“Not a Fund, Not a Trust”: Saylor Draws the Line as MSCI Considers MicroStrategy’s Fate

MicroStrategy CEO Michael Saylor fired back at MSCI’s review of the company’s classification, framing his firm as a hybrid operating business, not an investment fund. The clarification comes amid a formal consultation on how digital asset treasury companies (DATs) should be treated in flagship equity indexes, a decision that could have major market consequences for

MicroStrategy CEO Michael Saylor fired back at MSCI’s review of the company’s classification, framing his firm as a hybrid operating business, not an investment fund.

The clarification comes amid a formal consultation on how digital asset treasury companies (DATs) should be treated in flagship equity indexes, a decision that could have major market consequences for MSTR.

Michael Saylor Draws the Line: “MicroStrategy Is Not a Fund or Trust” Amid MSCI Scrutiny

In a detailed post on X (Twitter), Saylor emphasized MicroStrategy is not a fund, not a trust, and not a holding company.

“We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital,” he articulated.

The statement positions MicroStrategy as more than a Bitcoin holder, with Saylor noting that funds and trusts hold assets passively.

“Holding companies sit on investments. We create, structure, issue, and operate,” Saylor added, highlighting the company’s active role in digital finance.

This year, MicroStrategy completed five public offerings of digital credit securities: STRK, STRF, STRD, STRC, and STRE. These total more than $7.7 billion in notional value.

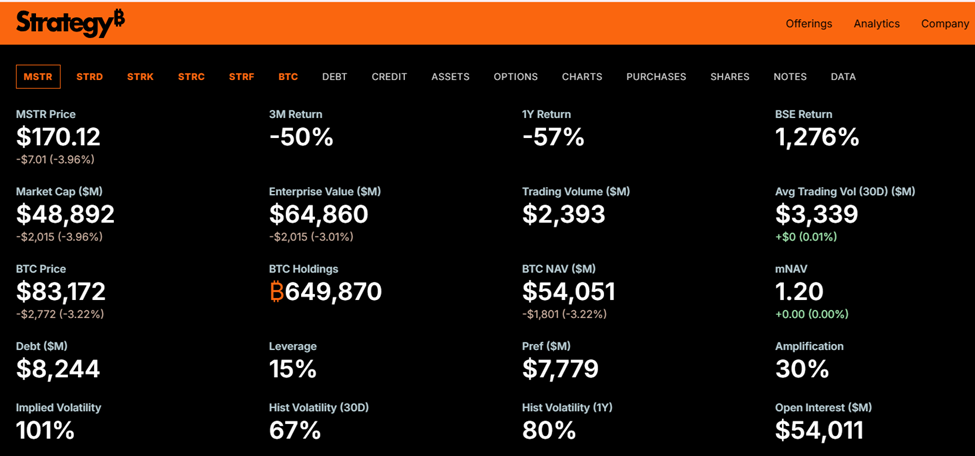

MicroStrategy Public Offerings. Source:

Strategy website

MicroStrategy Public Offerings. Source:

Strategy website

Notably, Stretch (STRC) is a Bitcoin-backed treasury instrument that offers variable monthly USD yields to both institutional and retail investors.

Saylor describes MicroStrategy as a Bitcoin-backed structured finance company that operates at the intersection of capital markets and software innovation.

“No passive vehicle or holding company could do what we’re doing,” he said, stressing that index classification does not define the company.

Why MSCI’s Decision Matters

MSCI’s consultation could reclassify firms like MicroStrategy as investment funds, making them ineligible for key indexes such as MSCI USA and MSCI World.

Exclusion could trigger billions in passive outflows and heighten volatility in $MSTR, which is already down roughly 70% from its all-time high.

The stakes extend beyond MicroStrategy. Saylor’s defense challenges traditional finance (TradFi) norms, asking whether Bitcoin-driven operating companies can maintain access to passive capital without being labeled as funds.

MicroStrategy holds 649,870 Bitcoin, with an average cost of $74,430 per coin. Its enterprise value stands at $66 billion, and the company has relied on equity and structured debt offerings to fund its Bitcoin accumulation strategy.

The MSCI ruling, expected by January 15, 2026, could test the viability of such hybrid treasury models in public markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ATOM rises 1.87% over 24 hours as network enhancements and governance proposals unfold

- ATOM rose 1.87% in 24 hours amid Cosmos' Iris-5 upgrade, introducing improved staking and cross-chain features despite 1-year 58.63% decline. - Three governance proposals aim to reallocate inflation funds to developer grants and boost validator incentives, with above-average community voting participation. - Ecosystem growth accelerates with new dApps and a cross-chain stablecoin aggregator, signaling maturing infrastructure and real-world use cases. - Analysts caution short-term volatility persists due

LTC Properties Rises 1.91% Over 24 Hours as Portfolio Adjusts and Dividends Remain Steady

- LTC Properties boosted Q3 earnings with portfolio rebalancing and 80% dividend payout ratio, ensuring monthly dividend coverage despite macroeconomic challenges. - 2025 guidance raised to $2.70-$2.83/share FFO range, reflecting $124.53M-$130.53M in total value as LTC prioritizes seniors housing over skilled nursing assets. - $270M invested in seniors housing portfolio (85% of $460M target), including a 7% yield acquisition, signaling strategic shift to stable income-generating properties. - Long-term deb

Elvis-Inspired Judge Steps Down Following Conduct Issues That Raise Questions About Fairness

- Missouri Judge Matthew Thornhill resigned after disciplinary commission found his Elvis-themed courtroom antics violated judicial conduct standards. - He admitted to wearing Elvis wigs, playing music, and making irrelevant references during proceedings, undermining courtroom solemnity. - His resignation includes a six-month unpaid suspension and 18-month reduced role before permanent departure, following prior 2008 misconduct. - Critics argue his actions eroded judicial impartiality, while Thornhill clai

Analyst Sets a Bold Bull Target for ETH at $12,000 in the Next 2-3 Years