Key Notes

- SharpLink Gaming disclosed purchasing 19,271 ETH at $3,892 average price, doubling its concentration ratio to 4.0 since June this year.

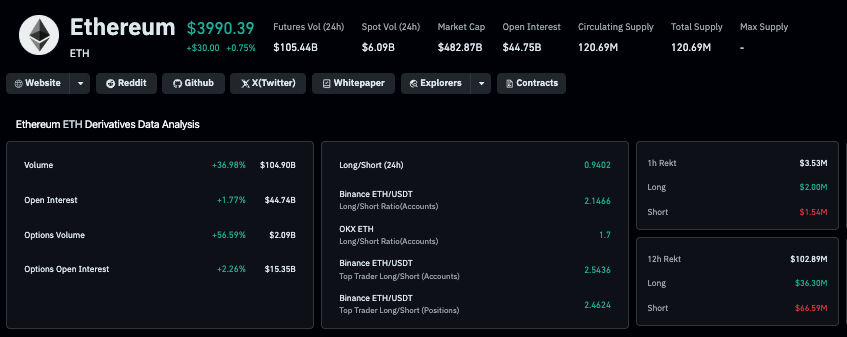

- Derivatives data shows 37% volume spike but only modest open interest growth, indicating active repositioning rather than sustained capital inflows.

Ethereum ETH $3 832 24h volatility: 1.1% Market cap: $463.26 B Vol. 24h: $46.11 B price climbed above $4,000 on Tuesday, October 21, posting a 3% daily gain amid a broader market rebound. The upside momentum followed SharpLink Gaming’s announcement of fresh ETH acquisitions, strengthening bullish sentiment around the second largest cryptocurrency by market cap.

Ethereum Price Rises 3% as SharpLink Expands ETH Treasury

In a post shared on X (formerly Twitter), SharpLink Gaming disclosed it had purchased 19,271 ETH at an average price of $3,892, bringing total holdings to 859,853 ETH, worth roughly $3.5 billion as of October 19, 2025.

The company’s treasury update also highlighted positive staking performance, with 5,671 ETH earned in rewards since June 2.

NEW: SharpLink acquired 19,271 ETH at an average price of $3,892, bringing total holdings to 859,853 ETH valued at $3.5B as of October 19, 2025.

Key highlights for the week ending October 19, 2025:

– Raised $76.5M at a 12% premium to market

– Added 19,271 ETH at $3,892 avg.… pic.twitter.com/Y4Ewu4EiuF— SharpLink (SBET) (@SharpLinkGaming) October 21, 2025

SharpLink’s ETH concentration ratio has doubled since June, now standing at 4.0, reflecting aggressive treasury expansion. The firm also raised $76.5 million at a 12% premium to market, reinforcing market confidence in Ethereum’s institutional appeal.

ETH trades near $4,020, maintaining strong footing above its 50-day moving average, while traders eye potential retests of the $4,200 resistance.

As Coinspeaker reported on Tuesday , Bitmine, Ethereum’s largest treasury firm also announced fresh ETH buys worth $250 million, bringing its total reserves to $13.4 billion.

ETH Derivatives Insights Suggests Short-Term Volatility

Derivatives metrics show a considerable increase in Ethereum trading activity on Tuesday, but limited evidence of long-term capital inflows. Coinglass data reveals a sharp 37% rise in Ethereum futures trading volume, but only a modest 1.77% increase in Open Interest (OI), bringing the total OI to $44.74 billion.

Ethereum derivatives markets analysis, Oct 21, 2025 | Coinglass

This imbalance indicates that more of the intraday market activity came from ETH traders repositioning existing contracts, rather than new inflows.

Meanwhile, the long/short ratio sits at 0.94, reflecting a slight bearish bias as short traders maintain a marginal edge. This suggests that, while Ethereum’s spot market momentum leans positive, derivatives traders remain cautious.

Failure to close above $4,000 could see traders unwind more positions, giving way to retest of the $3,900 levels. On the upside, the build of short-positions increases the likelihood of a rapid breakout to $4,200 if macro catalysts trigger a short-squeeze.