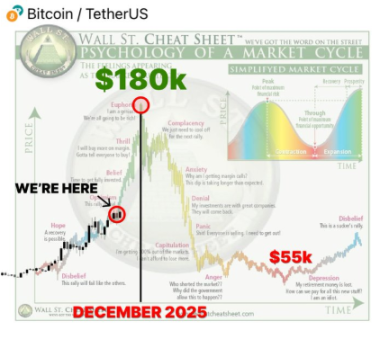

Bitcoin will start a new growth cycle in 5 days—retail investors are fearful, while institutions are quietly positioning themselves!

In the past few weeks, the crypto market has experienced a dramatic correction,

and most retail investors believe the bull market is over.

However, after I spent 18 consecutive hours analyzing on-chain and macro data,

I found that this is merely the prelude to the next super cycle.

1. Beneath the Surface of Fear Lies a Historic Opportunity

When 99% of traders are panicking, exiting, or waiting on the sidelines,

a true tidal wave is brewing in the shadows—the largest Altseason in history is about to begin.

The market is sending out multiple synchronized signals,

and whether you can understand these signals within 5 days

will determine if you can seize the next leap in wealth.

2. Signal One: Institutional Funds Are Flowing Back In

Bitcoin ETF is not just present—it is continuously absorbing billions of dollars in capital inflows.

This is not retail buying, but long-term allocation by the world’s largest funds.

Institutional capital never chases highs—

they only quietly build unshakable positions at the bottom and in chaos.

3. Signal Two: The Halving Effect Is Being Realized

The halving has already occurred, and new BTC output has dropped by half.

Sudden supply reduction + steadily growing demand = inevitable price increase.

This is the simplest and most ruthless arithmetic in the blockchain world.

All upward cycles are ultimately built on this “mathematical inevitability of scarcity.”

4. Signal Three: Political and Policy Shifts

For the first time, there is a public crypto-friendly wave in US politics.

Presidential candidates and members of Congress are supporting industry innovation and regulatory relaxation.

This means the crypto industry is receiving “top-down” institutional protection for the first time.

Capital and innovation will no longer be restricted, but will fully enter a stage of compliant growth.

5. Signal Four: L2 Ecosystem Rapidly Evolving

Arbitrum, Optimism, zkSync, Polygon and other layer 2 networks

are undergoing qualitative changes in performance, cost, and user experience.

Millions of developers and new users are flowing in,

which means the real demand of the Ethereum ecosystem is exploding, not just speculative bubbles.

6. Signal Five: Macro Environment Boosts Risk Assets

Global inflation is slowing, and the Federal Reserve is about to cut interest rates.

Historical experience tells us: every round of easing is accompanied by a surge in risk assets.

When the market seeks new high-yield channels,

cryptocurrencies will once again become the core battleground for capital competition.

7. Signal Six: Development and Innovation Have Never Stopped

Even during downturns, developers continue to build:

AI tokens, GameFi 2.0, RWA (real-world assets on-chain) and other new tracks are emerging one after another.

This shows that the underlying value of the market remains active, and the foundation for future growth is being accumulated.

Conclusion:

All macro, on-chain, and policy signals are converging to the same conclusion:

Bitcoin will start a new growth cycle within the next 5 days.

The fear of retail investors is the entry signal for institutions;

the silence of the market is the last gasp before an explosion.

You can choose to keep waiting,

or you can be that 1%—

position yourself early and rationally, and embrace the next decade’s wealth cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BitGo Becomes First US Provider to Offer Canton Coin Custody Services

BitGo Enhances Security with $250M Insurance, Regulated Cold Storage, and Multi-Signature Protection for Canton Coin Custody

Canaan Secures 4.5 MW Contract in Japan for Crypto Mining Grid Stabilization

Avalon A1566HA Hydro-Cooled Mining Servers to Bolster Regional Utility's Power Grid in Japan by 2025

Powell: Another rate cut in December is not a certainty, there are significant divisions within the committee, the job market continues to cool, and there is short-term upward pressure on inflation (full text attached)

Powell stated that inflation still faces upward pressure in the short term, while employment is facing downside risks. The current situation is quite challenging, and there remains significant disagreement within the committee regarding whether to cut rates again in December; a rate cut is not a foregone conclusion. Some FOMC members believe it is time to pause. Powell also mentioned that higher tariffs are driving up prices in certain categories of goods, leading to an overall increase in inflation.

Mars Morning News | Due to uncertainty over Federal Reserve rate cut expectations, the crypto market seeks support downward

Federal Reserve Chairman Powell stated that a rate cut in December is not inevitable, leading to a significant decrease in market expectations for rate cuts and a decline in risk assets. The crypto market also dropped as a result, with bitcoin falling below $110,000. The trading volume of Bitwise Solana ETF continues to grow. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively updated.