Bitcoin News Update: Recent Cloud Outages Highlight Systemic Risks, Fueling DePIN Adoption

- Cloudflare's 2025 global outage disrupted major websites and crypto platforms, exposing centralized infrastructure vulnerabilities and boosting DePIN interest. - The incident caused 500 errors and API failures, impacting services like ChatGPT, X, and crypto exchanges, while pushing Cloudflare's stock down 3.5%. - DePIN advocates argue decentralized infrastructure reduces single-point failures, with projects like Gaimin promoting distributed cloud models using global resources. - Blockchain's operational

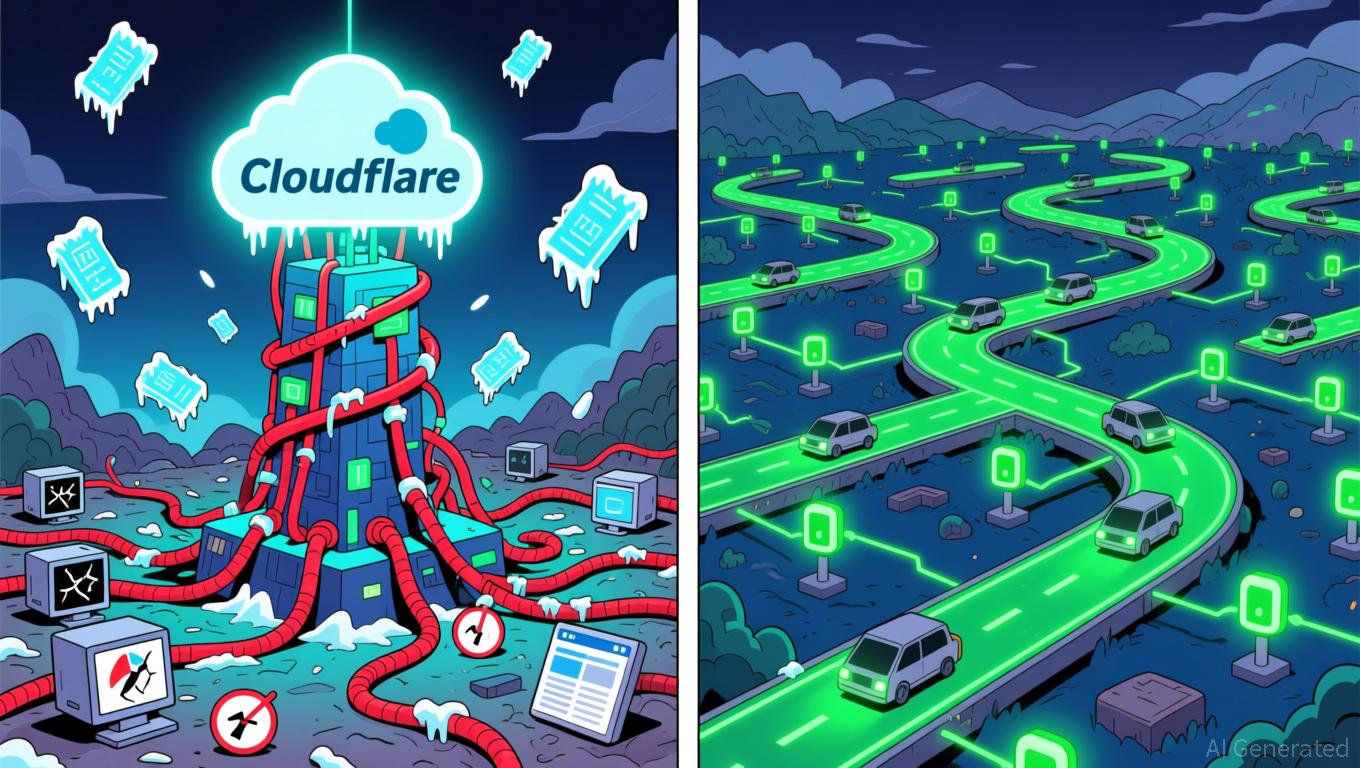

On November 18, 2025, a worldwide outage at Cloudflare disrupted numerous prominent websites and crypto platforms, sparking renewed discussions about the weaknesses of centralized internet systems and increasing attention on decentralized alternatives like DePIN. The disruption, which stemmed from an "unexpected surge in traffic" targeting one of Cloudflare’s services, led to widespread errors that impacted platforms such as OpenAI’s ChatGPT, Shopify, Elon Musk’s X, and several crypto services including BitMEX and

The outage’s effects rippled through the crypto sector, causing downtime for block explorers like Arbiscan and DefiLlama

At the same time, blockchain networks demonstrated their robustness during the outage, in stark contrast to the failures seen in Web2 services. While centralized platforms struggled, on-chain transactions continued without interruption,

The event also brought broader infrastructure issues into focus. Tata Consultancy Services (TCS) and its partners recently launched projects to develop sovereign cloud infrastructure in East Africa and Australia,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Paxos' USDG0 Integrates Regulatory Standards with Cross-Chain DeFi Advancements

- Paxos launches USDG0, a cross-chain stablecoin using LayerZero’s OFT standard to expand dollar-backed liquidity across multiple blockchains while maintaining regulatory compliance. - The global stablecoin market hit $300B in October 2025, with trading dominating 88.2% of transactions, showing expanding use cases beyond crypto trading. - USDG0 avoids wrapped tokens, enabling native cross-chain functionality on Ethereum , Solana , and others, preserving compliance and composability. - Regulatory frameworks

Cloudflare Outage Sheds Light on the Inherent Dangers of Relying on Centralized Internet Systems

- Cloudflare's 2025 outage disrupted major platforms like ChatGPT and X due to a large config file. - The incident exposed vulnerabilities in centralized internet infrastructure, causing a 4% stock drop. - Experts warn of systemic risks from over-reliance on few providers, urging diversified infrastructure. - Financial services and crypto platforms faced downtime, highlighting the need for redundancy.

PENGU Token Technical Review: Managing Immediate Market Fluctuations and Blockchain Indicators

- PENGU token faces critical juncture with conflicting technical indicators and accumulating on-chain activity in November 2025. - Short-term bearish signals (RSI 38.7, 12 sell signals) clash with bullish MACD/OBV divergence and whale accumulation ($273K acquired). - On-chain patterns suggest potential breakout above $0.0235 resistance, with $0.026 target if volume supports, but $0.01454 support remains vulnerable. - Risks persist due to unquantified NVT score and bearish pressure from broader indicators,

Bitcoin News Update: Retail Investors Panic While Whales Remain Confident as Bitcoin Hits Lowest Point in Seven Months

- Bitcoin fell to a seven-month low near $89,250, sparking debates over a potential bottom or prolonged correction amid mixed technical and institutional signals. - Analysts highlight a possible 40% rebound by year-end, driven by bullish figures like Michael Saylor and whale accumulation of 345,000 BTC since October. - Retail investors flee as fear metrics hit extremes, contrasting with institutional confidence seen in Czech National Bank's $1M Bitcoin pilot and ETF inflows. - Technical indicators warn of