Aster News Today: Aster’s Hybrid Approach Combines the Fast Execution of CEX with the Openness of DeFi

- Aster, a decentralized perpetual exchange, launches Stage 4 airdrop and $10M trading competition to boost user engagement and liquidity through dual incentives. - The platform aims to replicate CEX speeds with transparent on-chain infrastructure, planning a Layer-1 protocol by 2026 and expanding token utility via staking and partnerships. - Aster diversifies offerings with gold/index perpetuals and leverages capital-efficient models, positioning itself as a hybrid DeFi hub amid growing institutional and

Aster, a decentralized perpetual trading platform, is ramping up its ecosystem expansion with the introduction of the Stage 4 (Harvest) airdrop and a $10 million "Double Harvest" trading contest, marking a significant effort to boost user activity and trading volumes. The airdrop, distributing 1.5% of the total

This campaign builds upon the achievements of Aster's Rocket Launch initiative, which has

Looking ahead, Aster’s roadmap features the creation of a high-speed, optionally private Layer-1 on-chain order-book protocol,

Aster’s international reach is expanding, as CEO Leonard recently presented at Binance Campus APAC and

The platform’s ecosystem growth is driven by its distinctive capital efficiency framework, enabling users to utilize liquid-staking tokens (such as asBNB) or yield-bearing stablecoins (USDF) as collateral

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

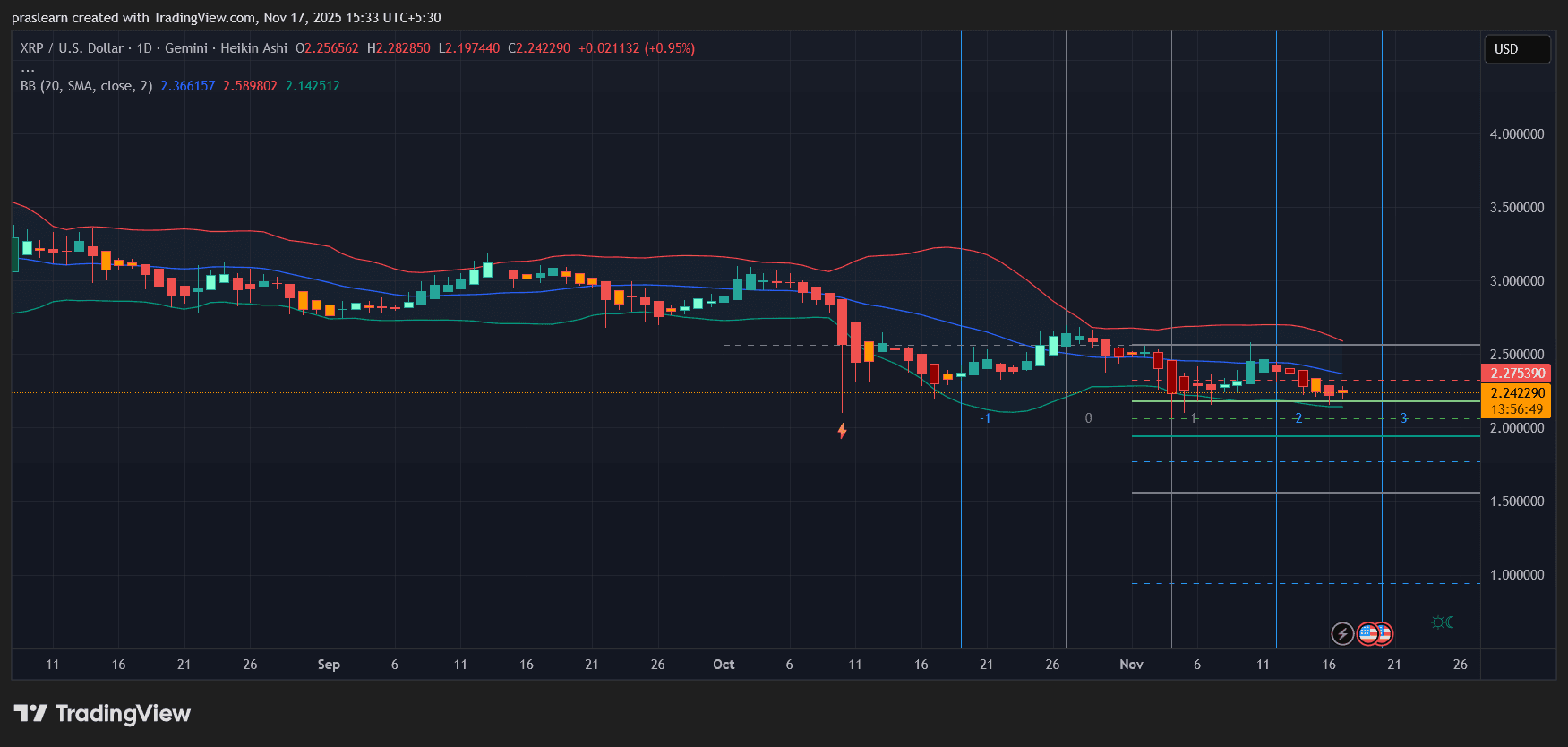

Will XRP Price Crash to 0.65?

Bitcoin News Today: Are Bitcoin Futures Indicating a Market Bottom or a Potential Trap for Investors?

- Rare Bitcoin futures signal emerges as open interest drops below $8B and funding rates turn negative, sparking debate about a potential market bottom. - Derivatives experts note this rare alignment of metrics historically precedes crypto market consolidation or reversals, but caution against over-interpretation. - On-chain data shows whale accumulation rising 12% in a month, contrasting with broader market weakness and weak Bitcoin fundamentals. - Analysts warn macroeconomic factors like inflation could

Druckenmiller’s $77 Million Investment Sparks Momentum in Blockchain Lending, Analysts Raise Their Projections

- Billionaire Stanley Druckenmiller's $77M investment in Figure (FIGR) triggered a 15% stock surge, signaling institutional confidence in its blockchain lending model. - Analysts raised price targets to $55-$56 after Q3 results showed 70% YoY loan growth to $2.5B and 55.4% EBITDA margins, surpassing estimates by 40-200%. - Figure's AI-driven capital-light model and RWA tokenization (e.g., $YLDS stablecoin) are highlighted as growth catalysts, with 60% of loans now via its Connect platform. - Institutional

Solana Latest Updates: VanEck's Collaboration on a Staked Solana ETF Reflects Growing Institutional Trust in Blockchain's Prospects

- VanEck partners with SOL Strategies for staking in its new Solana ETF (VSOL), enhancing institutional blockchain integration. - SOL Strategies' ISO-certified validators secure $437M+ in assets, chosen for operational expertise and institutional focus. - VSOL offers staking rewards with fee waivers until $1B AUM, reflecting growing demand for Solana-based funds like Bitwise's BSOL. - VanEck's $5.2B digital asset portfolio expands with VSOL, though staking risks and regulatory uncertainties remain for inve