ALGO Falls by 2.28% Over 24 Hours as Short- and Long-Term Performance Shows Mixed Results

- ALGO dropped 2.28% in 24 hours to $0.1844, contrasting with 17.29% weekly and 4% monthly gains but a 44.84% annual decline. - Traders monitor ALGO's resilience amid macroeconomic shifts, though long-term bearish trends highlight structural challenges. - Key support at $0.18 could trigger bullish momentum if held, while breakdown risks further declines toward $0.15. - A backtest analyzing 15% single-day spikes aims to assess ALGO's potential for sustained gains or pullbacks post-rallies.

As of NOV 11, 2025,

ALGO’s 24-hour drop stands in contrast to its robust performance over the last 7 and 30 days. The 17.29% weekly rise points to persistent demand, possibly fueled by strategic moves ahead of significant macroeconomic announcements. In the near term, traders have shown optimism in ALGO, as seen in its ability to withstand volatility that often follows major news. Still, the nearly 45% decline from its 2025 high signals deeper structural issues, such as macroeconomic headwinds and the cyclical swings typical of the crypto market.

Technical analysis suggests ALGO may be approaching a pivotal moment. The latest retracement has brought the price near important support levels that traders are monitoring. Should ALGO remain above $0.18, it may indicate the beginning of a new upward trend, especially if the overall crypto market continues to strengthen. On the other hand, if the price slips below this threshold, it could lead to further losses toward $0.15—a level that has historically served as a key psychological barrier for investors.

Backtest Hypothesis

To evaluate possible scenarios for ALGO’s current setup, a backtest can be performed using specific entry and exit rules. The approach would target instances where there is a 15% single-day surge, defined as a closing price at least 1.15 times higher than the previous day’s close. The backtest would review average returns and volatility following such moves, using data from January 1, 2022, to the present. By analyzing ALGO’s behavior after similar sharp increases, traders can gain insight into whether these spikes tend to lead to continued rallies or signal an impending correction. The analysis would also consider maximum drawdowns and ideal holding durations, offering a thorough perspective on the balance between risk and reward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar (ASTR) Price Rally: On-Chain Usage Growth and DeFi Cross-Chain Innovations Fuel Upward Trend

- Astar (ASTR) surged to $1.26 in late 2025 after Binance's CZ bought $2M in tokens, but ecosystem upgrades drove sustained momentum. - Q3 2025 saw 20% active wallet growth, $3.16M whale accumulation, and $2.38M TVL resilience amid broader DeFi declines. - Astar 2.0's 150,000 TPS cross-chain hub and partnerships with Casio/Mazda bridged Web2/Web3, enhancing DeFi interoperability. - Whale activity showed mixed signals, but strategic upgrades and $0.80–$1.20 2030 price targets highlight long-term investment

Hyperliquid News Today: The Reason 2025 Crypto Presales Focus on Practical Use Rather Than Hype

- 2025 crypto presales prioritize utility-driven projects like Noomez ($NNZ), Bonk ($BONK), and Floki ($FLOKI) with structured tokenomics and transparency. - Noomez employs a 28-stage BNB Chain price ladder, liquidity locks, and token burns to create scarcity, currently at $0.0000151 in Stage 3. - Bonk transitions from meme coin to utility-focused Solana project with DeFi integrations, while Floki combines meme appeal with metaverse and staking tools. - Presales offer early-stage advantages over listed tok

