Another major financing lands this year: How does Ripple support a $40 billion valuation?

Large-scale financing, RLUSD surpassing 1 billion, and a partnership with Mastercard—these three developments have created a positive feedback loop and may signal Ripple's transformation from the concept of a “blockchain-based SWIFT” to a revenue-driven global settlement infrastructure.

Author: zhou, ChainCatcher

On November 5, digital asset and infrastructure company Ripple announced the completion of a $500 million strategic financing round, bringing its post-investment valuation to $40 billions—this marks the largest external financing round for the project since its Series C round in 2019 ($200 million, $10 billions valuation), with its valuation quadrupling over six years.

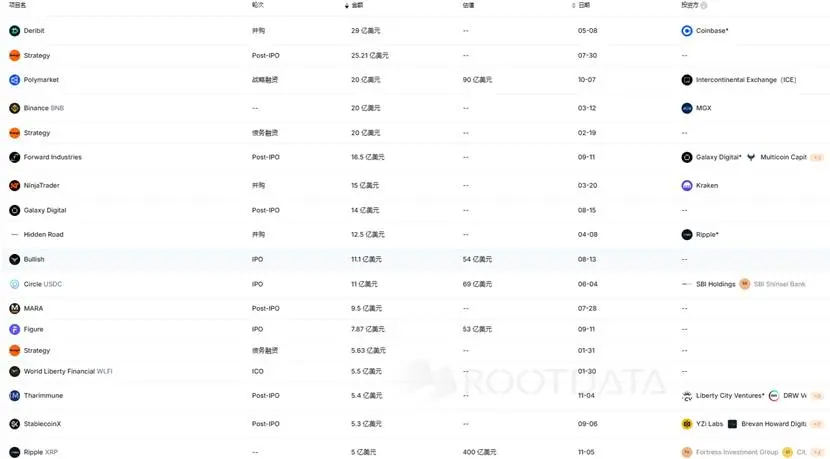

This round was co-led by Fortress Investment Group and Citadel Securities, with Pantera Capital, Galaxy Digital, Brevan Howard, Marshall Wace and other institutions participating. It marks the third-largest single financing deal in the crypto primary market in 2025, only behind Polymarket's $2 billions strategic financing in October and Binance's $2 billions minority equity transaction in March.

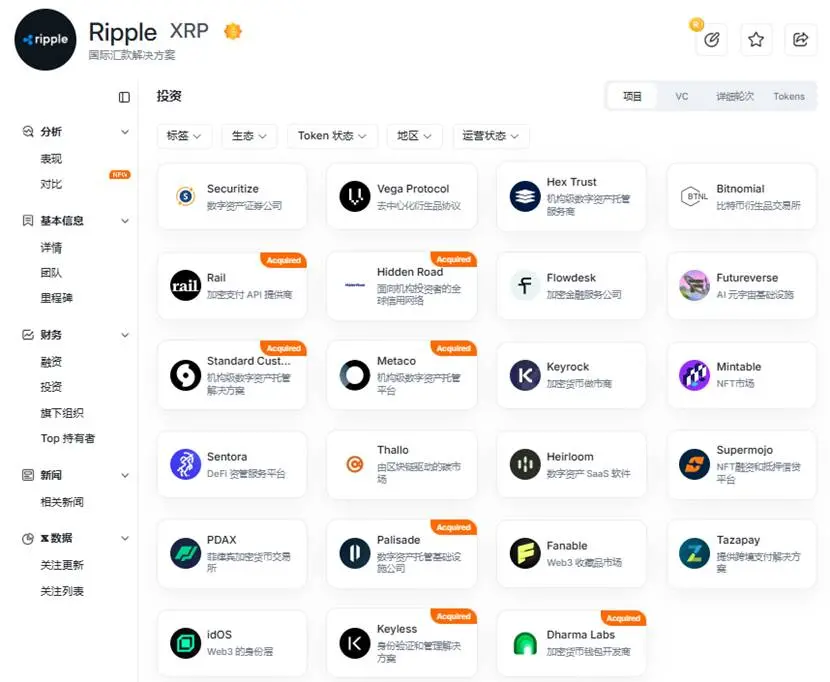

Regarding the use of funds, Ripple stated that the focus will be on continued mergers and acquisitions, global expansion of RLUSD, and the construction of compliance infrastructure. Since the beginning of this year, Ripple has launched a strategic investment plan exceeding $4 billions, successively acquiring institutional broker Hidden Road ($1.25 billions), enterprise treasury management platform GTreasury ($1 billions), payment infrastructure Rail ($200 million), and digital asset custodian Palisade (financial details undisclosed).

Reportedly, Ripple (also known as 瑞波) was created by Ripple Labs and is a global cross-border payment network based on distributed ledger technology, claiming to enable secure, instant, and nearly free global financial transactions of any scale. Ripple's business consists of its cross-border payment network (RippleNet), compliant stablecoin (RLUSD), enterprise-grade public chain (XRPL), and institutional M&A ecosystem. According to RootData, the current price of XRP is $2.33, up 7.2% in 24 hours, down 20% over the past month, ranking 4th globally by market cap, with a total market cap of $139.8 billions and a circulating supply of 60.1 billion coins.

From a valuation perspective, the $40 billions valuation is significantly higher than most similar projects. Public information shows that in the stablecoin sector, Circle's NYSE-listed market cap is about $25 billions, Paxos is valued at about $2.4 billions; in the public chain infrastructure track, Polygon is valued at about $7 billions, Sui and Aptos at about $6 billions and $4.5 billions respectively; in the payment network sector, Stellar's market cap is about $9 billions. Ripple's high valuation is partly due to the growth potential of its XRPL public chain and RLUSD, but is also affected by a liquidity premium due to its unlisted status. Ripple President Monica Long stated that the company currently has no IPO plans or timetable, which may prolong the uncertainty of investor exit paths.

