Bitcoin Updates: Major Institutions Accumulate Bitcoin Amid Market Reaching "Extreme Fear" Levels

- Bitcoin's Fear & Greed Index plummeted to 15, signaling extreme fear as prices trigger panic-driven selling across crypto markets. - Institutional buyers like American Bitcoin Corp. added 3,000 BTC in Q3, boosting holdings to 3,418 BTC amid bearish conditions. - Analysts note historical correlations between extreme fear and market bottoms, though timing remains uncertain amid regulatory and macroeconomic challenges. - Market remains divided between retail panic and institutional buying, with some viewing

The cryptocurrency sector is currently experiencing heightened investor unease as

The index, created by Alternative and Santiment,

Despite the ongoing volatility, institutional investors continue to take advantage of the market dip.

Although bearish sentiment is widespread, some analysts warn against reacting too strongly to short-term market emotions.

The market’s direction will depend on whether institutional buying can continue to outweigh retail selling pressure. For now, the sector remains in a wait-and-see mode, with the Fear & Greed Index acting as both a cautionary signal and a possible chance for opportunity. As one analyst observed, "The worst moments rarely mark the bottom, but every bottom is always preceded by the worst."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Apeing’s Whitelist Compared to Bitcoin’s Surge: The 2025 Crypto Battle Between Innovation and Speculation

- Apeing ($APEING) emerges as a 2025 crypto standout with a whitelist-first model emphasizing Ethereum-based security and community governance. - Bitcoin tests $105,000 resistance amid stalled institutional demand, while Ethereum advances Supra's 1.5x faster EVM execution engine to address scalability. - Market analysts highlight a "mid-cycle consolidation phase," with 72% of Bitcoin supply still in profit despite recent volatility. - Apeing's structured whitelist contrasts with meme coin risks, offering e

Ethereum News Update: Major Ethereum Holders' Recent Buying Strategy Results in $18.97M Loss Amid Ongoing Market Fluctuations

- Ethereum whale "7 Siblings" faces $18.97M unrealized loss from aggressive dip-buying strategy amid volatile market conditions. - The group accumulated 49,287 ETH at $3,531 average cost, but recent price dips and profit-taking triggered $500M+ market-wide profit/loss swings. - ETH hovers near $3,100 critical support level, with breakdown risks forcing potential selling pressure from whale holders. - Historical patterns show large loss realizations often precede heavy distribution, as seen in January's 50%

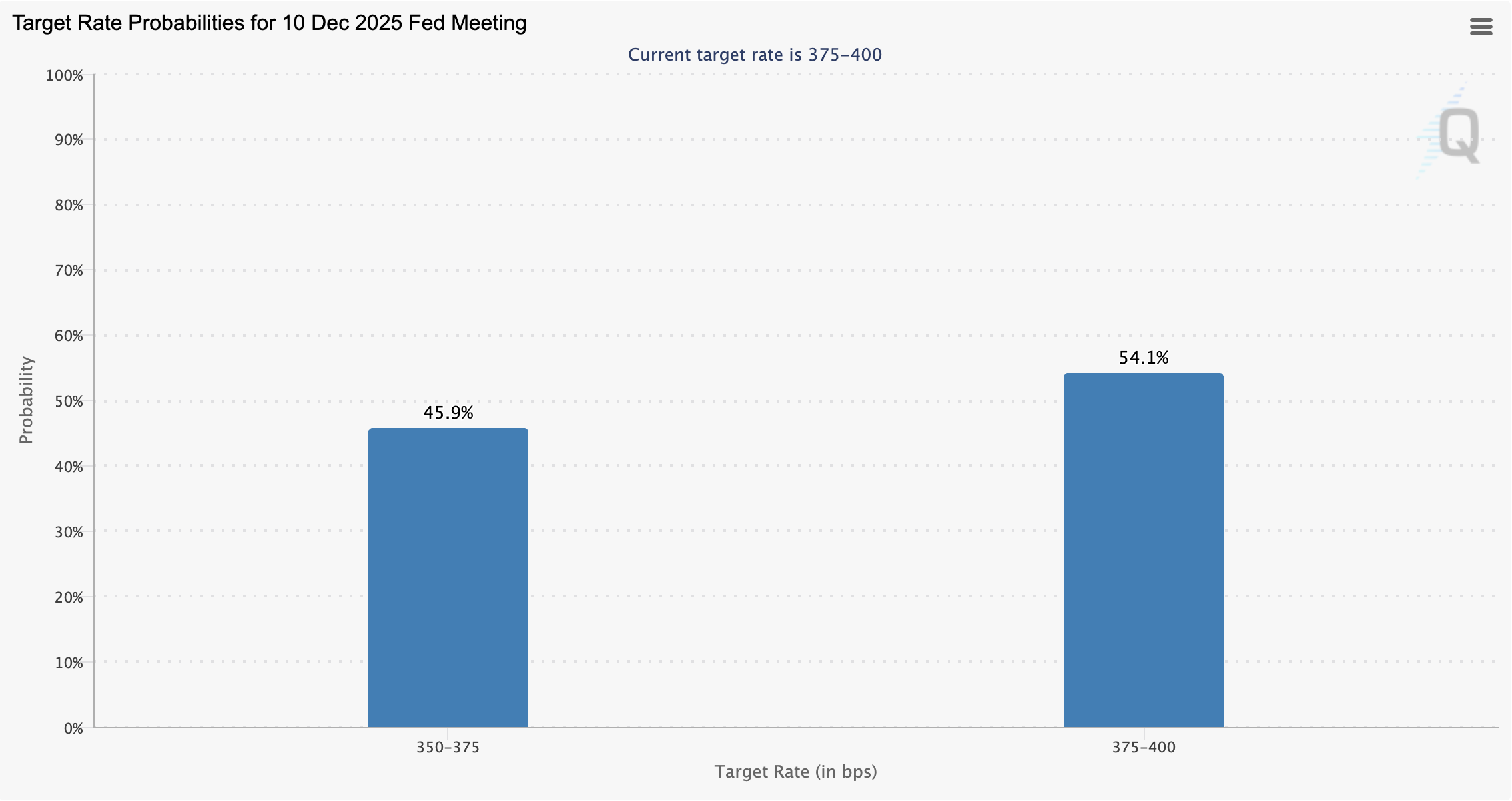

Probability of December interest rate cut falls below 50%