Pi Coin Price Rise May Slow Down As Investors’ Bullishness Saturates

Pi Coin’s recent upward momentum has started to cool, with the altcoin facing a 5% pullback in the past 24 hours. The rise in price earlier this week has now met short-term resistance as inflows show signs of saturation. This shift suggests that the strong buying activity supporting the rally may slow in the near

Pi Coin’s recent upward momentum has started to cool, with the altcoin facing a 5% pullback in the past 24 hours. The rise in price earlier this week has now met short-term resistance as inflows show signs of saturation.

This shift suggests that the strong buying activity supporting the rally may slow in the near term.

Pi Coin Faces Slight Bearishness

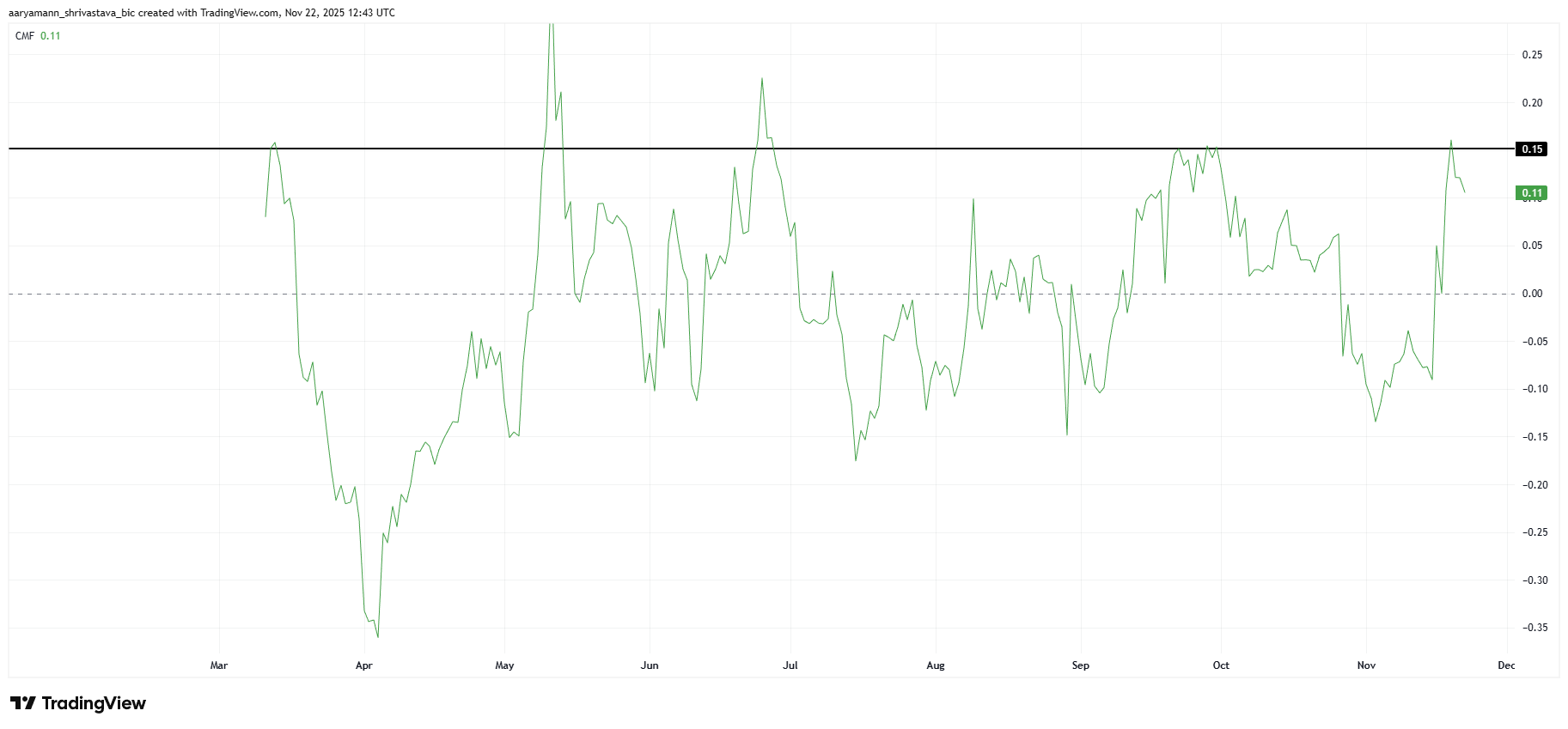

The Chaikin Money Flow is slipping after touching the 0.15 level, signaling weakening capital inflows.

CMF tracks money entering and exiting an asset, and while 0.20 is typically viewed as a saturation point, Pi Coin’s threshold appears lower. Historically, a move above 0.15 has often led to both price reversals and netflow declines.

This pattern may repeat, as Pi Coin has struggled to maintain inflows once CMF breaks above this zone.

A renewed drop in capital could pull the price lower in the coming sessions, creating short-term bearish pressure.

Want more token insights like this? Sign upa for Editor Harsh Notariya’s Daily Crypto Newsletter

Pi Coin CMF. Source:

Pi Coin CMF. Source:

