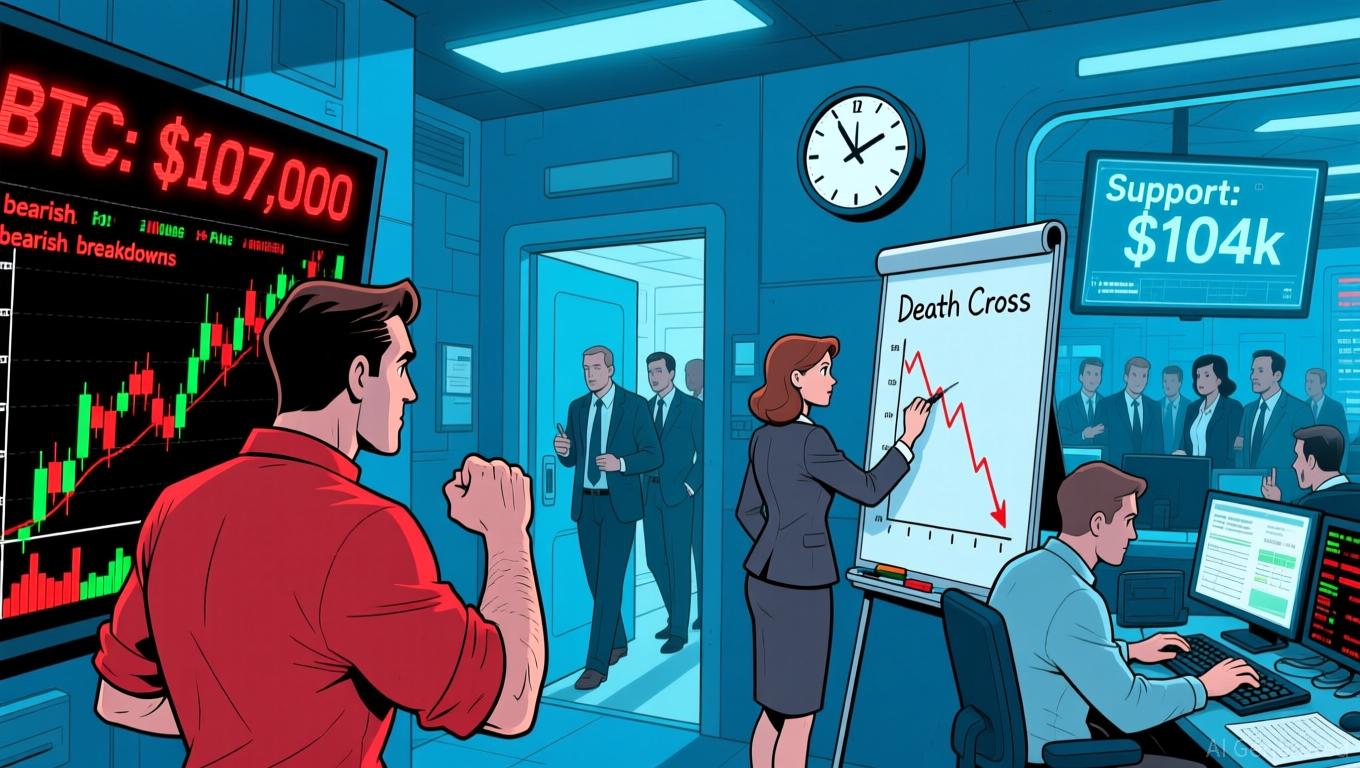

Bitcoin News Update: Bitcoin’s $100,000 Support Falters Amid Rising Death Cross and Increased Miner Sell-Off

- Bitcoin's failed $107,000 breakout triggered a "death cross" bearish pattern as 50-day SMA fell below 200-day SMA, signaling prolonged downward pressure. - Key support at $104,000 becomes critical for stabilizing BTC, with CME futures gaps potentially enabling bounces if buyers intervene. - Institutional panic selling risks accelerating declines below $100,000, with ETF liquidity "air pockets" at $93,000 amplifying volatility concerns. - Miner selling and weak ETF inflows constrain recovery attempts, whi

Bitcoin’s latest price movements have drawn increased attention as the cryptocurrency encounters significant turning points after failing to break past $107,000. The rejection at this resistance level has fueled renewed bearish outlooks, with market observers pointing to the formation of a “death cross”—a negative technical signal where the 50-day simple moving average (SMA) falls below the 200-day SMA. This pattern, initially highlighted in a Coindesk report

The unsuccessful effort to reclaim $107,000 has shifted focus to the next major support at $104,000, with traders preparing for possible sharp price swings. Data from Cointelegraph and TradingView indicate that Bitcoin’s inability to maintain levels above $107,000 has sparked concerns about a potential move back to $100,000

Meanwhile, the selling activity from miners is adding complexity to Bitcoin’s short-term prospects. According to Crypto News, a rise in miner sales, combined with slowing ETF inflows, might limit Bitcoin’s ability to recover within the $100,000–$108,000 band

As Bitcoin approaches these crucial price levels, the next few weeks will reveal whether buyers can regain momentum or if sellers will strengthen their hold on the market’s direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI's Growing Demand for Power Pushes the Energy Industry Into an Intense Sustainability Competition

- Energy and tech sectors collaborate to address AI's surging energy demands through sustainable computing infrastructure and efficient GPU solutions. - Devon Energy and Alliant Energy boost capital spending on grid modernization and storage, aligning with AI-driven power needs while maintaining shareholder returns. - NVIDIA advances open-source GPU efficiency via Nova driver, yet faces market volatility as AI sector grapples with financial risks and regulatory pressures. - Industry challenges include bala

ZEC drops 11.51% over 24 hours, Large Holder Movements and Accumulation Patterns Indicate Market Fluctuations

- ZEC fell 11.51% in 24 hours as a major whale liquidated 30,000 ZEC ($960K), facing 46% unrealized losses and a $420 liquidation price. - Binance saw $30M ZEC accumulation via coordinated whale buys, while the largest short position (0xd47) reduced losses to $10.87M amid ongoing bearish bets. - Zcash’s November 2025 halving will cut block rewards by 50%, boosting scarcity, while Grayscale’s $137M Zcash Trust highlights growing institutional interest. - Privacy-focused Zcash gains regulatory clarity under

Bitcoin News Update: Short Sellers Hit Hard as $341M in Crypto Liquidations Sparks Volatility Spike

- Bitcoin's $106,000 surge triggered $341.85M in crypto liquidations, with short sellers losing $106.75M as leverage-driven volatility spiked. - Senate's shutdown resolution boosted Bitcoin 3.93% in 24 hours, alleviating regulatory uncertainty and injecting market optimism. - Hyperliquid's $18.96M single liquidation highlighted risks of 1,001:1 leverage, as platforms amplified price swings through stop-loss mechanisms. - November's $20B in crypto derivatives liquidations revealed systemic fragility, with E

XRP News Today: XRP ETFs: Wall Street's Pathway to a $6 Trillion Ambition

- U.S. regulators fast-track XRP ETF approvals, with 21Shares, Franklin Templeton, and Canary Capital nearing launches by late November. - Analysts predict XRP could surge to $100–$1,000 if multiple ETFs debut simultaneously, potentially pushing its market cap to $6 trillion. - Ripple's $4B funding round and SEC court rulings validate XRP's utility in cross-border payments, signaling institutional adoption. - Risks persist, including regulatory delays and unmet adoption targets, though ETFs could normalize