Bitcoiners perk up as odds of a December Fed rate cut almost double

Bitcoiners were noticeably more upbeat on social media today as the odds of a US Federal Reserve rate cut in December nearly doubled compared to just a day earlier.

Some crypto market participants are speculating that this could be the catalyst Bitcoin (BTC) needs to halt the asset’s downward trend.

“Let’s see if that’s enough to find a bottom here for now,” crypto analyst Moritz said in an X post on Friday, as Bitcoin’s price trades at $85,071, down 10.11% over the past seven days, according to CoinMarketCap.

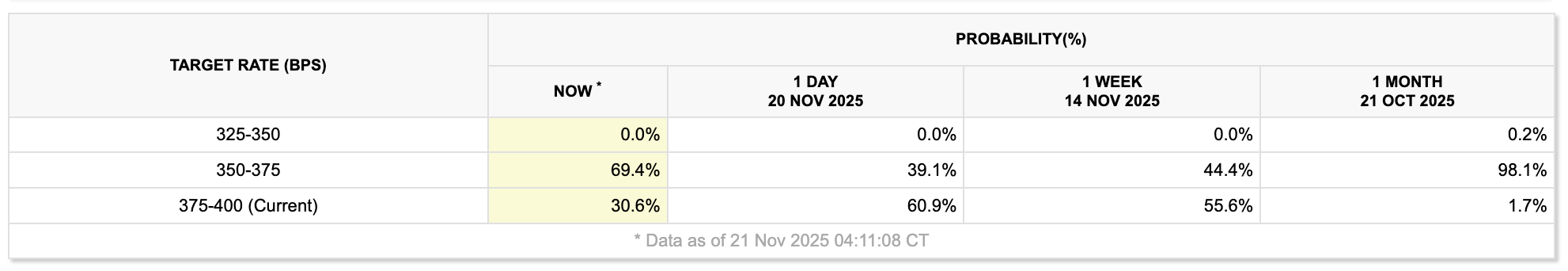

On Friday, the odds of an interest rate cut at the December Federal Open Market Committee (FOMC) meeting almost doubled to 69.40%, according to the CME FedWatch Tool. Just the day before, on Thursday, it was nearly 30.30% lower, at 39.10%.

Many in the wider market attributed the spike at least partly to dovish remarks from New York Fed president John Williams, who said the Fed can cut rates “in the near term” without endangering its inflation goal. Bloomberg analyst Joe Weisenthal said it was the reason the odds have “massively increased.”

The setup is looking “unfathomably bullish,” says analyst

However, economist Mohamed El-Erian warned market participants not to get “carried away” by the comments. Meanwhile, the broader crypto community has reacted even more bullishly. “Usually this would be bullish,” Mister Crypto said in an X post on Friday.

The Fed cutting rates is typically bullish for riskier assets such as Bitcoin and the broader crypto market, as traditional assets such as bonds and term deposits become less lucrative to investors.

Crypto analyst Jesse Eckel pointed to the surging rate cut odds and said, “If you zoom out, the setup is unfathomably bullish.”

“I don’t know why we keep going lower,” Eckel said. “We are going from a tightening cycle into an easing cycle,” he added.

Crypto analyst Curb said, “Crypto will explode in a massive rally.”

The odds of a rate cut were previously “mispriced”

Coinbase Institutional said in a X post on Friday, “While markets are leaning toward ‘no cut’ this time, we believe the odds for a rate cut are actually mispriced. Recent tariff research, private market data, and real-time inflation indicators suggest otherwise.”

Related: BTC ETF outflows are 'tactical rebalancing,' not institutional flight: Analysts

“Since the October FOMC meeting, futures have shifted from expecting a 25bps cut to favoring a hold, mainly due to rising inflation concerns,” Coinbase Institutional said.

“However, studies show that tariff hikes can lower inflation and increase unemployment in the short term, acting like negative demand shocks,” it added.

It comes as sentiment across the entire crypto market has remained weak over the past seven days. The Crypto Fear & Greed Index, which measures overall crypto market sentiment, posted an “Extreme Fear” score of 14 in its Friday update.

Magazine: Bitcoin whale Metaplanet ‘underwater’ but eyeing more BTC: Asia Express

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK Investigation Connects Tether to Financing Conflicts and Political Contributions

- UK authorities dismantled a £25M stablecoin laundering network linking UK crime to Russian war funding via Tether (USDT), with 128 arrests and cash/crypto seizures. - Russian intelligence exploited similar crypto networks to fund a spy ring led by ex-Wirecard executive Jan Marsalek, channeling £45K through Tether for espionage and assassination plots. - Tether's UK political ties emerged as major donor Christopher Harborne, who owns 12% of the stablecoin, donated £10M to Nigel Farage's Brexit Party amid

Ethereum News Update: Investors Move Toward Ozak AI as AI-Powered Blockchain Exceeds $4.5 Million in Presale

- Ozak AI's $4.5M presale surges as analysts predict 83x price growth to $1 by 2026, driven by AI-blockchain integration. - Platform combines AI prediction agents with DeFi optimization, partnering with Perceptron Network, HIVE , and SINT for decentralized automation. - Ethereum investors shift capital to Ozak AI, viewing it as a next-gen complement to traditional blockchain infrastructure amid ETH's consolidation phase. - C3.ai's 27.4% stock decline contrasts Ozak AI's momentum, as AI sector volatility hi

ZEC Drops 10.26% Over 24 Hours as Market Fluctuates

- ZEC dropped 10.26% in 24 hours to $495.01, but rose 778.18% annually. - Short-term decline reflects market volatility, with investors split between entry points and caution. - Analysts link ZEC's swings to macroeconomic factors and speculative trading, not direct news. - Broader crypto trends and leverage-driven corrections may influence future stability.

Bitcoin Updates: Bitcoin Climbs Even as ETF Outflows Hit Record Highs and Hopes for Fed Rate Cuts Fade

- Bitcoin rebounds as markets price a 46% chance of a December Fed rate cut, down from 93.7% in October. - U.S. spot Bitcoin ETFs saw $523M in single-day outflows, with BlackRock's IBIT leading $2.1B in redemptions. - Technical indicators show a fourth "death cross" and declining liquidity amid unresolved macro risks. - Traders add $5.7M in short positions, reflecting broader caution as crypto faces regulatory and volatility challenges.