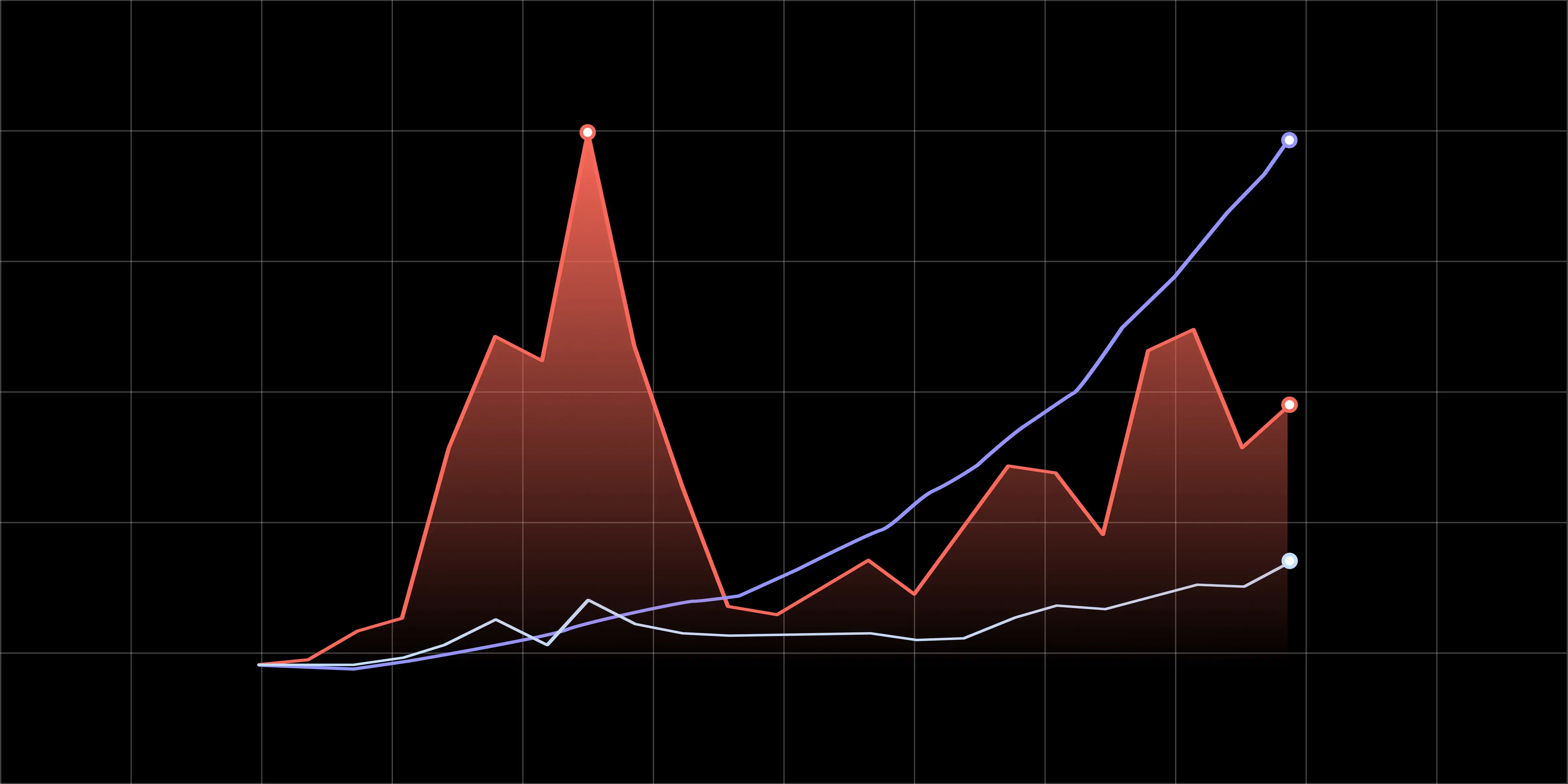

- Solana trades near $194 and faces resistance at $207 with strong support near $176.

- A confirmed breakout above $207 could lead to a rally targeting the $296 resistance area.

- The current consolidation range suggests a possible reversal before early 2026 momentum shif

Solana (SOL) is approaching a critical technical level at $207, a price point that traders believe could signal the beginning of a major bullish phase. According to analysis shared by Emijap Turbo on X (formerly Twitter), a breakout above this zone may trigger a strong upward move toward the $296 resistance range.

At the time of posting, Solana traded near $194.25, marking a 2.24% decline on the Binance three-day chart. Despite the dip, the structure shows resilience, with support levels holding steady within the $176 to $186 range. The setup suggests the potential for a major reversal if buyers regain momentum above $207.

This prompts the key question — can Solana’s price sustain a bullish breakout above $207 and set up for a rally into 2026?

Technical Setup Points to Possible Reversal

The TradingView chart shows Solana consolidating inside a well-defined ascending channel, supported by repeated rebounds near its base. The $207 resistance has emerged as the primary price barrier preventing upward continuation, while the $176 support zone serves as the foundation of ongoing accumulation.

Analysts highlight that a confirmed close above $207 could validate a breakout pattern similar to earlier rallies seen in 2025. The price projection marked T1 on the chart shows a target near $296, a level that aligns with the mid-channel resistance.

In recent months, Solana has demonstrated consistent higher lows, indicating the formation of a broader uptrend structure. If this momentum continues, the path toward $296 may unfold as part of a renewed bullish cycle extending into early 2026.

Market Structure and Price Context

The analyst’s post outlines clear conditions for an upward breakout. Should the price surpass $207, the next resistance areas will likely appear near $258 and $296. These levels could act as key profit-taking zones for short-term traders while defining mid-term targets for swing positions.

Technical metrics suggest that Solana remains within a phase of reaccumulation, a typical precursor to significant rallies. The convergence of moving averages near $190 provides structural support for a potential rebound, reducing downside risks in the short term.

However, failure to reclaim the $207 level could maintain Solana’s consolidation between $176 and $206, delaying any major rally attempt. For now, traders continue to watch the upper channel boundary closely as momentum builds toward year-end positioning.