Bitcoin Updates: Institutions Pull Out and $2 Billion Wiped Out—Is This a Crypto Catastrophe or a Strategic Market Reset?

- Bitcoin ETFs face $3.79B outflows in November, triggering a $2B liquidation crisis as prices drop 9% below $84K. - Institutional profit-taking, fading Fed rate-cut hopes, and $4.2B options expiry amplify crypto market fragility. - $120B daily market loss highlights sector vulnerability amid regulatory scrutiny and geopolitical risks under Trump. - Analysts warn ETF outflows, stalled listings, and leveraged trading pressures pose ongoing rebound risks.

The cryptocurrency market is experiencing significant instability as

Bitcoin’s value plunged more than 9% within a day,

Market vulnerability was further exposed by a $4.2 billion crypto options expiration on November 21, with

Even amid the steep losses,

As volatility persists, the U.S. crypto sector remains fraught with uncertainty. While pro-crypto initiatives under President Donald Trump have gained industry backing,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst Shares Why He’s Not Worried About XRP Price – ‘The Road To Valhala

Hyperliquid Drops Over 12% In Overbought Correction

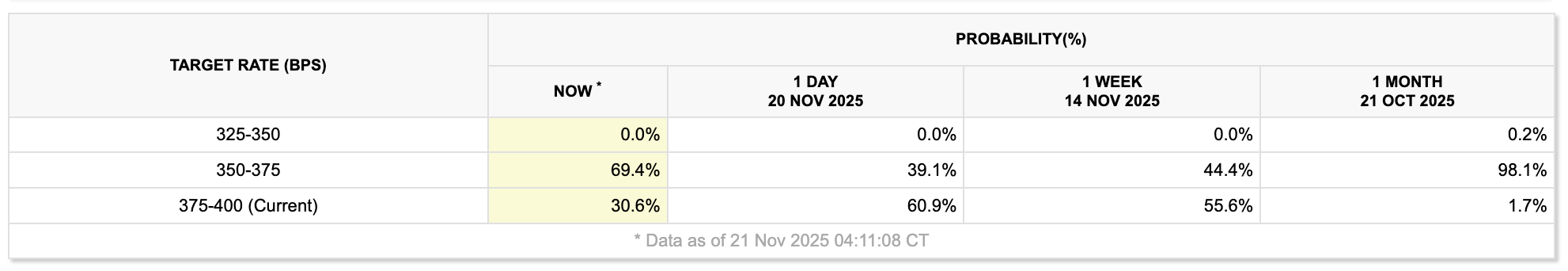

Bitcoiners perk up as odds of a December Fed rate cut almost double

Interview | Visa’s stablecoin push forces Wall Street to act: BitPay