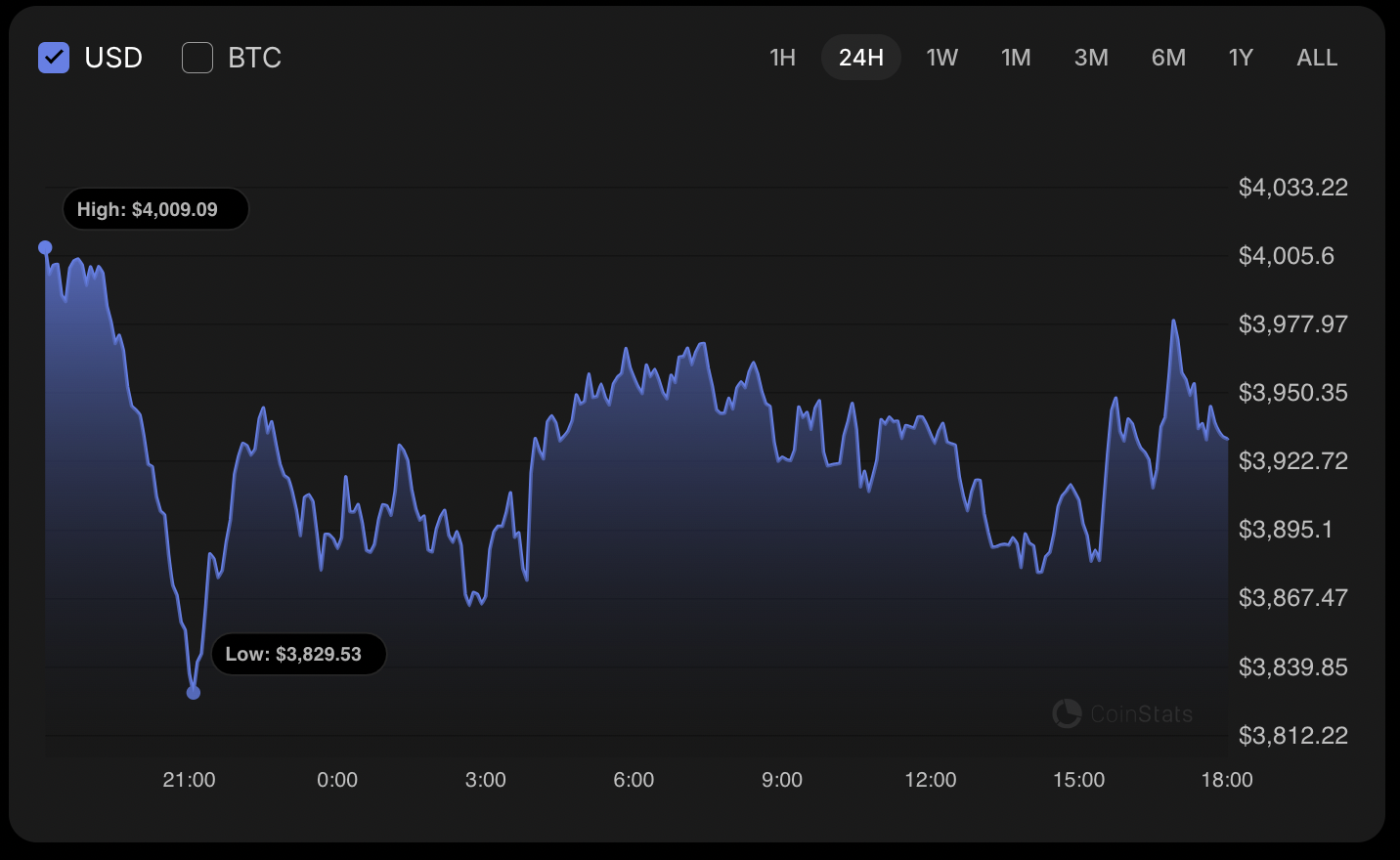

ETH/USD

The rate of Ethereum (ETH) has declined by almost 2% over the last 24 hours.

On the hourly chart, the price of ETH has made a false breakout of the local resistance of $3,976. However, if the daily bar closes around that mark, traders may expect a test of the $4,000 zone by tomorrow.

On the longer time frame, the rate of the main altcoin has entered a bearish area after breaking the $4,107 level.

Until the price is below that mark, sellers keep controlling the situation on the market. In this case, one can expect a further decline to the $3,700-$3,800 range.

From the midterm point of view, one should focus on the weekly candle's closure in terms of the $4,107 level. If it happens below it, the correction is likely to continue to the $3,600 mark.

Ethereum is trading at $3,937 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exchanges Call on SEC: Deny Exemptions to Maintain Fairness in the Market

- WFE warns SEC against broad crypto exemptions for tokenized stocks, citing risks to investor protections and market integrity. - Tokenized stocks lack dividend rights, voting access, and custody frameworks, creating "mimicked products" with weaker safeguards. - SEC's sandbox-style exemptions risk regulatory arbitrage, allowing crypto platforms to bypass rules enforced on traditional exchanges. - Global bodies like IOSCO warn tokenization amplifies data integrity and custody risks, urging unified standard

Decentralized AI Network Cocoon Takes on Centralized Titans with a Privacy-Centric Approach

- Telegram founder Pavel Durov launched Cocoon, a TON-based decentralized AI network enabling GPU owners to earn cryptocurrency by processing private AI requests. - The platform challenges centralized providers like Amazon and Microsoft by using Trusted Execution Environments (TEEs) to ensure secure, verifiable model execution with user data privacy. - Cocoon connects GPU providers with developers for confidential tasks, reducing reliance on costly intermediaries while aligning with ethical AI principles t

Ethereum News Update: Fusaka Upgrade Signals New Era of Unified Scaling for Ethereum

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces PeerDAS and BPO forks to enhance scalability via reduced data verification costs and incremental rollup capacity expansion. - Gas limit raised to 60M through "Pump The Gas" initiative lowers fees and congestion, while L2 data costs could drop 40-60% to boost developer adoption. - EIP-7917/7951 improves security and UX with deterministic finality and P-256 signatures, aligning Ethereum with fintech standards while reducing node storage demands. - Upgrade

UAE's regulatory initiatives set the stage for a surge in institutional DeFi adoption

- DWF Labs commits $75M to DeFi projects enhancing institutional-grade infrastructure across Ethereum , BNB Chain, and Solana . - UAE's new Central Bank Law mandates licensing for DeFi protocols, balancing innovation with regulatory oversight and consumer protection. - Doma Protocol and ORA introduce liquid domain trading and cash-flow-driven models, expanding DeFi's functional scope beyond speculative tokenomics. - Institutional adoption faces hurdles including regulatory uncertainty, smart contract risks