Bitcoin Slide Leaves Over 70% of Active capital in Losses as Sentiment Collapses

Social media data from shows that retail sentiment for Bitcoin has sunk to its lowest level since December 2023, with capitulation and panic selling reaching two-year highs.

Bitcoin’s recent drop toward $80,000 has driven most active capital in the asset into losses, signaling a shift in market conditions for the world’s largest cryptocurrency.

Bitcoin has erased nearly 35% from its October peak of about $126,000 after sinking to a seven-month low. As a result, it is now generating one of the largest waves of unrealized losses this cycle.

Over 70% of US Dollars Invested in Bitcoin is in Loss

According to data from on-chain analytics firm Checkonchain, the price rout has forced more than 70% of the capital allocated to Bitcoin underwater.

Bitcoin analyst James Check explains that 71.2% of the network’s realized capitalization carries a cost basis of at least $86,500. This metric prices each coin in the circulating supply at the value it last moved on-chain.

This chart shows the USD value of every coin in the Bitcoin supply priced when it last transacted onchain.Think of this as our collective invested cost basis.Over 70% of the USD invested in Bitcoin is now underwater.

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) November 21, 2025

Thus, it effectively represents the aggregate entry price for the market’s active investors.

So, with Bitcoin recently tumbling below that critical waterline, a flood of buyers who entered during the late-2024 and early-2025 rallies now face mounting losses. Many of these investors are effectively trapped in positions that no longer break even.

This heavy concentration of volume near the highs indicates that short-term holders are experiencing acute stress. It is forcing their Net Unrealized Profit and Loss metrics to collapse to cycle lows.

Bitcoin Market Sentiment Reaches 2-Year Low

Meanwhile, this fracture in the broader market structure is further corroborated by Glassnode data.

The firm’s Relative Unrealized Loss indicator, which tracks the dollar value of coins held below their acquisition price relative to total market capitalization, has spiked to 8.5%. In a typical, healthy bull market, this metric generally remains below 5%.

The Relative Unrealized Loss in the market is now trading at 8.5%. 📉

— glassnode (@glassnode) November 21, 2025

So, the current breach suggests that the drawdown represents a significant “market reset” of the asset’s ownership base rather than a standard volatility correction.

While prices have staged a modest recovery to the $84,543 level at press time, the psychological damage to the retail sector appears severe.

