Kalshi says its prediction markets will compete directly with U.S. equities within a few years

Kalshi is no longer trying to just carve out a space for itself. It wants to go head-to-head with the U.S. stock market.

Tarek Mansour, the CEO of Kalshi, made that very clear on Tuesday during the Futures Industry Association’s Expo in Chicago. “This is starting to look like a trillion-dollar market,” he said. “I always thought it was going to be pretty fast and go pretty big. I just didn’t think that fast.”

This whole shift kicked into overdrive after Kalshi beat U.S. regulators in court last year, giving it the legal green light to let people trade contracts on the outcome of the next presidential election.

Since that win, things have moved faster than even Tarek expected. He originally thought it’d take a full decade for prediction markets to catch up to traditional equities, but Kalshi has already built what he calls “a whole class of active traders.”

Kalshi adds news and sports to fuel rapid growth

Kalshi didn’t stop at politics. The firm started offering new markets tied to sports, pop culture, and other current events, using its special regulatory setup to slip through cracks in states where sports betting is either banned or heavily restricted.

Tarek says more sports-related deals are coming soon. “I think prediction market is going to be embedded very smoothly, very effectively in the news,” he said, adding that major media partnerships are also in the pipeline, though he didn’t name any outlets.

What separates Kalshi from typical betting platforms is how the bets work. Instead of placing odds like a sportsbook, Kalshi sets up binary questions, yes or no outcomes, and lets users trade both sides of the prediction like a financial contract. This creates a kind of tug-of-war between users instead of the house-versus-you model.

Tarek insists that makes it not gambling at all. “While the house always wins in gambling, prediction markets provide a more level playing field,” he said. But not everyone’s buying it.

The Commodity Futures Trading Commission (CFTC) is still on Kalshi’s side, giving the exchange regulatory cover to continue operations. But some state-level gambling watchdogs have ordered Kalshi to shut down. And courts in some states have already ruled against it, threatening the company’s national expansion.

Tarek admitted there’s always been “weird tension with gambling” in new financial innovations, especially in derivatives. That tension hasn’t gone away, if anything, it’s heating up.

Wall Street steps in as rivals circle Kalshi

It’s not just state regulators Kalshi has to deal with. Gambling firms are coming for the same users, and industry insiders say Kalshi and other prediction exchanges might struggle to compete with more mainstream betting products.

Even so, Wall Street is starting to circle the space.

Intercontinental Exchange (ICE), the company that owns the New York Stock Exchange, is putting up to $2 billion into Polymarket, Kalshi’s biggest rival.

Meanwhile, CME Group is building a new app with Flutter Entertainment, mixing sports bets with financial data contracts.

Tarek says he’s fine with competition. He believes it’ll push the industry forward faster. Kalshi’s trading volume is booming, especially after teaming up with Robinhood, where users can now access its contracts directly. Its own platform has also seen a spike, mostly driven by sports-related wagers.

Looking ahead, Tarek says Kalshi will go global. The company is planning to launch in multiple countries over the next 18 months, betting big on what it sees as unstoppable momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Update: Federal Reserve Postponements and $1.2 Billion ETF Withdrawals Trigger 26% Drop in Bitcoin Value

- Bitcoin falls 26% to $83,000 amid Fed's delayed rate-cut timeline and $1.2B ETF outflows, marking its longest losing streak since 2024. - Analysts warn of structural risks, with Bloomberg's Mike McGlone projecting a potential $10,000 drop and Cathie Wood revising bullish 2030 forecasts. - Market volatility intensifies as JPMorgan's index exclusion proposal sparks crypto sector backlash and S&P 500 defensive sector shifts highlight interconnected risks. - Fed's December rate-cut speculation and upcoming i

ALGO rises by 0.21% even after a 5.32% decline over the week, reflecting ongoing market fluctuations

- ALGO rose 0.21% to $0.1439 on Nov 24, 2025, but fell 5.32% weekly and 56.92% annually amid market volatility. - Persistent selling pressure and lack of project/regulatory catalysts highlight structural valuation declines since peak levels. - Analysts project continued downward pressure unless major developments like regulatory updates or institutional adoption emerge. - Investors advised to remain cautious as short-term gains fail to offset 18.77% monthly losses and broader bearish market conditions.

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

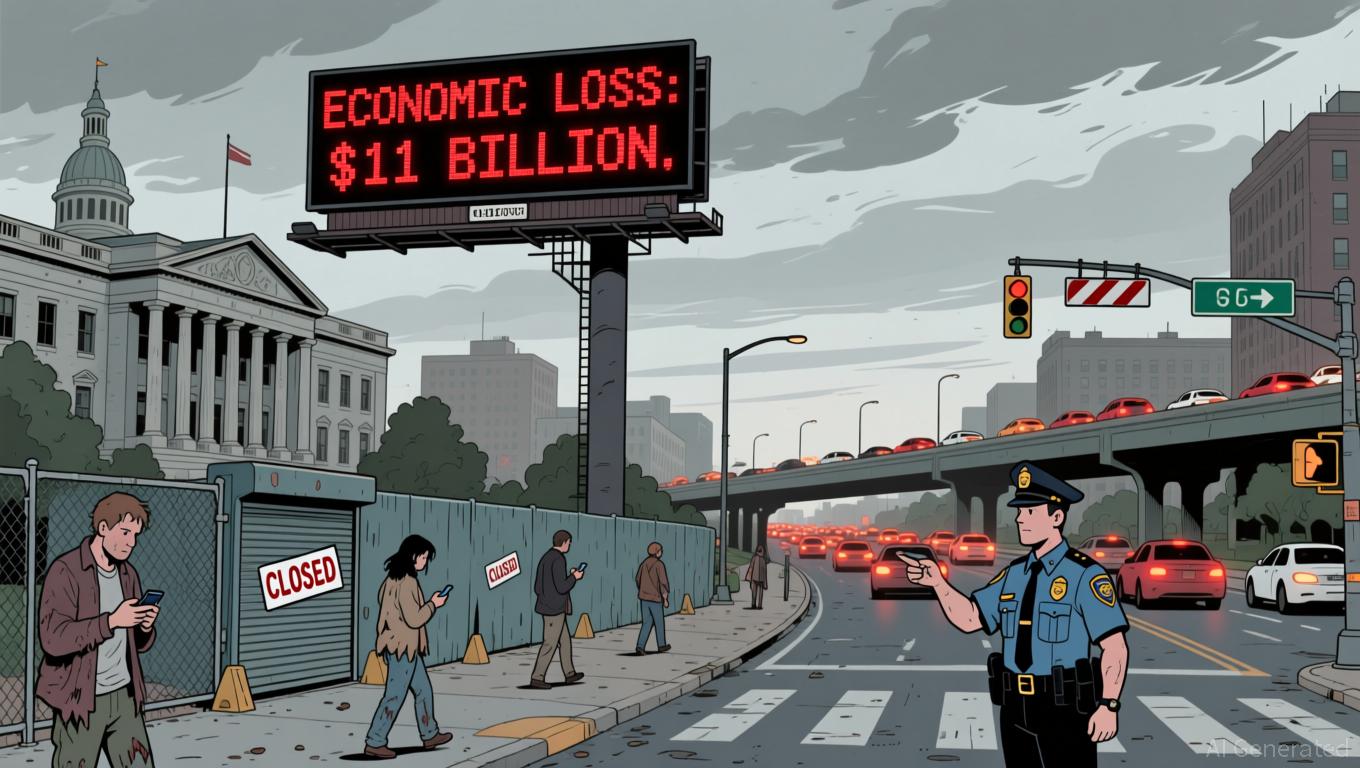

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets