ECB Maintains Interest Rates Amid Economic Challenges

- ECB maintains interest rates amid global uncertainties.

- No immediate changes to euro liquidity.

- Focus remains on inflation targets.

The European Central Bank maintained interest rates unchanged at 2.15% for refinancing and 2.00% for deposit facilities as of October 30, 2025. Officials emphasize a ‘meeting by meeting’ review approach amid geopolitical and fiscal uncertainties.

Points Cover In This Article:

ToggleThe unchanged rates by the ECB reflect caution amid global economic uncertainties and a sustained focus on inflation.

European Central Bank Interest Rate Decision

ECB Holds Interest Rates Steady

The European Central Bank (ECB) has left its key interest rates unchanged as of October 30, 2025. Main refinancing rate remains at 2.15%, with the deposit facility rate at 2.00%, as per officials.

Led by President Christine Lagarde, the ECB Governing Council decided to maintain rates amid global economic challenges. Officials emphasize their data-driven approach to achieve the 2% inflation target.

Decisions will be made ‘meeting by meeting,’ signaling little appetite for near-term easing despite ongoing geopolitical tensions, trade policy uncertainty and potential fiscal impacts from higher defense spending. — Christine Lagarde, President, European Central Bank

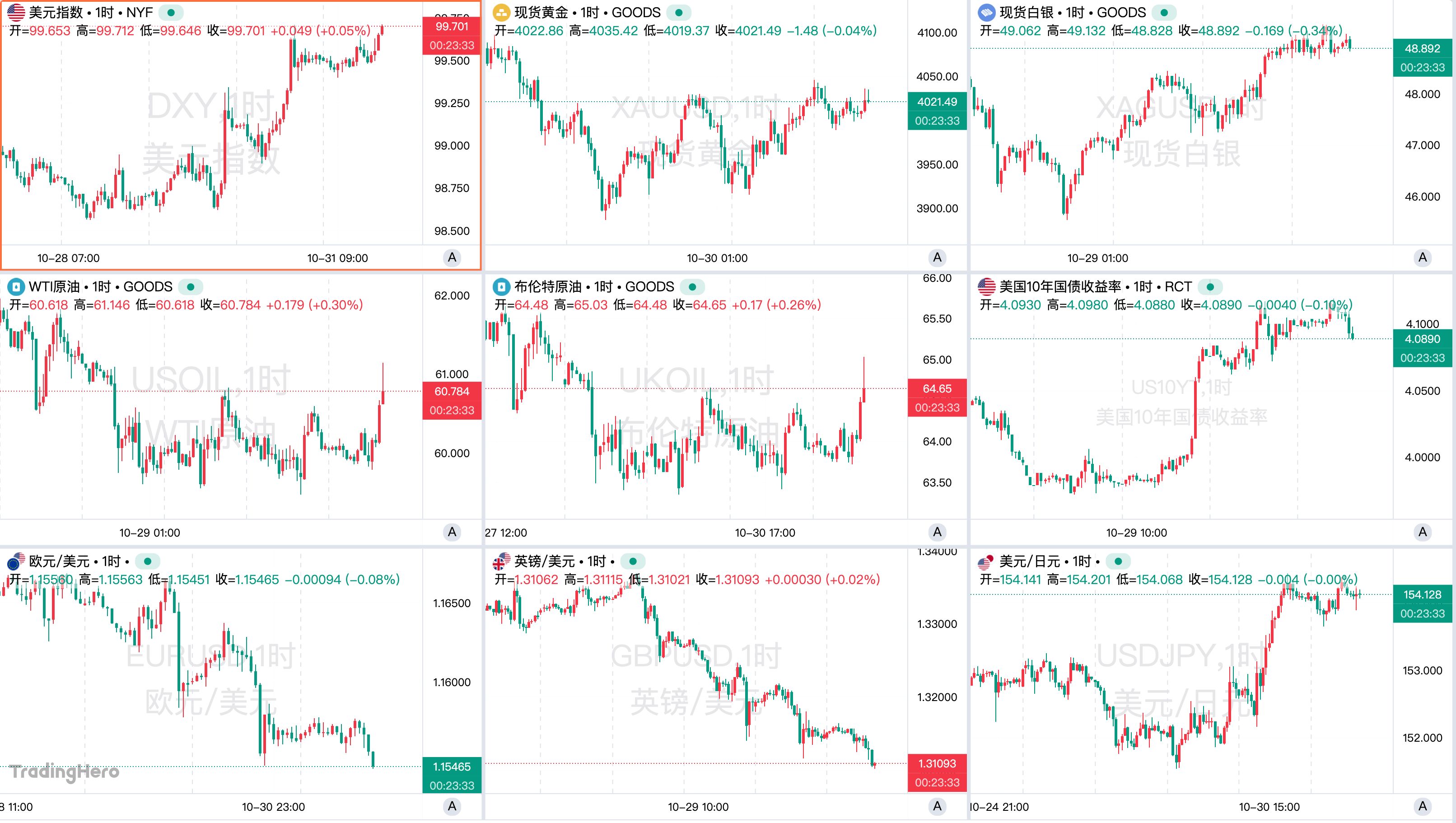

Market Impact and Analysis

There are minimal immediate impacts on major cryptocurrencies and euro-based stablecoins. Market participants may adjust strategies as euro liquidity conditions evolve, impacting trading volumes and asset management approaches.

This policy stance suggests caution against premature economic adjustments. Analysts observe effects on cross-currency trades and anticipate market responses based on evolving economic conditions.

Monitoring Financial and Technological Developments

While major cryptocurrencies exhibited limited response, potential shifts could emerge as liquidity conditions change. Asset managers monitor developments closely for potential adjustments.

Experts suggest ongoing monitoring of financial, regulatory, and technological developments. Historical patterns indicate possible impacts on DeFi protocols and euro-based trading pairs, as the ECB continues its cautious monetary approach.

ECB Holds Interest Rates Steady Amid Economic Challenges