From a business perspective, as the major financing news landed, on November 6, the total circulation of Ripple's compliant stablecoin RLUSD exceeded $1 billions (UTC+8) for the first time. In just 330 days since launch, this stablecoin has become the 11th largest USD stablecoin globally according to DefiLlama, with a current circulation of $1.022 billions, of which $819 million is on Ethereum and $203 million natively on XRP Ledger.

Ripple President Monica Long stated that to date, Ripple has processed nearly $100 billions in payment volume, and RLUSD is the "main stablecoin" used for payment flows. However, in the stablecoin market dominated by USDT ($183 billions) and USDC ($76 billions), RLUSD's share is relatively small and still faces liquidity competition risks.

On the XRPL public chain side, as Ripple's technical core, it has served more than 500 financial institutions worldwide, with an annualized transaction volume approaching $95 billions. XRPL has recently upgraded to introduce an EVM-compatible sidechain and partnered with Polygon CDK to enhance smart contract capabilities. XRPL's DeFi ecosystem is relatively lagging; according to DefiLlama, XRPL DeFi TVL is only $79.59 million (ranked 49th), far behind mainstream public chains such as Solana ($10.1 billions) and Ethereum ($74.7 billions).

In addition, today's news reports that Mastercard will cooperate with Gemini and Ripple to explore using the RLUSD stablecoin on XRPL to settle fiat card transactions. The backend settlement of Gemini XRP credit cards will be fully migrated to XRP Ledger, using RLUSD to achieve 3-second final settlement. Mastercard stated that this cooperation will become one of the first cases of regulated US banks using public blockchains and regulated stablecoins to settle traditional card transactions, which is expected to reduce merchant costs.

In this light, the financing provides endorsement for RLUSD's growth, the scale of the stablecoin injects liquidity for real-time credit card settlement, and the Mastercard partnership validates the feasibility of compliant public chains replacing traditional rails. These three developments form a positive feedback loop, potentially marking Ripple's transformation from a "blockchain version of SWIFT" concept to a revenue-driven global settlement infrastructure.

However, Ripple is currently facing two key regulatory events. First is the progress of XRP spot ETF approval. Seven institutions—Grayscale, Bitwise, Franklin Templeton, WisdomTree, Canary Capital, 21Shares, and CoinShares—have submitted applications for XRP spot ETFs, and collectively updated their S-1 filings on November 4, removing the original indefinite extension clause and switching to the same automatic effectiveness mechanism as bitcoin and ethereum ETFs. The earliest batch is expected to take effect between November 13 and 15 (UTC+8), with Polymarket prediction markets showing a 99% probability of approval in 2025.

It is worth noting that the REX-Osprey XRP ETF (ticker XRPR) was listed on September 18, with a first-day trading volume of $37.7 million, setting the highest single-day debut trading volume record this year. If the subsequent seven ETFs are launched, they may attract more compliant funds, providing a deeper liquidity pool for XRP and helping to smooth out extreme volatility in the long term.

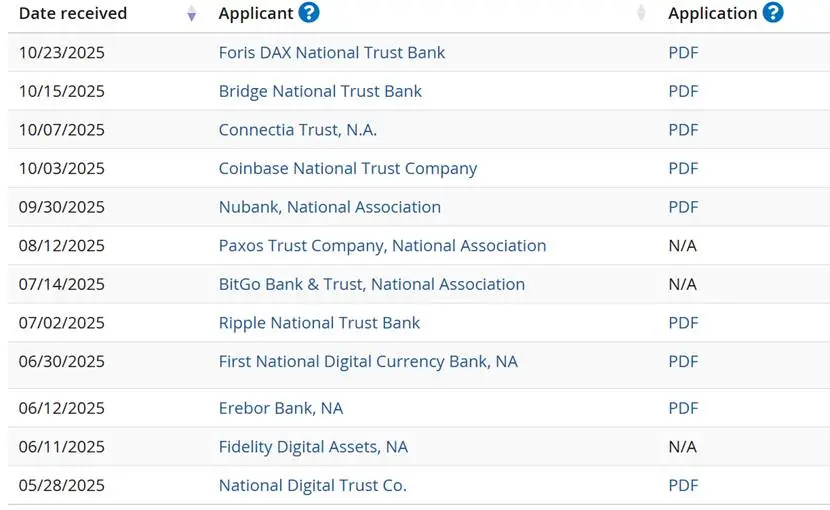

The second is the US banking license application. On July 2, 2025, Ripple submitted an application to the US Office of the Comptroller of the Currency (OCC) to establish Ripple National Trust Bank, which is currently in the 120-day statutory review period, with a preliminary result due by November 2, 2026, at the latest. According to the latest status on the OCC website, Circle (First National Digital Currency Bank) applied on June 30 and has exceeded the 120-day review period without approval; Paxos applied on August 12 and is under review; Coinbase applied on October 3 and is also under review.

Ripple is among the earlier applicants. If the license is approved, RLUSD reserves can be deposited directly into the Federal Reserve's master account, enabling 24/7 real-time minting and redemption. Ripple would become the second crypto-native company after Anchorage Digital to hold a federal trust license. This, combined with the XRP ETF, would form a dual regulatory boost, increasing institutional adoption confidence and capital inflows.

Overall, Ripple has seen frequent positive developments recently. However, breaking down its business, the stablecoin sector is already a red ocean, XRPL lacks competitiveness among public chains, and cross-border payment business is still dominated by traditional payments. Under the pressure of multi-party competition and regulatory uncertainty, whether it can sustain a $40 billions valuation ultimately depends on the delivery of data—the market has already voted with its feet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Signs Potential Mid-Cycle Bottom As Fear Grips the Market

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.