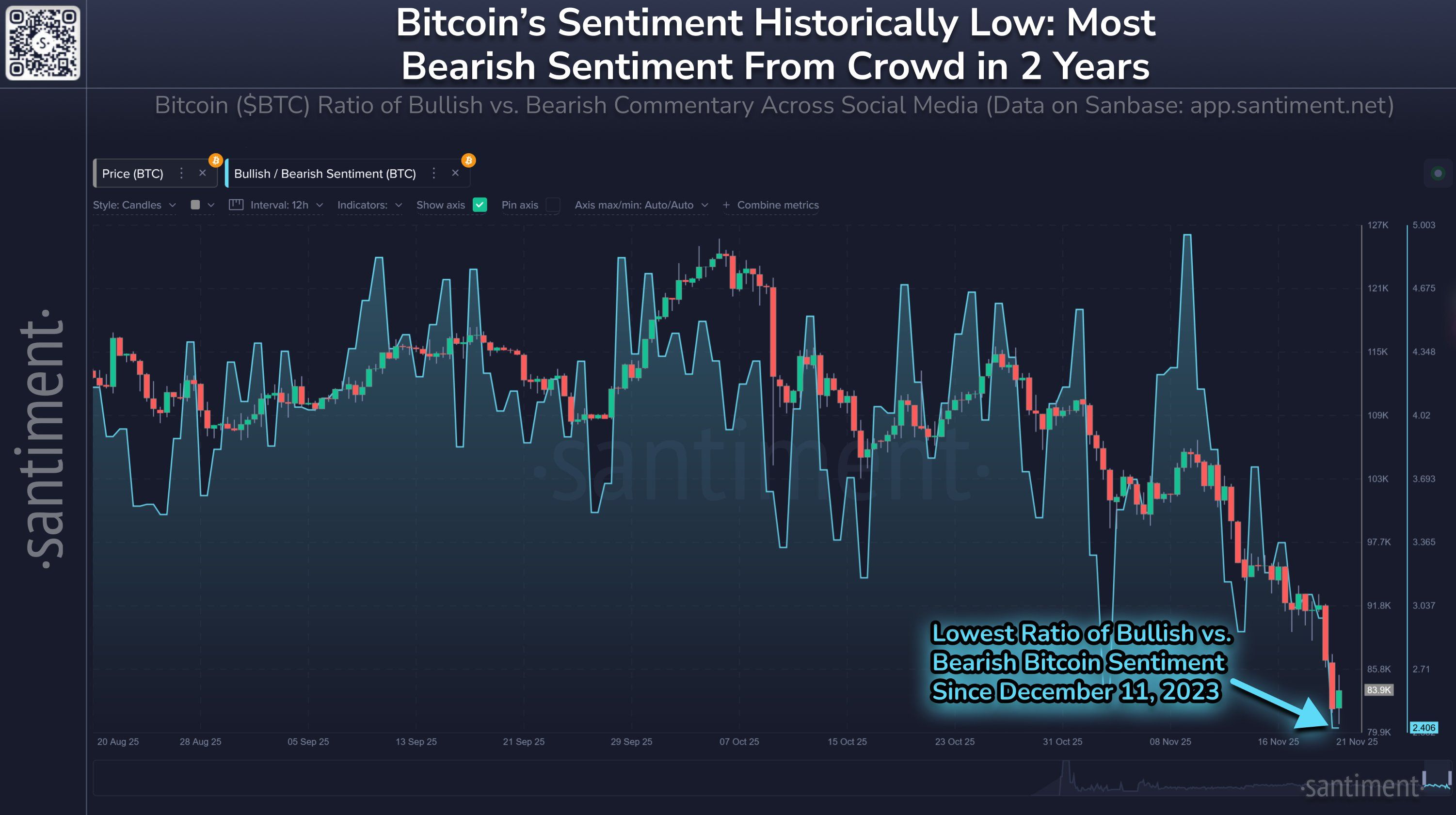

Social media sentiment has cratered to its lowest point since December 2023, according to blockchain analytics platform Santiment.

The firm said its analysis of social media commentary across X, Reddit, and Telegram shows that retail traders are capitulating and panic-selling at levels unseen in two years.

Bitcoin Social Media Sentiment. Source:

Santiment

Bitcoin Social Media Sentiment. Source:

Santiment

Historically, such extreme levels of bearishness often act as a contrarian signal, suggesting that the market may be clearing out weak hands in preparation for a local bottom.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ATOM rises 1.87% over 24 hours as network enhancements and governance proposals unfold

- ATOM rose 1.87% in 24 hours amid Cosmos' Iris-5 upgrade, introducing improved staking and cross-chain features despite 1-year 58.63% decline. - Three governance proposals aim to reallocate inflation funds to developer grants and boost validator incentives, with above-average community voting participation. - Ecosystem growth accelerates with new dApps and a cross-chain stablecoin aggregator, signaling maturing infrastructure and real-world use cases. - Analysts caution short-term volatility persists due

LTC Properties Rises 1.91% Over 24 Hours as Portfolio Adjusts and Dividends Remain Steady

- LTC Properties boosted Q3 earnings with portfolio rebalancing and 80% dividend payout ratio, ensuring monthly dividend coverage despite macroeconomic challenges. - 2025 guidance raised to $2.70-$2.83/share FFO range, reflecting $124.53M-$130.53M in total value as LTC prioritizes seniors housing over skilled nursing assets. - $270M invested in seniors housing portfolio (85% of $460M target), including a 7% yield acquisition, signaling strategic shift to stable income-generating properties. - Long-term deb

Elvis-Inspired Judge Steps Down Following Conduct Issues That Raise Questions About Fairness

- Missouri Judge Matthew Thornhill resigned after disciplinary commission found his Elvis-themed courtroom antics violated judicial conduct standards. - He admitted to wearing Elvis wigs, playing music, and making irrelevant references during proceedings, undermining courtroom solemnity. - His resignation includes a six-month unpaid suspension and 18-month reduced role before permanent departure, following prior 2008 misconduct. - Critics argue his actions eroded judicial impartiality, while Thornhill clai

Analyst Sets a Bold Bull Target for ETH at $12,000 in the Next 2-3 Years