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell: Another rate cut in December is not a certainty, there are significant divisions within the committee, the job market continues to cool, and there is short-term upward pressure on inflation (full text attached)

Powell stated that inflation still faces upward pressure in the short term, while employment is facing downside risks. The current situation is quite challenging, and there remains significant disagreement within the committee regarding whether to cut rates again in December; a rate cut is not a foregone conclusion. Some FOMC members believe it is time to pause. Powell also mentioned that higher tariffs are driving up prices in certain categories of goods, leading to an overall increase in inflation.

Mars Morning News | Due to uncertainty over Federal Reserve rate cut expectations, the crypto market seeks support downward

Federal Reserve Chairman Powell stated that a rate cut in December is not inevitable, leading to a significant decrease in market expectations for rate cuts and a decline in risk assets. The crypto market also dropped as a result, with bitcoin falling below $110,000. The trading volume of Bitwise Solana ETF continues to grow. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively updated.

Weekly Hot List Selection: Fed Rate Cut Announced but Hawkish Signals Emerge! Improvement in International Trade Sentiment

Powell clearly indicated that a rate cut in December is not certain, with hawkish sentiment "awakening"! International trade sentiment is improving, and gold prices remain highly volatile. The Gaza ceasefire remains fragile, while Japan-U.S. relations are entering a "golden era." Nvidia's market value surpasses 5 trillions! Which exciting market moves did you miss this week?

Jensen Huang's fried chicken meal sends Korean "chicken stocks" soaring

Jensen Huang appeared at the Kkanbu Chicken restaurant in Seoul and had a fried chicken dinner with the heads of Samsung Electronics and Hyundai Motor, unexpectedly sparking a frenzy in Korean "meme stocks."

Trending news

MorePowell: Another rate cut in December is not a certainty, there are significant divisions within the committee, the job market continues to cool, and there is short-term upward pressure on inflation (full text attached)

Mars Morning News | Due to uncertainty over Federal Reserve rate cut expectations, the crypto market seeks support downward