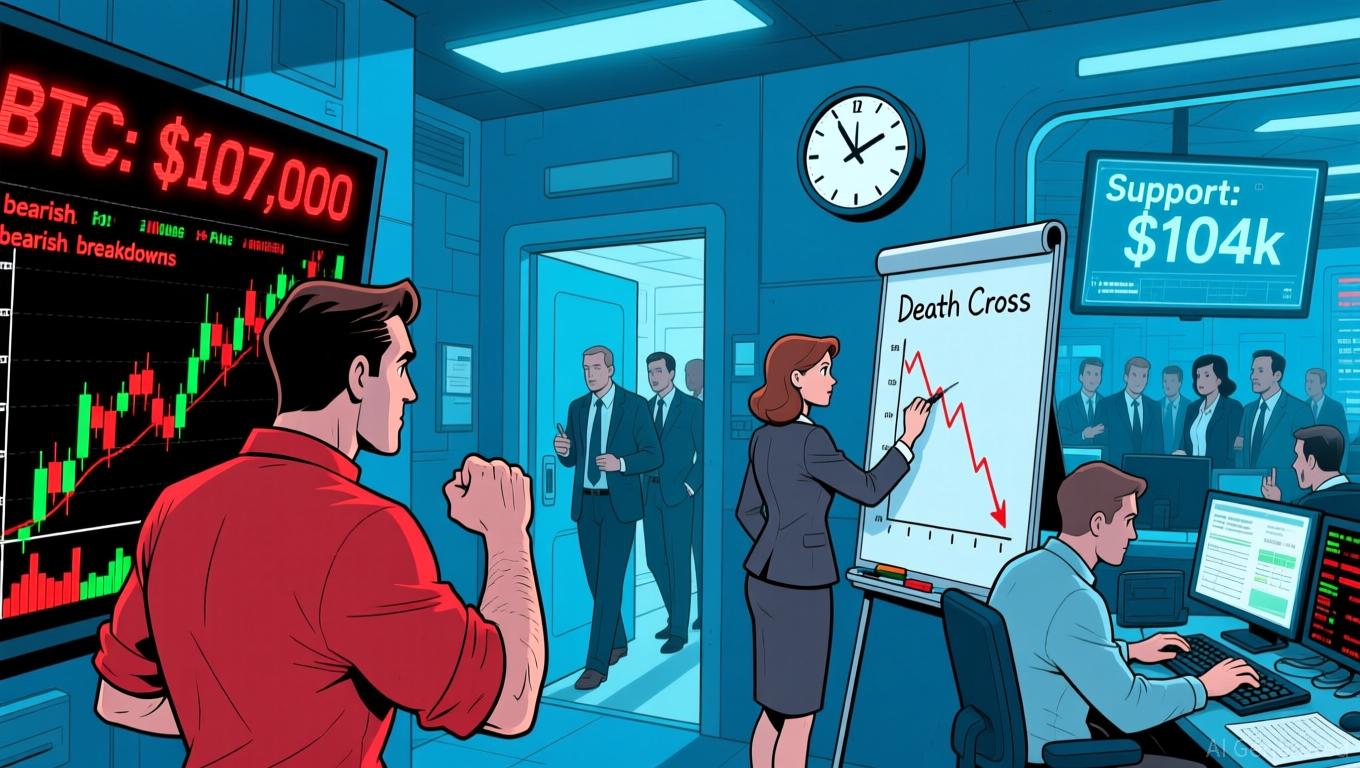

Bitcoin News Update: Bitcoin’s $100,000 Support Falters Amid Rising Death Cross and Increased Miner Sell-Off

- Bitcoin's failed $107,000 breakout triggered a "death cross" bearish pattern as 50-day SMA fell below 200-day SMA, signaling prolonged downward pressure. - Key support at $104,000 becomes critical for stabilizing BTC, with CME futures gaps potentially enabling bounces if buyers intervene. - Institutional panic selling risks accelerating declines below $100,000, with ETF liquidity "air pockets" at $93,000 amplifying volatility concerns. - Miner selling and weak ETF inflows constrain recovery attempts, whi

Transparent scarcity is what fuels Noomez's attractiveness within the speculative cryptocurrency market

- Analysts highlight Noomez ($NNZ) as 2025's top crypto pick due to deflationary mechanics and transparent on-chain metrics. - Project's 28-stage presale model burns unsold tokens, raising prices as supply shrinks, with $20,000+ raised in Stage 3. - Noom Engine ecosystem and 15% liquidity lock differentiate it from speculative projects, offering post-launch utility and staking rewards. - Vault Events and KYC-verified team address security concerns, while real-time tracking on Noom Gauge builds investor tru