Santiment: BTC social discussion hits a 4-month high, significantly increasing the probability of a market reversal.

crypto sentiment analysis platform Santiment points out a surge in Bitcoin's social media discussion. Although this is not necessarily a signal that the crypto market has bottomed out, the probability of a market reversal is significantly increasing. When Bitcoin's price fell below $95,000 this Friday, the discussion heat reached a 4-month high, indicating that retail investors' extreme panic and FUD sentiment are fully erupting.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

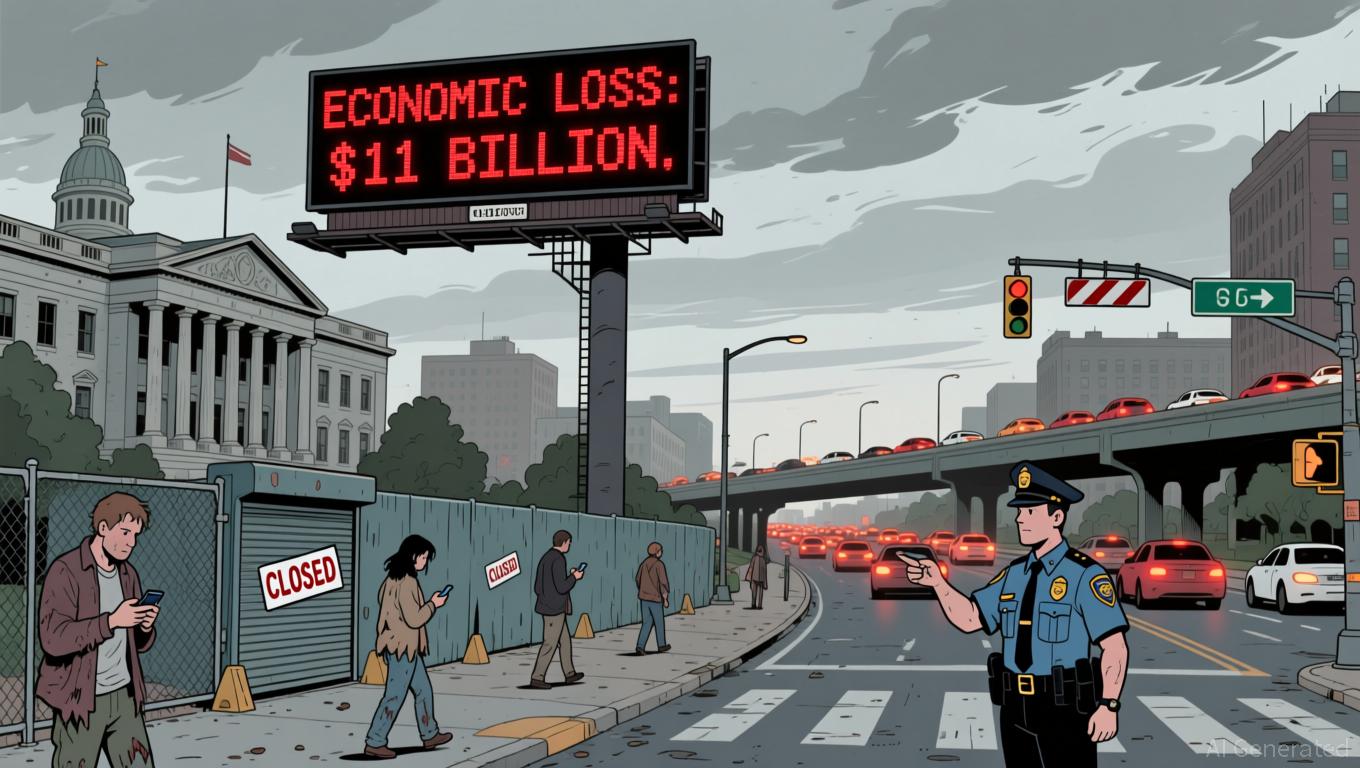

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest

Ethereum Updates Today: DATs Buyback Strategy May Surpass Liquidity Challenges Amid Rising Debt

- FG Nexus sold $32.7M in ETH to repurchase 8% of shares amid 94% stock price drop, reflecting DAT sector struggles with NAV discounts. - Industry-wide $4-6B in forced crypto liquidations by DATs highlights systemic risks as debt rises and liquidity tightens across firms like ETHZilla and AVAX One . - Analysts warn debt accumulation and stalled corporate buying could worsen instability, while companies pivot to tokenization to address declining investor appetite. - Market skepticism persists as FG Nexus tr