Argentina’s LIBRA Investigation Climaxes But $58 Million Moves Before Final Report

Argentina’s Congressional Commission investigating the cryptocurrency LIBRA will present its long-awaited final report today at 4 PM local time (2 PM EST), just as millions of dollars in wallet movements trigger fresh scrutiny. The timing and the scale have raised urgent questions about political responsibility, judicial oversight, and the fate of funds tied to one

Argentina’s Congressional Commission investigating the cryptocurrency LIBRA will present its long-awaited final report today at 4 PM local time (2 PM EST), just as millions of dollars in wallet movements trigger fresh scrutiny.

The timing and the scale have raised urgent questions about political responsibility, judicial oversight, and the fate of funds tied to one of Argentina’s most contentious crypto investigations.

Final Libra Report to Land Amid New Evidence and Judicial Actions

Maxi Ferraro, President of the LIBRA Investigative Commission, confirmed that the final report is the culmination of months of testimony, documents, technical analysis, and judicial coordination.

“Look at that… right on the day of the presentation of the final report, after yesterday’s meeting with Taiano and following the report from the Public Prosecutor’s Office. To this is added the judge’s ruling from 11/6 and the information revealed by the Commission on 10/21, which was furthermore confirmed in that judicial resolution,” Ferraro shared in a Tuesday post.

Yesterday, Ferraro and Commission members met with Prosecutor Carlos Taiano, delivering what he described as critical evidence.

According to Ferraro, the information provided included details that could be linked to indirect payments to public officials related to one of the alleged crypto dens.

Ferraro emphasized that the Commission acted within its oversight mandate, saying the report aims to determine what political actions or omissions “allowed, facilitated, or failed to prevent the development of this case.”

$58 Million in Crypto Quietly Moves Just Before the Report

While Congress prepares to release its findings, on-chain analysts detected major wallet activity linked to the LIBRA case.

According to blockchain researcher Fernando Molina, two dormant wallets, “Milei CATA” and “Libra: Team Wallet 1” suddenly liquidated their USDC positions, totaling more than $58 million, and swapped the stablecoin for SOL.

These wallets had been inactive for nine months. The SOL was then moved to another address known as FKp1t.

“The first interpretation… is that they did it so that the money cannot be frozen… it may be the last time we see this money visible,” Molina noted.

He also highlighted that US authorities froze and later unfroze the funds after determining there was “no risk,” while Argentine prosecutors have repeatedly sought freezing orders since April.

Crucially, SOL cannot be frozen, unlike USDC, a detail that fuels speculation about the timing and intent behind the transfers, especially with the Commission’s report being released today.

Political Oversight Meets Crypto Immutability

Ferraro stressed that the Commission’s mission was never symbolic.

“Political oversight is not an institutional formality, but an indispensable obligation to preserve the integrity of the State… we are going to present a serious and compelling final report.”

The Commission argues that it achieved more in months than others did with significantly more time, framing today’s release as a turning point for institutional accountability in Argentina’s cryptocurrency governance.

The publication of the final report will set the stage for judicial follow-through, potential political consequences, and renewed scrutiny of LIBRA-linked wallets, which are now shifting funds beyond the reach of freezing orders.

With prosecutors actively investigating alleged indirect payments and on-chain analysts warning those recent transactions may be the last visible traces of key funds, today’s findings could reshape the next phase of Argentina’s ongoing crypto crackdown.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

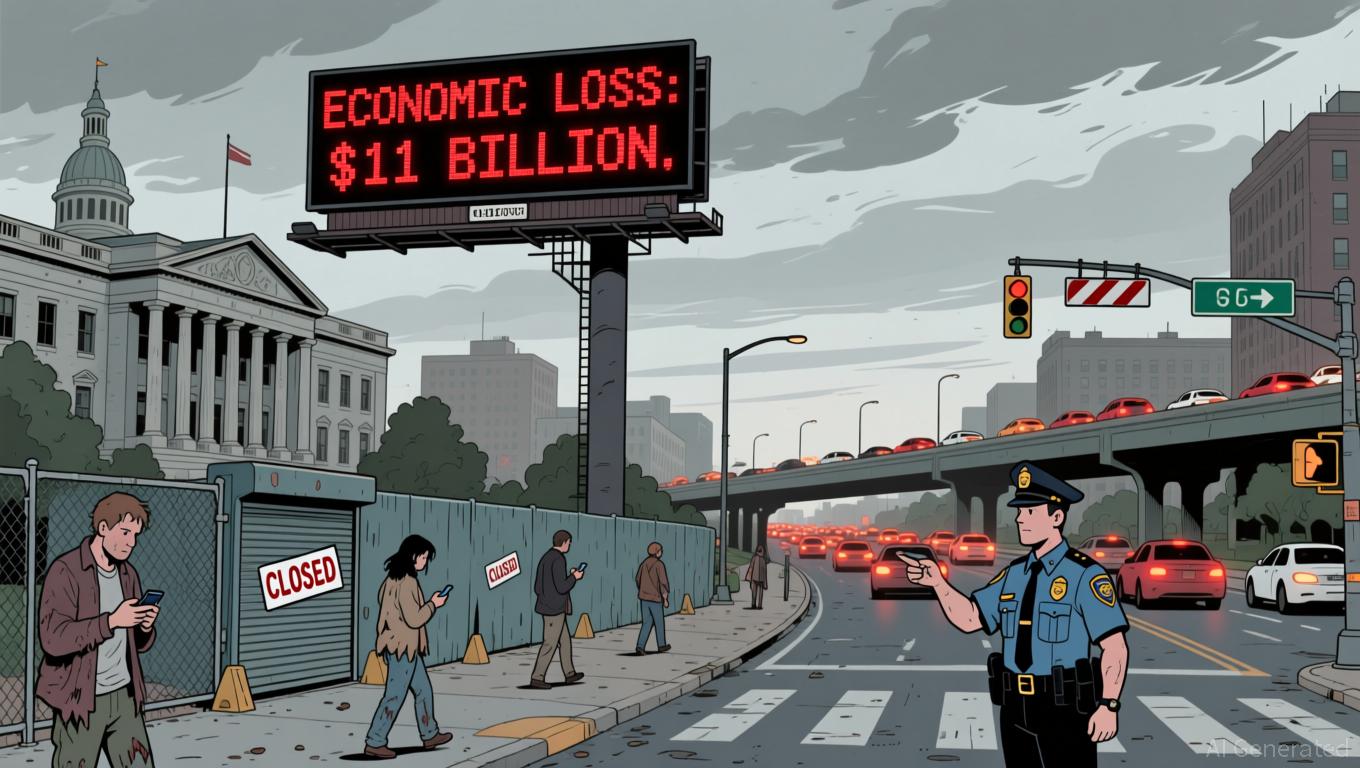

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest

Ethereum Updates Today: DATs Buyback Strategy May Surpass Liquidity Challenges Amid Rising Debt

- FG Nexus sold $32.7M in ETH to repurchase 8% of shares amid 94% stock price drop, reflecting DAT sector struggles with NAV discounts. - Industry-wide $4-6B in forced crypto liquidations by DATs highlights systemic risks as debt rises and liquidity tightens across firms like ETHZilla and AVAX One . - Analysts warn debt accumulation and stalled corporate buying could worsen instability, while companies pivot to tokenization to address declining investor appetite. - Market skepticism persists as FG Nexus tr