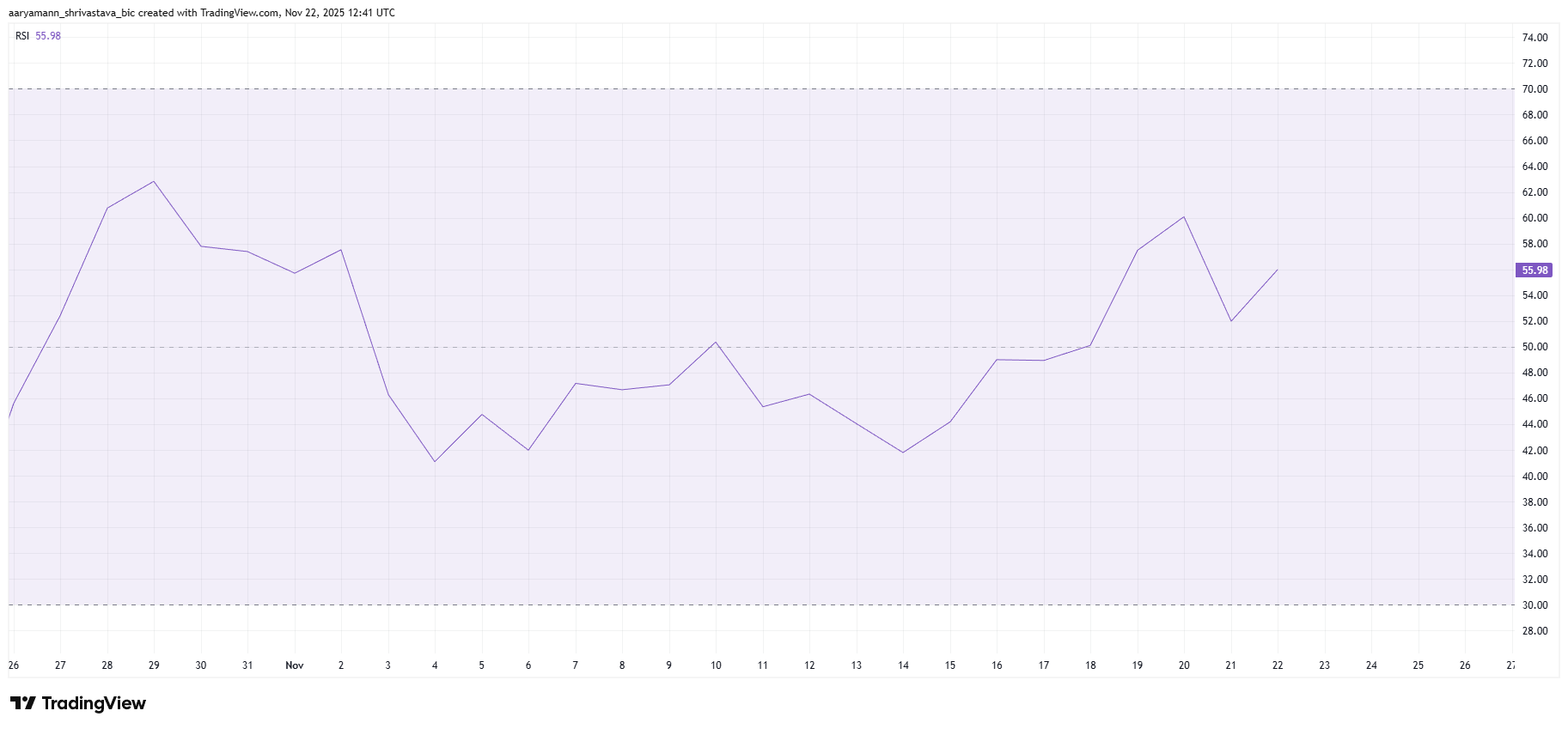

Despite the slip in sentiment, macro indicators still show pockets of strength. The Relative Strength Index remains in bullish territory above the neutral line.

This means Pi Coin is managing to sustain buying interest even as broader market sentiment trends bearish. Strong RSI readings often imply underlying resilience.

One contributing factor is Pi Coin’s negative correlation with Bitcoin.

As BTC weakens, Pi Coin has avoided following the typical market trend, allowing it to maintain upward movement independently. This divergence continues to support the asset, even with inflows softening.

Pi Coin RSI. Source:

Pi Coin RSI. Source:

PI Price Is Finding Its Footing

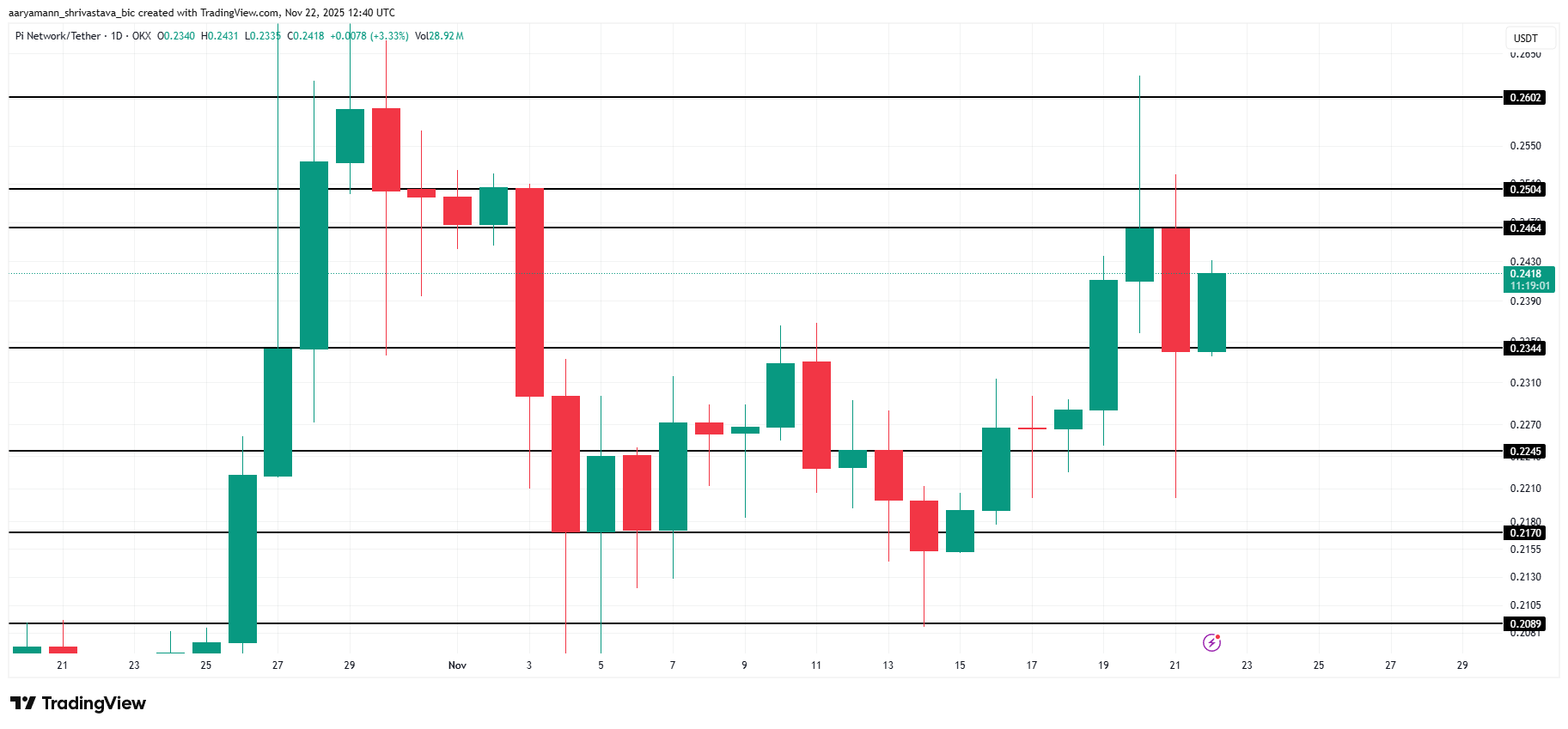

Pi Coin is trading at $0.241, sitting just below the $0.246 resistance level. The altcoin’s 5% drop yesterday reflects short-term bearish pressure. This has eased but not disappeared entirely. Price action suggests a cautious environment as traders wait for stronger signals.

If buying strength continues to fade, Pi Coin could slip below the $0.234 support or remain range-bound between $0.234 and $0.246.

Consolidation appears likely unless inflows strengthen again, which historically has taken time once CMF retreats.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, if capital inflows rise again, Pi Coin may break above the $0.246 resistance.

A successful move could lift the price to $0.250 and potentially to $0.260. This would invalidate the bearish outlook and restore short-term bullish momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ATOM rises 1.87% over 24 hours as network enhancements and governance proposals unfold

- ATOM rose 1.87% in 24 hours amid Cosmos' Iris-5 upgrade, introducing improved staking and cross-chain features despite 1-year 58.63% decline. - Three governance proposals aim to reallocate inflation funds to developer grants and boost validator incentives, with above-average community voting participation. - Ecosystem growth accelerates with new dApps and a cross-chain stablecoin aggregator, signaling maturing infrastructure and real-world use cases. - Analysts caution short-term volatility persists due

LTC Properties Rises 1.91% Over 24 Hours as Portfolio Adjusts and Dividends Remain Steady

- LTC Properties boosted Q3 earnings with portfolio rebalancing and 80% dividend payout ratio, ensuring monthly dividend coverage despite macroeconomic challenges. - 2025 guidance raised to $2.70-$2.83/share FFO range, reflecting $124.53M-$130.53M in total value as LTC prioritizes seniors housing over skilled nursing assets. - $270M invested in seniors housing portfolio (85% of $460M target), including a 7% yield acquisition, signaling strategic shift to stable income-generating properties. - Long-term deb

Elvis-Inspired Judge Steps Down Following Conduct Issues That Raise Questions About Fairness

- Missouri Judge Matthew Thornhill resigned after disciplinary commission found his Elvis-themed courtroom antics violated judicial conduct standards. - He admitted to wearing Elvis wigs, playing music, and making irrelevant references during proceedings, undermining courtroom solemnity. - His resignation includes a six-month unpaid suspension and 18-month reduced role before permanent departure, following prior 2008 misconduct. - Critics argue his actions eroded judicial impartiality, while Thornhill clai

Analyst Sets a Bold Bull Target for ETH at $12,000 in the Next 2-3 Years